Do you make use of freelancers or contractors to help you do business? Or, do you operate through your own 'personal service company'?

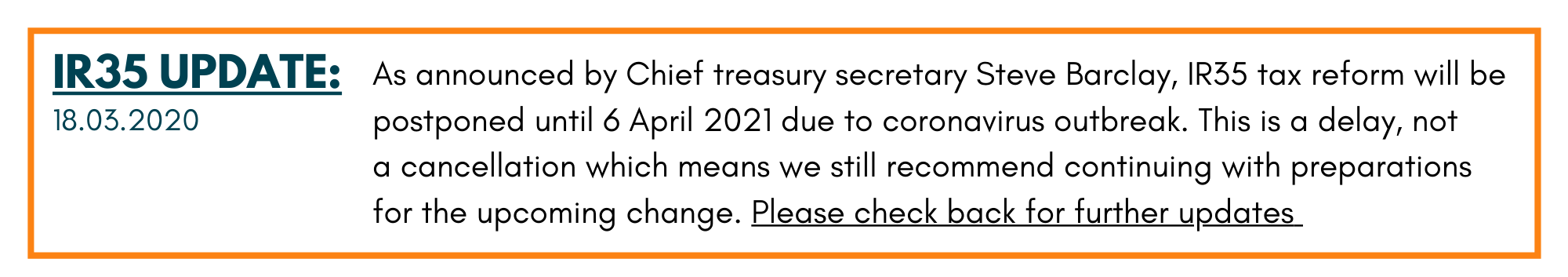

It's a very important question because new IR35 tax rules are set to be applied to the private sector in 2020!

First introduced to the public sector in 2017, the rules known as off-payroll working regulations could see many business owners facing significantly higher tax bills. Government data suggests the reforms have already generated annual tax revenues of over £550m since 2017, hence the move to apply the same legislation to the private sector from 5 April 2020.

The regulations are designed to tackle disguised employment. This means HM Revenue & Customs (HMRC) will be targeting businesses that hire contractors to do work for them, where in effect they're actually operating as an employee.

In this post we'll explain exactly what is changing, why, and what you should do to prepare for it by performing an IR35 check.

IR35 is legislation designed to prevent individuals from claiming to be contractors or freelancers when for tax purposes they're actually considered employees. This is because workers can enjoy potential tax advantages when operating through a limited company, or as sole traders, compared to employment.

For many years HMRC have suspected that many businesses have made use of freelancers and contractors when in effect the real relationship was the same as that of employer and employee. This can suit employers because they don't have to pay national insurance contributions for these workers.

Often the individual workers benefit as well because such measures can help reduce the amount of national insurance and income tax they incur. Given the pressure on the public finances, the need to reduce the budget deficit, and plug the tax gap, it's unsurprising this is a target area for HMRC.

Consequently the government introduced rule changes to the public sector back in 2017.

For the last 2 years it has been the responsibility of public sector bodies to check the employment status for tax purposes of the freelancers and contractors they hire. Where they think the legislation doesn't apply to a worker, namely being outside of IR35, then they have to treat them as an employee. This means deducting the correct amount of income tax and national insurance from their wages at source.

As of April 2020 private sector organisations will also be required to ascertain the tax status of third party workers by undertaking their own off-payroll working assessment. Where identified, you will have to apply the relevant taxation if you deem that the legislation doesn't apply. Needless to say this has stirred up plenty of uproar in the private sector.

Given the already significant administrative burden of operating a payroll (think RTI reporting and pension auto enrolment), this will be another regulatory task that adds more time and cost pressures to the back office finance function. You'll be forced for every third party you're engaged with to consider their tax status carefully.

There's also many questions as to what does and doesn't constitute off-payroll working. HMRC has not published a definitive guide as to who falls inside and outside of the system. This leads to uncertainty for businesses and individuals alike. Make the wrong call and you could be challenged by the taxman, potentially facing fines and a large bill with interest applied.

Furthermore while freelancers and contractors may see their tax statuses change, they won't correspondingly ascertain the same benefits of being treated as employees. That means while paying more in tax they still won't be entitled to the same rights for matters such as holiday allowance, claiming maternity pay, and sick pay!

The legislation is set to apply to medium and large private sector businesses that engage with contractors, personal service companies etc. If you're a small business using contractors the reforms will not apply to you... yet.

The government defines small businesses as those that meet 2 out of the following 3 threshold tests:

If you own a personal service company that works with medium and large businesses then you should be prepared for changes to contract rates and take home pay as of April 2020.

Personal service companies that engage with small businesses are still required to assess the employment status of its own workers as has been the case in the past.

It's estimated that potentially hundreds of thousands of workers could be impacted by this. Given the uproar, the Chancellor, Sajid Javid, mooted recently that the rules would be reviewed ahead of their introduction. He didn't however, commit to any specific changes or announcements!

This means the situation, at present, remains the same for April 2020. Therefore you need to assess whether one of your workers is really an employee of your organisation, or a genuine freelancer or contractor.

There are 3 principles HMRC uses as part of an IR35 test and you can apply them yourself to determine the answer to whether you have a worker or an employee?

When, where, and how do they perform their work?

Can they work as they wish?

Do they have to work from a specific location and at certain times of the day at request?

The more control the provider has over tasks, the more likely this will fall inside IR35.

Can the task only be completed by the individual?

Can someone be sent to substitute for the work in their place?

If the work can be performed by others quite easily this would point to being outside of IR35 status.

Is there a commitment from the work-provider to distribute work?

Is there a requirement on the individual worker to carry out the tasks?

If the answers to the above questions are yes, this suggests to being inside of IR35.

Other IR35 checklist questions to consider carefully:

It's important to note that so-called 'IR35 friendly' contracts should not be relied on to circumvent off-payroll working regulations. As with most HMRC reviews they will look at substance over form which has been proven in previous IR35 Supreme Court rulings.

1. Conduct a review of all the freelancers or contractors that your business makes use of.

2. Use the above principles to identify which ones are likely to not be compliant with HMRC's off payroll definitions.

3. Communicate this matter to those freelancers explaining both the potential tax implications and that they'll probably have to shift to PAYE.

4. You may need to review and alter rates of remuneration in light of their new employment status.

5. As soon as possible, get these people set up on your payroll and look at altering any existing contracts to reflect these changes.

Finally you can review HMRC's "check employment status for tax" tool. It allows organisations and individuals to get a broad, but not necessarily specific, idea of their tax status. However, it is not a substitute for legal advice being more an outline guide. Instead be sure to discuss such matters carefully with your accountant for specific direction.

The content of this post was updated 18/03/2020 and originally published 17/01/2020.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -