How do you know how well your business is doing?

The answer to this question comes down to measurement. You may have reports on performance in various areas of your business, but are you measuring that against other things? If not, how will you know if you're on track, or falling short?

This is where Key Performance Indicators (KPIs) come in as they help you to both measure and improve your business as opposed to just reviewing various different data. The question then is which KPIs should you focus on?

There aren't any specific, hard rules as to which KPIs you should track, it depends on the nature of your organisation, and your circumstances. In this blog post we'll look at the common KPIs you may want to track, when to apply them, and what to consider.

By reading this blog, you will learn about the following:

KPIs are measurable statistics used to evaluate how well your business is doing, and how close you are to reaching your objectives. Keeping a close eye on KPIs will help determine whether your strategies and investments are paying off, and what more you need to do to achieve your targets.

KPIs shouldn't be confused with goals or objectives. A goal is an outcome that you hope to achieve, usually in a set timeframe. The KPI on the other hand is a metric that you use to determine how well you're progressing towards that goal. It's the measure you use to help you decipher if your results will allow you to attain your goal(s).

Your KPIs will therefore be determined by the type of business you have, and your circumstances. They help you understand what is, and isn't, working effectively in your business. You can then make any necessary adjustments, or not, as the case may be.

There is no unique set of KPIs that every business should measure. This is because what you should track is dependent on what stage your business is at in the business lifecycle (see diagram below), and the objectives you have set, either from the outset or your current stage of development.

There are a few KPIs that every business should at least consider monitoring. The reason being there is by nature certain items that may be universally important regardless of size, sector, or demographic. Furthermore, as a business owner, depending on the sort of enterprise you run, there is likely to be a lengthy list of other indicators that may be relevant and worth considering.

You cannot possibly track every KPI for a small business due to the limitations of time, effort, and resources. That would not only be challenging, but it could also cause you to lose sight of what is truly important. There are three factors that you should consider carefully when choosing your KPIs, they are:

Business owners often focus their attention on what the bottom line is for their business. While it's important to keep track of whether your business is becoming more or less profitable, this is not the only factor you should keep track of. Good KPIs will assist you in determining what is most important to your business.

Think about the different goals that you have set. You may have objectives for your consumers or clients, your people, your operations, and your sales and marketing. What are the most essential measures in relation to your long-term goals?

Customer satisfaction and the lifetime value of a customer can be extremely significant for some businesses. For others, performance may be determined by staff productivity, or the speed in which they sell their goods. This means KPIs can only be helpful if you choose them based on the business goals you have set.

At various stages of your business lifecycle (see the Shirlaws diagram below), certain KPIs may be more significant than others. A start-up may be trying to establish and stabilise cash flow, this might then place emphasis on a metric such as the days sales outstanding (DSO). The reason being this measures how quickly you can turn a receivable (the balance of money owed for goods or services) into cash.

/Wellers%20Images/About%20You-Inner%20Page%20Images/The%20stages%20model%20Shirlaws%20official%20version.jpg?width=700&name=The%20stages%20model%20Shirlaws%20official%20version.jpg)

DSO may be less important to an established business, where working capital is not so tight and its credit terms with customers may be longer. Instead, such scaling businesses may concentrate more on staff retention, for example, to help you expand the business to meet customer demand. You should therefore focus on the most relevant KPIs that best lend themselves to where you are, and where you're looking to get to, on your journey.

Choosing both lagging and leading indicators is the optimal KPI combination. What do these mean? A leading indicator is the one that looks ahead and has the ability to affect outcomes. A lagging indicator, on the other hand, is backward-looking and will tell you the results that have already happened.

Customer satisfaction is considered as a leading indicator. If your services and products provide a remarkable experience for your customers, they are likely to return. As a result, the sales for your business may then grow at an exponential rate, which is considered healthy.

Profit on the other hand, is a lagging indicator. It is useful in demonstrating how well your business has performed in the past but does not necessarily provide much insight into future performance.

There are a handful of KPIs to consider monitoring. These are essential to understanding the health of your organisation. These aren't necessarily the only ones you will want to measure but they're a good starting point.

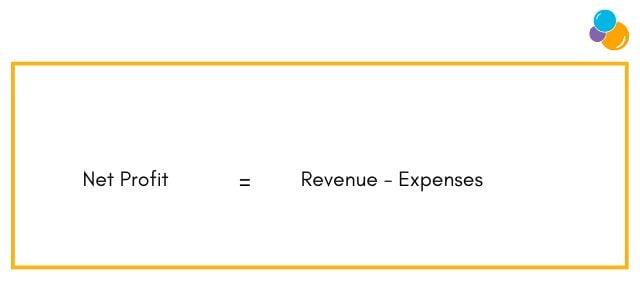

Tracking your net profit over time is a simple and easy place to start with. Net profit is the profit remaining after all expenses including operating costs, taxes, and interest have been deducted. Is your business becoming more, or less, profitable over time?

You cannot always count on net profit to rise immediately. When you invest in your business, or when the economy is struggling, your profits can take a hit. Keeping a track of them is a crucial measure every owner manager needs to be aware of to ensure you have the means to keep trading.

You cannot always count on net profit to rise immediately. When you invest in your business, or when the economy is struggling, your profits can take a hit. Keeping a track of them is a crucial measure every owner manager needs to be aware of to ensure you have the means to keep trading.

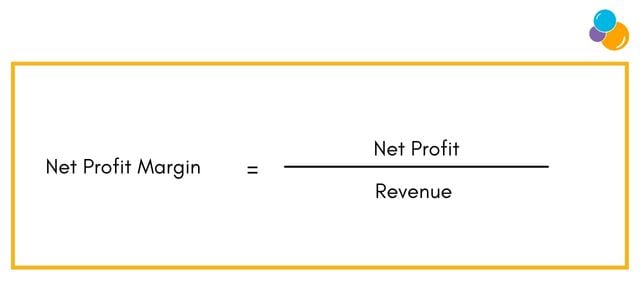

Your Net profit margin, is a metric for determining how profitable your business is as a percentage of your turnover. It will show you how well your revenue is being utilised, similar to the net profit statistic and the higher the figure the healthier you can consider the business to be.

Your net profit margin would be 40% if your business generates £100,000 in revenue and makes a net profit of £40,000 over the year.

Your net profit margin would be 40% if your business generates £100,000 in revenue and makes a net profit of £40,000 over the year.

This indicates that, your business keeps 40 pence in every pound it makes. When you compare your profit margin from year-to-year, you can evaluate if a rise in sales will likely lead to a similar gain in profits.

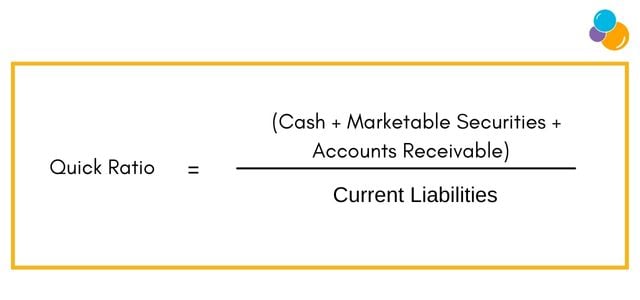

Business owners need to keep a close eye on their cash flow. It is frequently recognised as one of the leading causes of small business failure, namely they run out of cash.

The quick ratio highlights if your cash, assets, and receivables are sufficient to pay your liabilities. The formula is as follows:

If you have £10,000 in cash, £5,000 in accounts receivable, and £12,000 in current payables, your calculation will be (£10,000 + £5,000) / £12,000 = 1.25

If you have £10,000 in cash, £5,000 in accounts receivable, and £12,000 in current payables, your calculation will be (£10,000 + £5,000) / £12,000 = 1.25

If your quick ratio is 1 or greater, you have sufficient funds and liquid assets (assets that can be sold quickly for cash) to pay down your debts. A quick ratio of less than one indicates that covering immediate responsibilities may be a challenge.

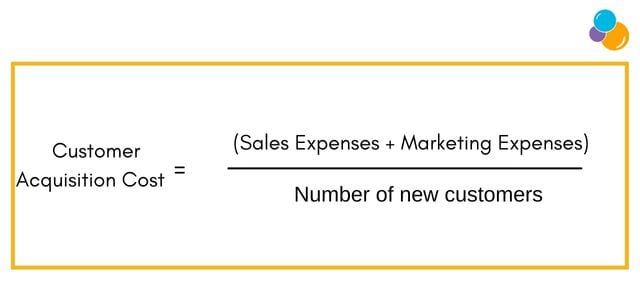

Do you know how much it costs your business to acquire a new customer (or client)? You might not be concerned about how much it costs to make a sale in the early stages of your business, but when you expand this can be a vital indicator to monitor.

Use the following equation:

So, if you spent £5,000 on marketing over a quarter and acquired 10 new clients, your customer (or client) acquisition cost per client is £500.

So, if you spent £5,000 on marketing over a quarter and acquired 10 new clients, your customer (or client) acquisition cost per client is £500.

What is the value of a customer to your business over time? This is a crucial number to understand since it may assist you in determining how much you can spend on sales and marketing to acquire them.

If you know your average client spends £100 with you, you'll want to make sure your acquisition expenses are far lower. This is more difficult to measure than some other KPIs. As a result, some businesses will be able to measure it more easily than others.

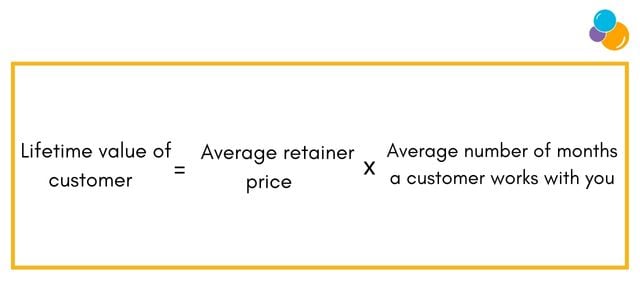

If you work with clients on a retainer model, whereby there is a regular payment to a provider for the provision of their services, it is as follows:

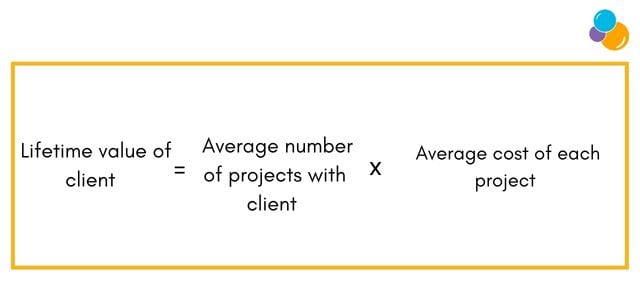

You'll need to perform a bit more research if you work with clients on a project basis. You may calculate the average lifetime value of a customer by estimating the average number of projects you undertake with a client and the average cost of each project:

You'll need to perform a bit more research if you work with clients on a project basis. You may calculate the average lifetime value of a customer by estimating the average number of projects you undertake with a client and the average cost of each project:

Other KPIs to consider tracking:

The KPIs listed above aren't the only ones to keep an eye on. Others, depending on the type, and stage, of your business can provide you with an accurate picture of how effectively you're functioning:

This basic statistic defines how many leads turn into customers. Depending on the sort of business you run, you may assess conversion rate in a variety of ways.

You may determine this for an online business by comparing the number of customers who made a purchase last month to the number of people who visited your site. Let's pretend you have 400 sales and 10,000 unique visits in a month. The conversion rate for you would be 4%.

Alternatively, an agency's conversion rate would be 20% if they pitch 10 new customers in a month, and secure two of the projects.

Tracking your conversion rate over time will allow you to evaluate if the sales and marketing investments you make are leading to more business.

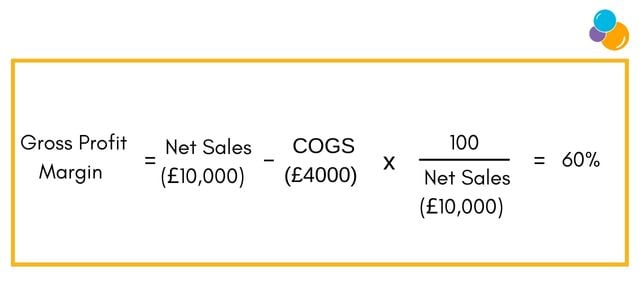

If your business sells commodities, one KPI to track is the gross profit margin. After paying for the items you sell, your gross profit margin ratio will inform you how much money is left over.

The gross profit margin ratio can be calculated on a product-by-product basis or as a whole for your business.

Let's imagine you sell £10,000 in a month and your cost of goods sold (COGS) is £4,000. The gross profit margin is 60% and it's calculated as follows:

Divide your gross margin (£10,000 of sales minus £4,000 in COGS) by total sales.

Divide your gross margin (£10,000 of sales minus £4,000 in COGS) by total sales.

You can perform the same calculation on each item if you want to discover which commodities are the most profitable for you to sell. Let's say you're selling shirts and a consumer pays £20 for one. If the shirt costs you £8, your gross margin ratio on the item is 60%. (£20 – £8) / £20) = 60%

The bigger your gross profit margin, the more money you'll have left over to cover other costs like staff, rent, and marketing as well as potentially some left over as net profit.

Many of your clients on retainer may be a source of monthly recurring revenue for some service-based enterprises. If you have two £1,000 per month recurring client contracts, your monthly recurring revenue is £2,000 per month.

This can assist in planning. As a consequence, you'll have a good idea of what your monthly minimum revenue will be, and you can budget any expenditure accordingly.

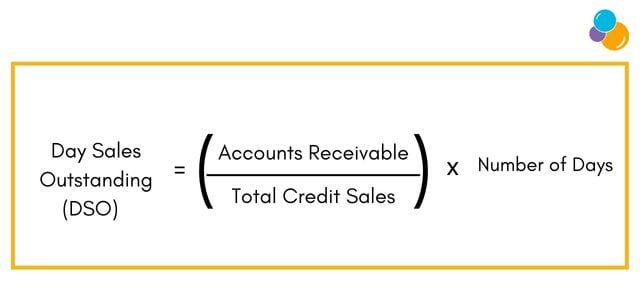

When it comes to getting paid, how efficient is your business? This is critical. However, for new businesses, or those attempting to stabilise their cash flow, this is especially important.

DSO is a metric for determining how long a receivable has been outstanding. For instance, how long does it take on average for your organisation to receive the cash once a transaction is made?

DSO is calculated by multiplying the total sales by the number of days in a period and dividing the accounts receivable balance by the total sales. Let's imagine you had £50,000 in credit sales in January (sales where the consumer didn't pay right away). With 31 days left in the month and a £30,000 accounts receivable amount, your DSO is 18.6.

DSO is calculated by multiplying the total sales by the number of days in a period and dividing the accounts receivable balance by the total sales. Let's imagine you had £50,000 in credit sales in January (sales where the consumer didn't pay right away). With 31 days left in the month and a £30,000 accounts receivable amount, your DSO is 18.6.

When your DSO rises or your business is experiencing delays in receiving payments which can cause a cash flow problem, it may be time to work on optimising your receivables process.

When your business is experiencing delays in receiving payments, it can cause a cash flow problem. This means your DSO will rise and it may be to work on optimising your receivables process. A low DSO usually indicates that your business is getting its payments quickly or on time.

Understanding how much traffic your web pages generate is one of your essential KPIs if you operate an e-commerce business. You'll look to measure traffic trends over time using various tools including Google Analytics potentially.

Analysing your website traffic may help you figure out why, and when, spikes and dips occur. You'll also gain a deeper understanding of your visitors. Does running an ad campaign result in an increase in traffic? Is there a greater increase in traffic when you have a sale? Is your traffic increasing (a positive indicator), or decreasing?

This usually dovetails nicely with the conversion rate metric mentioned above, and in conjunction with the top and bottom line in your business.

Once you’ve decided on the right KPIs to track for your business, you’ll want to set up how you track them promptly.

There will be a lot of things to keep in mind as a business owner. Adding several KPIs to your list of things to track without creating an easy way to monitor them can lead to unwanted complications.

Thankfully, there are a variety of tools available to assist you in gathering the data you need to track those essential metrics. As a result, you'll spend less time tinkering with spreadsheets and more time focusing on implementing initiatives to grow.

Cloud accounting software allows you to keep track of your essential financial figures in, more or less, real time. It may be possible to create a dashboard that displays your most essential stats once you've logged in.

It's critical that every stakeholder in your business understands the KPIs to track and agrees that they're significant. Each person's priorities may alter depending on their position. There may therefore be ones they are responsible for, or more interested in.

The Finance Director might focus more on the financial metrics whereas the Marketing Director may focus more on the website, and lead generation side of the business. The people at the helm should consider, evaluate, and review the most relevant and significant metrics for the business regularly.

KPIs should be the core focus of your key people whereby they're committed to improving them over time. This will likely develop the business and lead to greater prosperity for employees, and stakeholders alike.

The content of this post was created on 06/07/2022, and was updated on 07/09/2022.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -