The financial world, consisting of stock brokers, shareholders, and journalists to name just a few, often seems obsessed by the term, profits!

They're always referring to seeking more profit growth and finding markets, and businesses, with decent profit potential. But why?

To understand this, first we must take a step back and ask some questions such as:

What exactly do we mean by profits?

If your business is profitable, what does that actually signify?

The point is there's a wide range of different endeavours that can result in a profit, and consequently there's many different ways you can make a profit. That's why we've created this post for you, by reading it you'll then have clarity for your business as to:

In this post you'll discover:

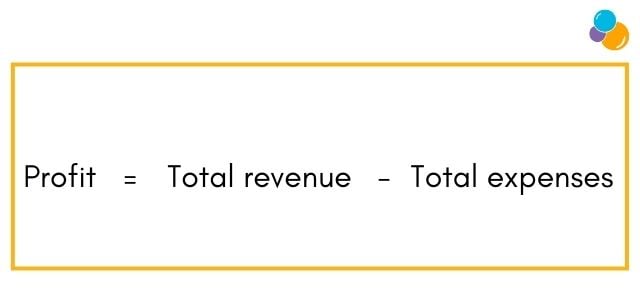

Profit can be viewed as a measure of accomplishment for a business. In its simplest form, it's the amount left after subtracting your total expenses from your total revenue. The money remaining, your profits, can either be kept in the business and re-invested to finance future growth, or distributed as a draw or dividends to stakeholders.

To calculate your profit you use this formula:

To understand if your business is capable of making a profit, first you need to know what your break-even point (BEP) is. Not many start-up businesses can achieve profits from day one. The early stages are often about investment and absorbing some losses to eventually break-even.

BEP is reached when your revenue and the expenses are the same. At this specific level there is no profit, or loss, you are therefore breaking even. Consequently this informs you how many products, or how much output in terms of services, you need to sell before you can surpass the BEP and be in profit.

You can also use the BEP figure to decide if you need to increase prices, or reduce costs, or a combination of both, in order to achieve a profit in the future. BEP is calculated through the following formula:

.jpg?width=640&name=Blog%20Image%20Template(11).jpg)

Fixed costs are typically expenses that don't change much over time, such as rent and utilities.

The sales price is how much your business will charge a customer for a single unit of your product or service.

Variable costs are those that are required to produce your product or service. This is likely to be employees and potentially materials. These expenses will often fluctuate.

Profit is also often referred to as the bottom line. This refers to the location of profit, also known as net income, at the bottom of the income statement in a set of accounts. If you are growing your revenue (more sales), or reducing your costs (operating efficiently), then you are said to be improving your bottom line. We cover some of the strategies you can implement to achieve this, below.

Generally, the higher your profits the better your business is perceived to be doing. This may then result in growth in the value of your business. At the point of making a profit, you can decide whether you want to re-invest the money into the business, to fund expansion and future profitability, or extract the money for yourself and other shareholders.

Whatever your decision, the question is then likely to focus on how to make more money? There are various ways to increase profits however, you need to be very mindful that in chasing this aim in the short run, there aren't longer term, negative consequences.

Remember business is about relationships, fostering and developing them so that you can produce something meaningful, and useful, that results in sales. Chasing more money could be at the expense of those relationships which may in turn damage your ability to generate profits in the future.

Consider the following strategies carefully, and proceed with caution on some of them:

To understand which strategies are likely to have the greatest impact on your profits, you'll likely need a business budget. You may want to increase sales, but can your employees cope with the additional burden of work to do so? How much more will they have to produce? How much additional marketing will you have to do to achieve those sales?

Having a business budget will provide you with as reliable an indicator, as possible, to obtain informed answers to those questions.

As part of your business budget you need to know what your margins are. These determine the profitability of your business by assessing whether the current mark up on your product/services is enough to cover your direct expenses to generate a profit.

Expressed as a percentage, the most common ones are gross profit margin, and net profit margin. If you see your profit margins shrinking then you'll know that either, pricing, sales, costs, or a combination of all of them will need to be reviewed.

You can also benchmark these margins, and other ratios to compare your business to your wider industry or sector. This will give you a feel for how well you're doing relative to competitors.

It is a natural instinct of many business owners to reduce their prices to be more competitive, and gain market share. However, the reality is reducing prices is likely to impact negatively on your profits.

As an alternative, consider increasing the price of your product/services! A slight increase could potentially drastically improve your profits. Increasing the price per product will help gain more profit on sale per product. More money for less work.

This has to be weighed as a decision with the risk that price increases above a certain level could potentially see customers move to the competition, resulting in a possible decrease in sales.

The logic here is, increase your number of sales and your profits will grow. Building a good customer base is one of the most important factors for a growing business. A good customer base means loyal customers who make repeat purchases.

Think strategically, are there new target markets you can enter? How do your current products or services fit in those markets? What do you need to alter to meet the demands and needs of those potential customers?

Adding new customers however, is likely to require extensive time, effort, and resource to acquire them. It could increase your expenses with all the marketing and sales efforts required. An alternative could be to reach out to existing customers, who are already bought into your brand, to get them to purchase more from your business.

Which of your products or services are bringing in profits? Which aren't? A smart move then might be to eliminate those that aren't doing so well. Not all ventures work, ending will help diminish costs, ultimately improving the bottom line.

How good are your back office systems at informing you as to if the costs of rent, utilities, materials, marketing, and employees? Having this intelligence to hand is essential to understanding how rising costs impact on your profit margins.

Where you identify costs are rising, you may then review supplier relationships and arrangements to achieve efficiencies and improve profits.

Can the people in your business do more in the time they have available? Can they produce more, or sell more, or both? Work with your employees to identify areas and ways you can all be more efficient and effective. Better systems and processes throughout the business are key to healthy profit margins.

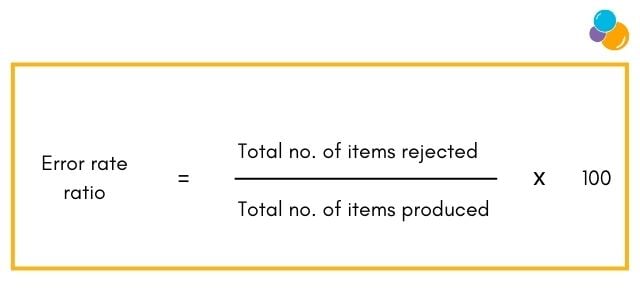

If your business is producing goods, do you assess how much is damaged and unusable? Cutting down on this in the production process eliminates waste, and can help increase sales and profits. You can use the error rate ratio to assess this. It's calculated as follows:

The higher the number, the more it indicates you have production issues that may need to be addressed.

The content of this post was created on 22/03/2022.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -