The other underlying theme of this Budget (and previous ones) was the state of the UK's finances. The government originally pledged to eliminate the deficit by 2018 and it's clear that won't happen now. This means seven years into austerity, there's still a long way to go. National debt stands at £1.5trn or 80% of GDP. Factor in unfunded pensions and it becomes £3.5trn or 191% of GDP.

According to the Institute of Fiscal Studies, the UK has the fourth largest budget deficit, measured relative to GDP, of all 28 advanced economies. What the Chancellor's statement revealed was a continuation in policy to reduce the deficit and eventually pay down the national debt by increasing the tax take. It's a potentially bleak prospect for self assessment tax payers, business owners, property owners and those on high incomes.

1. The economy

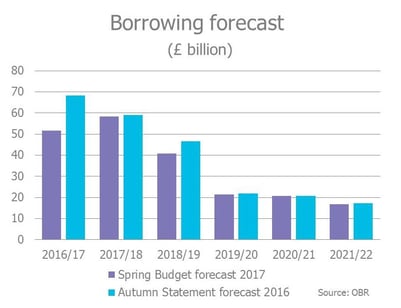

1. The economyThe latest short term economic numbers showed the government's finances, in terms of the gap between tax revenue and spending, were better than the Office for Budgetary Responsibility's Autumn Statement projections in November 2016.

Specifically government borrowing for 2016/17 came in at £51.7bn, that's £16.5bn less that originally forecast. The reality however, is the UK still spends £50bn per year on debt interest.

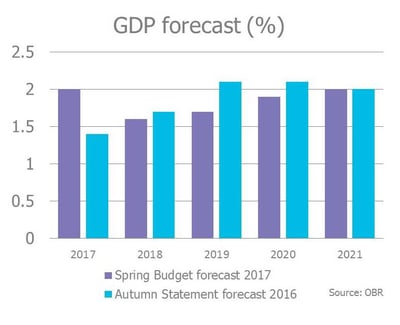

The economy is expected to grow faster than originally expected next year but there were downward revisions to GDP growth after that. This means GDP is set to expand at a slower rate than expected before the EU referendum vote.

The good news is Britain is second only to Germany as the fastest growing economies in the G7 group.

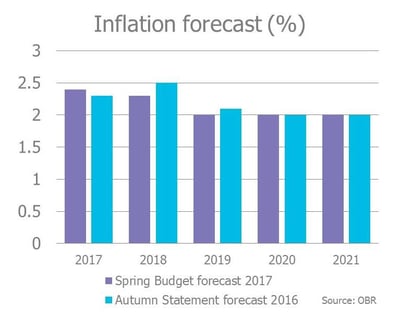

An area of concern is that inflation is showing signs of creeping up. It's now forecast to break the Bank of England's 2% target this year and the next two years after that. Might we see a rate rise from the Bank of England in the next few years?

Given the trend of the last few years and the commencement of Brexit negotiations, we'd suggest this is quite unlikely.

Given the trend of the last few years and the commencement of Brexit negotiations, we'd suggest this is quite unlikely.

The national debt is set to peak at an eye watering 88.8% of GDP in 2017/18. That's lower than the 90.2% predicted in the Autumn Statement. The other good news was real wages are set to rise in every year of the forecast period so the workforce should feel better off with potentially positive implications for consumer spending.

Corporation tax is set to fall to 19% from April 2017 and then again to 17% in 2020.

The Research and development (R&D) claim process will be simplified and the government aims to improve the awareness of the availability of R&D tax credits among the SME community.

On the controversial topic of the revaluation of business rates due to take effect from April 2017, the Chancellor announced three measures to help businesses:

Elsewhere, the mandatory application of quarterly digital self assessment reporting for unincorporated businesses and landlords with a turnover below the VAT threshold (£85,000 from April this year) will now be delayed by a year to April 2019.

There was mixed news for the workforce. The personal allowance for income tax will rise to £11,500 and the higher rate will increase to £45,000 in 2017/18. The national insurance contribution (NIC) upper earnings limit will increase to £45,000 in 2017/18 which will be in line with the higher rate income tax threshold.

However, there were planned tax hikes for the self employed, with Class 4 NICs stated to increase by 1% to 10% in April 2018. Another percentage increase on top of that was set for 2019. These changes sparked accusations that Mr Hammond had broken a Conservative manifesto pledge from the general election. Subsequent to this, Mr Hammond has stated that there will be no NIC increases in this Parliament and Class 2 NICs will be abolished from April 2018.

Another policy to impact business owners was the tax-free dividend allowance which was introduced in 2016/17 at £5,000, and is now set to reduce to £2,000 from 2018/19. These changes were justified by the Chancellor to promote fairness in the workforce and fund more money for social care.

On the topic of capital gains tax, the annual exempt amount (AEA) for individuals will increase to £11,300 in 2017/18. For most trustees the AEA will increase to £5,650. The nil rate band of inheritance tax remains at £325,000. New deemed domiciled rules apply from 6 April 2017 for inheritance, income and capital gains taxes.

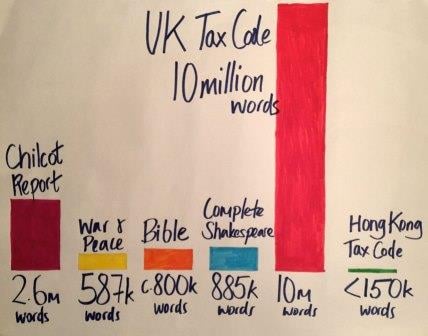

Dominic Frinsby, in an article in MoneyWeek on what the Chancellor should do today, explains how the UK tax code is not only extremely complicated but a colossal size. To be precise it's 21,000 pages long containing 10 million words. That makes it the largest tax code in the world. The image below, from Frinsby's Edinburgh Festival show 'Let’s Talk About Tax' put this into perspective.

Add in further complications around the lack of clarity and incomprehensibility of the book and it shouldn't be surprising that there's so much interpretation and exploitation in the form of tax avoidance and evasion. Something so large and complex is almost impossible for HMRC to administer and enforce.

Add in further complications around the lack of clarity and incomprehensibility of the book and it shouldn't be surprising that there's so much interpretation and exploitation in the form of tax avoidance and evasion. Something so large and complex is almost impossible for HMRC to administer and enforce.

Since 1990 successive Chancellor's have added pages and pages till we got to where we are today. Frinsby explains how much of this has been a case of creating legislation to close the loopholes exploited in previous legislation. This creates a vicious circle of more loopholes and subsequent additional rules after that. He goes on to explain that only a few can exploit this complexity which in turn leads to inequality.

What's actually now needed is major upheaval in terms of tax simplification. That means removing taxes and reducing much of the rule book. Nigel Lawson, whose tenure finished in 1989, is cited as the last Chancellor to do this:

"He made it his stated policy to remove a tax with every Budget, and he did so six times. He also reduced the number of income tax bands to two."

Given the weakness of political opposition and that the UK will be exiting the EU and single market as we know it, perhaps now is as opportune a time as any to reshape and simplify Britain's tax system. Philip Hammond, perhaps it's time to upgrade the spreadsheet and get radical with your fiscal plans!

Alas we expect more of the same policy announcements in the next Autumn Budget.

The content of this post is up to date and relevant as at 09/03/2017.

Please note that the names and characters used in the examples mentioned above are hypothetical. Please also be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -