The idea is designed to ensure that in the main, fiscal changes and announcements will only take place once a year. The spring statement will then review the Office for Budget Responsibility’s (OBR) economic forecasts. Holding the budget in the autumn should then provide businesses and individuals with sufficient time to plan for any changes announced by the Chancellor prior to start of the new tax year.

Other than that there weren’t any shocks, the Autumn Statement 2016 was actually quite a sombre affair. Given the current political climate that’s probably exactly what it needed to be.

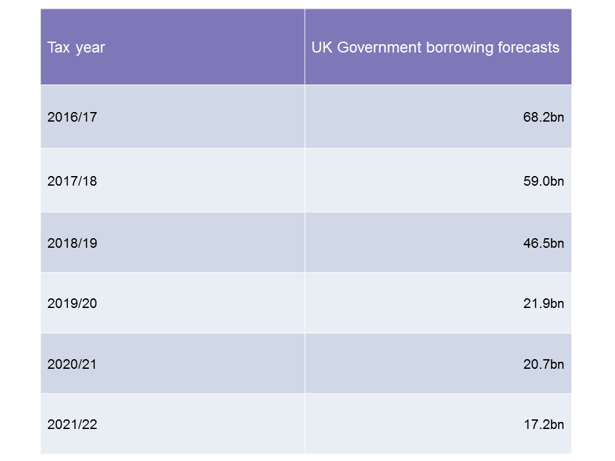

The Brexit referendum vote means revised economic forecasts the OBR which look significantly different to the last budget. It’s what the Chancellor described as a “fiscal reset”. The budget deficit stands at £48.6bn currently and borrowing projections look as follows:

This will add an additional £122bn to national debt which will stand at nearly £2trn by 2020/21. A date for achieving a surplus has been removed other than to do so in the next Parliament. This is to provide flexibility for the Chancellor to deal with an uncertain economic climate.

This will add an additional £122bn to national debt which will stand at nearly £2trn by 2020/21. A date for achieving a surplus has been removed other than to do so in the next Parliament. This is to provide flexibility for the Chancellor to deal with an uncertain economic climate.

Tackling Britain’s dire productivity - investmentInnovation and infrastructure will benefit from £23bn of government spending over the next 5 years. This stimulus and additional investment will come via the “National Productivity Infrastructure Fund” which is extra money borrowed to:

Infrastructure spending will be beneficial to those engineering and construction companies that win government contracts. Greater connectivity where broadband speeds and internet access are quicker will be beneficial to all. The Chancellor reiterated the government’s aim for Corporation Tax to be lowered to 17% by 2020/21.

There will be potential pressure on staff costs for many businesses with the announcement that the National Living Wage is set to rise from £7.20 to £7.50. Estate agents dealing in lettings will see a ban on the charging of fees to tenants. Landlords are now expected to cover the costs; this is the latest in a series of policies aimed at the buy-to-let market.

The insurance premium tax is rising to 12% from April 2017. This will for example, add £15 a year to the average car insurance premium. The Chancellor reiterated plans to clampdown on whiplash compensation claims but insurers argue the premium increase will offset most of the savings consumers will make from such reforms.

The government will axe salary sacrifice tax perks on a number of lifestyle benefits from 5 April 2017. Salary sacrifice schemes had allowed employers to offer their staff the option of giving up part of their salary in exchange for non-cash benefit(s). This came out of pre-tax pay which meant tax and national insurance wasn’t applicable.

These benefits will be taxed in the next financial year with the exception of pension contributions, childcare vouchers and cycle-to-work. If your staff are enjoying a scheme that will be axed (of if you offer one to them prior to next March), they may be able to keep the benefits until April 2018 or even April 2021.

The tax free threshold on income will rise from £11,000 to £11,500 in April 2017. The higher rate tax threshold of 40% will increase to £50,000 by 2020. Both employer and employee national insurance thresholds will be aligned at £157 per week.

There was only one change to private pensions, a cut in the Money Purchase Annual Allowance. At present you can contribute £40,000 to your pension per annum. However, once you draw down on your pension fund, your allowance then falls to £10,000. As of April 2017, that allowance will be reduced to £4,000 which means people are likely to delay when they start withdrawing money.

The government is launching a savings bond via National Savings & Investments. It’s going to pay interest of 2.2% per year on savings of up to £3,000. That sounds good but keep a careful eye on inflation, if it rises above that then you’re losing out in real terms.

The content of this post is up to date and relevant as at 24/11/2016.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -