Accounting services and professional advice to help owner managers grow their small businesses.

Following the frantic period of creating a business and having established a viable operation, you'll likely shift into a phase of growing sales, income and becoming profitable. Unfortunately business growth can come with drawbacks especially if there isn't a sufficient level of financial management, systems, and controls in place. Profits may not necessarily grow with turnover and your organisation will become far harder to manage.

Wellers - accountants for small business

At Wellers, our comprehensive range of accounting services are designed specifically to the needs of small businesses. We've been working with scaling organisations, like yours, for over 8 decades. So, we understand the challenges, financial obstacles, and growing pains you're likely to be facing.

We apply all that experience to help you succeed today, and plan for a financially sustainable business tomorrow. Our teams of high skilled, and knowledgeable, accountants are dedicated to streamlining your finances, helping you maximise your profitability, whilst also keeping you compliant with all relevant laws and legislation. Our bespoke approach means we're your trusted partner to achieving growth and financial success.

Why choose Wellers

Proficiency in accounting

Wellers as a business has thrived for over 80 years. Our partners and staff are trained to the highest regulatory standards: that’s a given in professional services. What sets us apart is that relationships are at the centre of everything we do. It’s our goal to help our clients understand, and achieve, their true potential.

Tailored solutions for your business

We understand that every small business is unique, with its own set of financial goals and challenges. Our accountants and advisors dedicate time, and effort, to gain an in-depth understanding of your business, sector, and goals. We then apply our experience of having worked with clients in the same sectors, and similar circumstances, to apply our services and skills to help you fulfil your aspirations.

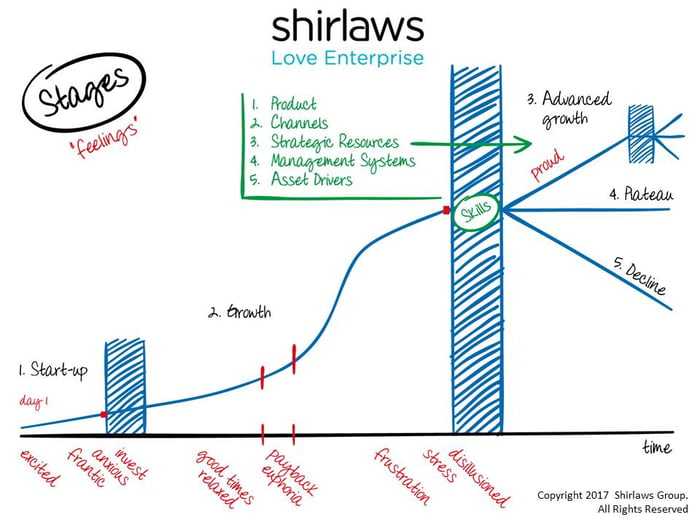

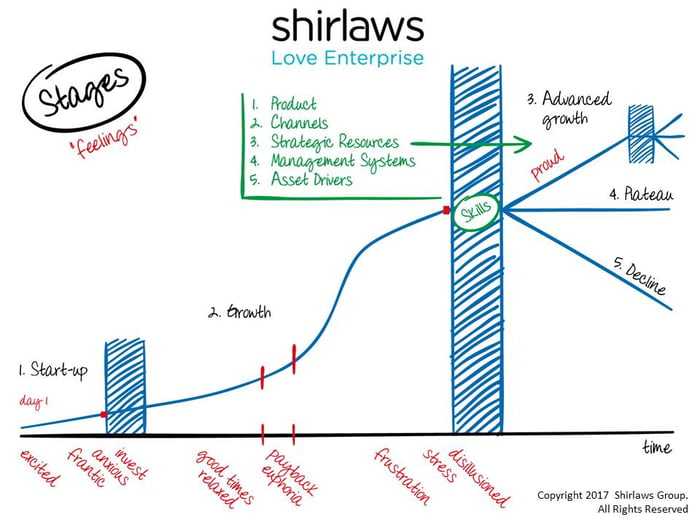

We understand business life cycles

From start-up to scale-up: we can guide you through expansion and help you navigate the challenges of moving from starting out to the next phase of development and profitability: sustainable business growth.

Shifting from a start-up perspective into the growth phase, per the stages model above courtesy of Shirlaws, does require a change of mindset. You may need to review your ownership structure, strategic direction, accounting software, tax relief options, and talent pipeline. It can feel overwhelming to do this for the first time: fortunately, we’ve been doing it for years and can guide you every step of the way through your journey.

We've helped many growing businesses progress and reap the rewards of their hard work.