It is important as an owner manager to have a tight grip of the various performance metrics in your business. Often the focus is, understandably, on generating more sales and revenue. After all this is a prime indicator of growth and generating money. However, this doesn't necessarily result in profitability or an increase in your profits!

For this reason you need to understand, and keep a close eye on, your profit margins. Doing so regularly will ensure you're in a well informed position to carry out important decision making with regards to cost control, revenue, inventory, taxes etc.

This is why we've written this post, to help you understand:

The main goals of a business are:

It's easy to fall into the mindset that an increase in profits alone is a sign of success for the business. However, rising profits can be misleading potentially, profits might go up but how much money you make on every sale, could be in fact be decreasing. This is why you need to understand margins.

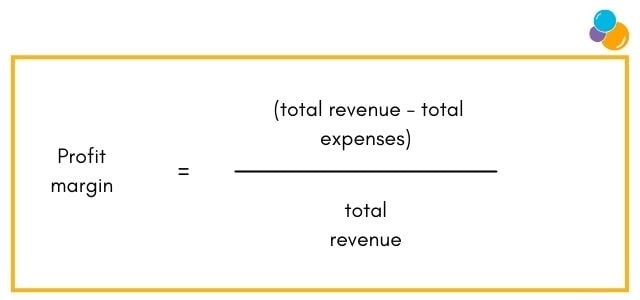

Profit margin is a ratio that helps you understand how much profit made from every sale of your product or service, after expenses have been paid. It is therefore an indicator as to whether a business activity is likely to make money.

Expressed as a percentage, profit margin is calculated by subtracting expenses from total revenue, to get to net income, and then dividing that number by total revenue.

Profit margins can be seen as a sign of efficiency. High profit margins are therefore generally viewed as a sign of financial health whereas consistent, low margins, may mean the business needs to review its expenses.

Creditors will refer to profit margin to understand whether a business will be able to generate enough profit, and therefore money, to pay off its loans. Investors on the other hand, will look at this percentage as a useful metric to gauge whether the business is sufficiently in profit to allocate dividend payments, should they invest in it.

Types of Profit Margins:

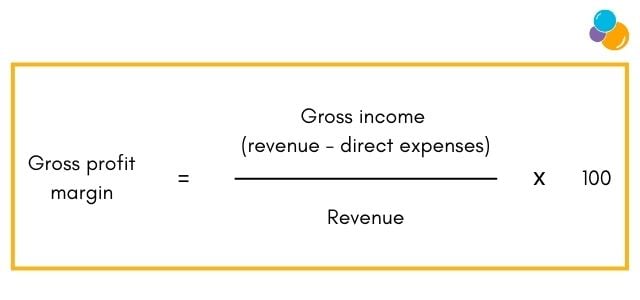

Gross profit margin is the simplest of the 3 to calculate. It tracks the amount of income left after you deduct direct expenses. These are costs that vary depending on the volume of goods, or services, your business produces. They can include things such as manufacturing of utilities, salaries, commissions, and raw materials.

As an example, if you have a cake selling business, the direct expenses involved will be all the recipe items you use to bake the cakes. To calculate gross profit margin, you can use the following formula:

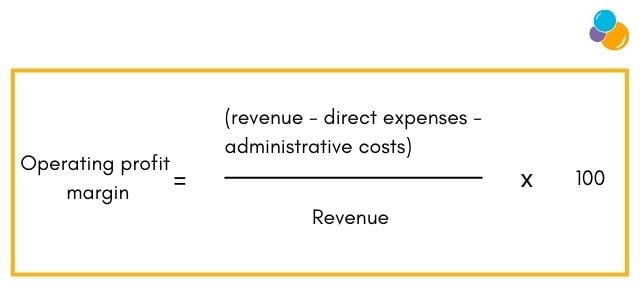

Operating profit margin allows you to understand how much profit your organisation will make after paying for variable costs, but not interest, or tax. This means it takes into account wages and raw materials.

To calculate this margin you need to understand your operating income, also known as earnings before interest and tax (EBIT). To calculate this you have to subtract direct expenses, and the administrative costs of running the business from revenue.

It is calculated as follows:

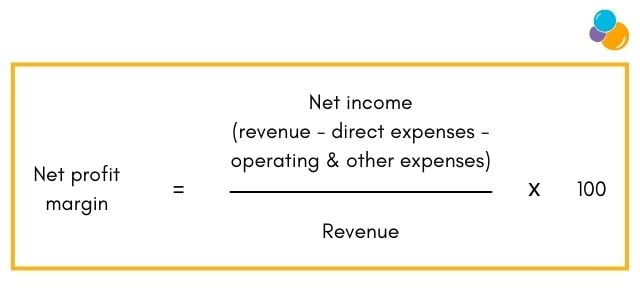

The ratio of profit your business earns to the total amount of net sales is known as the net margin. Net profit is what remains after accounting for all expenses which include things like operating costs, taxes and interest. It can also factor in things such as one-off payments, and debt.

Here’s the formula for net profit margin:

What is a good profit margin for a business?

Is there such a thing as a good profit margin? Ultimately this ratio differs from industry to industry. So, it all depends on location, and the sector, or sector(s), that you operate in. Be sure to do some research and check the data, where possible, of your various competitors.

As a useful, general indicator, The Office of National Statistics tracks that, profitability of UK businesses in December 2019 showed an average profit margin of 9.3% for private non-financial businesses, 9.4% for manufacturing companies, and 14.9% for service firms.

5 ways to improve your margins

There are several ways in which you can improve your margins. It is up to you to decide which route, or combination of options will work best depending on your circumstances. Below are some tips you could look at as a means to becoming more profitable:

1. Improve inventory visibility, avoid markdowns.

Markdown is a price reduction in a product to try and increase demand for it. Markdowns are often used to sell through all remaining stock. However, they are known to be notorious profit killers, so avoid them whenever possible.

You should always have a handle on what merchandise you have on hand, as well as keeping a mindful eye on what your fast and slow-movers are. This will help you make better decisions around purchasing future stock, in order to sell more products, and hopefully reduce the need for markdowns.

Another way to maximise your profit margins is to have 100% visibility of your inventory. Inventory refers to the items, parts, and materials that your business either uses in production, or sells. Having a very clear hand on all these expenses can help you minimise margin erosion.

If you review these numbers, can you identify any unnecessary expenditure?

Analysing the conversion rate on your website is a healthy way to measure its effectiveness. To calculate your conversion rate, divide the number of conversions by the number of website visitors and times by one hundred.

Once you have this benchmark, you can set about increasing your conversion rate, thereby getting more out of your existing web traffic and hence improving profitability.

Conversion rates can also be increased by studying the data available on your customers and identifying at which point potential customers are dropping off your website. This means there could be potential gaps in your marketing and sales process.

Try tweaking those webpages, to help visitors continue the journey from lead to new customer.

To reduce your overhead costs, you should aim at a faster turn around time for your product or service. Go back to the process you've created for delivery, what more can you automate? What can you do to speed it up?

Are there any steps you can eliminate without hampering quality? Remember, potentially the faster you convert this cycle, the better margins you can may achieve.

Operating expenses are those your business incurs conducting its usual business operations. Operating expenses include things such as:

Options you could look at to reduce these expenses and improve margins include:

5. Improve existing customer relationships to upsell and cross-sell

Customers that return to make repeat purchases are the lifeblood of a good business. It means they likely have bought into both your brand and your product, or service, offering. Conversely, getting new customers on board is time consuming, difficult, and potentially expensive. It is an investment in building up a relationship.

To grow sales, whilst also improving profit margins, would therefore suggest you focus on your existing customers, and maximising those existing relationships. What more can you provide them? How can you add more value?

Applying a disruptive mindset can potentially really help. By learning more about what your customer wants and needs, you can create personalised ways, or opportunities, to sell more to them.

Upselling is where you persuade a customer to purchase something additional, something more expensive, or upgrades. An example is in the purchase of a new car, where the buyer often has the option to upgrade on items such as sunroof, and leather seating.

Cross-selling is where you sell products or services to a customer that compliment what they have originally purchased. Think of a dessert wine that goes with a pudding in a restaurant.

The content of this post was created on 07/04/2022.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -