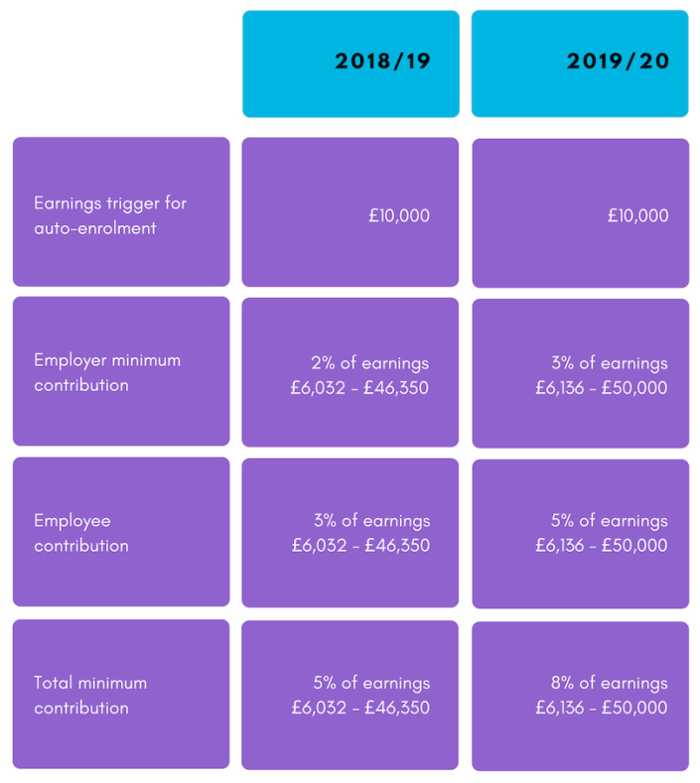

From the start of the new tax year, 6 April 2019, employers will have to increase the amount they contribute to staff enrolled in their occupational pension scheme, from 2% to 3% of salary. This comes at the same time as a 4.9% rise in the National Living Wage to £8.21 per hour for workers over the age of 25.

These payroll pressures could result in a squeeze on margins for many small and growing businesses. Whilst employees' minimum contribution to their pensions will increase from 3% to 5%, owner managers should plan ahead and not rely on this resulting in staff opting out of pension auto enrolment.

Some potential strategies for dealing with these changes:

Some potential strategies for dealing with these changes:

With costs rising in on area, the usual mindset would be to look at what can be reduced in other parts of the business. In this case however, reviewing the pension provider would be a great place to start.

Many small businesses made rapid decisions on this to be compliant when pension scheme auto-enrolment was first introduced. In such a rush, they may have missed out on the best deals. Therefore now would be a good time to review the marketplace for the best provider to find a deal that might represent better value for money and potential savings.

Your staff are likely to have an aspiration of what their pay will look like and rise to this year. If the increases on 6 April are likely to erode your margins and create a financial headache, now would be a good time to communicate effectively with employees and manage their expectations.

In such circumstances it's both fair and reasonable to explain to your employees that increases to their gross pay will reflect the increased contributions your business has to make to their pension scheme.

In effect they still get the same pay rise they expected but partly through the pension contribution. It's vital that they understand this especially where pay rises are altered accordingly. Be clear on what your currently contributing to their pension scheme, that it's funding their future retirement pot, and how it's increasing.

It may also be wise to point out to them that the personal allowance will rise by 5.5% to £12,500 while the basic-rate income tax band will increase by 8.7% to £37,500. This means the higher rate threshold (the sum of the two) will be £50,000, an increase significantly higher than inflation, meaning they will be better off in terms of their net pay.

The benefit for you is that limiting the pay rise means the wage bill will remain under control and pension contribution costs kept down.

The content of this post is up to date and relevant as at 22/03/2019.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment