We now have a new Prime Minister in Liz Truss, the 4th in just 7 years!

The former Foreign Secretary has pledged £30bn worth of tax cuts as part of her leadership bid. The question is can the new Cabinet deliver on the promises of spending commitments such as care for the elderly, whilst also managing to somehow lower the tax burden at the same time.

How much of what was discussed, debated, and pledged at hustings will really turn into policy? Time will tell! In this post we assess what could be coming in the government's next budget, expected to be scheduled for 21 September 2022. Read on to find out more.

The likely areas of focus in the next budget could be:

Under announcements by former Chancellor, Rishi Sunak, in the Spring Statement 2022, the Health and Social Care levy was effectively introduced in April 2022, adding 1.25% to National Insurance (NI) contributions with a separate standalone levy being implemented from April 2023.

The new, Liz Truss, government plans to reverse this NI increase and it is said the intention would be to alleviate the change soon after the budget, potentially by November, rather than waiting until April, as is custom under Treasury rules.

In the Budget 2021, the government announced changes to the Corporation Tax rate to take place from April 2023.

Profits above £250,000 were to be subject to an upper rate of 25%. Profits of £50,000 or below were to be taxed at a lower rate of 19%. Profits in between these limits were to be subject to a marginal rate of effectively 26.5% but with the benefit of marginal relief.

Leadership hustings reveal that Liz Truss has vowed to also reverse the Corporation Tax hike, citing that this would help attract investment to the UK. This despite it being estimated that it could cost the Treasury £18bn in potential tax revenue.

Truss has proposed a temporary suspension of the green energy levy. At present, it adds around 8% to domestic energy bills. This could save households an estimated £153 a year. It should be emphasised that this is likely to be a stopgap measure given the Prime Minister remains committed to the net-zero climate change policy.

Truss is against the windfall tax on energy companies and has ruled out extending it.

The Prime Minister is said to be in favour of transferring the personal allowance between married couples and civil partnerships. At present, if a person doesn't make full use of their personal tax allowance of £12,570, they can transfer £1,260 to their spouse, or civil partner.

Truss would look to take this further by allowing the full allowance to be transferred between couples where one of them is the sole earner.

There has also been speculation around the potential of VAT being cut to 5%! A considerable reduction given it currently stands at 20%. This is along the same lines of thinking to Gordon Brown’s temporary cut in VAT, from 17.5% to 15% during the financial crisis in 2009 in an attempt to boost the economy. VAT may also end up being removed from energy bills, albeit temporarily.

IR35 legislation exists to prevent individuals from claiming to be contractors, or freelancers, and enjoying the tax advantages of operating through a limited company, or as a sole trader, when in reality they would be considered to be employees.

The Prime Minister has acknowledged the benefits this status brings, but has pledged to review it. After all, self-employed people don't enjoy the same benefits as being employed, such as paid holidays. Truss feels the tax system should reflect that.

Truss has stated there will be no new taxes and that tax reform is part of her agenda. Tax simplification is something we've requested on this blog in many prior posts, given the scale of UK tax legislation and its complexity.

The government may conduct a full review of the tax system. This would include inheritance tax but details aren't yet forthcoming and it's likely this will be more of a long term aspiration.

Truss has promised a drastic review of all EU laws that have been retained following the Brexit vote. This is with a view to cutting many of them as businesses still have to adhere to them. Details have yet to emerge, but the idea is this will boost investment and growth.

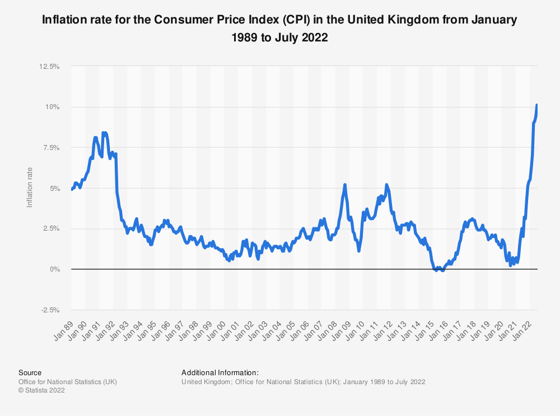

Some politicians have placed the cause, and reason, for inflation being far above target down to the Bank of England failing to act quickly enough. The bank is said, by some, to have lost control of inflation with the CPI measure now standing at over 5 times the bank's official 2% target.

Truss is said to want to review, and potentially change, the bank's mandate. It is unclear what this will look like. Might she want to establish a balance between managing inflation while ensuring unemployment doesn't soar? Or, create a lower inflation target that the bank must aim for regardless of other aspects of economic performance?

Could inflation and the cost of living crisis force Truss to change tack from her hustings pitches? Given the huge rises in energy prices, there is enormous pressure to provide targeted payment assistance to voters. Tax cuts alone may not suffice given they won't help the most vulnerable, in the form of pensioners and benefit claimants.

Does this mean that Truss will switch to some of the positions her leadership rival Sunak was espousing? Circumstances mean a potential pivot could be coming. We may see £100bn or more in direct handouts from the government to support people, families and businesses.

The content of this post was created on 05/09/2022 and updated on 15/09/2022.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -