Scaling up can be a scary experience!

If your business is entering a period of fast growth, or in the middle of it, things can feel like they're getting out of control. This is because as your organisation expands, it becomes harder to manage with so many more moving parts. This can lead to anxiety for owner managers as pressure mounts to maintain turnover targets, while meeting financial commitments.

Growth can cause significant operational issues as expansion in your customer base and increasing demand overwhelms the existing people, systems, and processes you have in place. Your back office may not adjust or grow quickly enough meaning you're faced with needing to make an investment.

An option available at this stage in your business journey could be venture capital finance and working with venture capitalists. They are a particular type of investor, made famous for their key early roles in developing some of today's most successful organisations. Think Facebook, PayPal, Picturehouse Cinemas, and Zoopla. Read on to find out what venture capital is and how it might help your business in the next phase of growth.

In this post we cover:

Venture capital (VC) is a form of financing provided by investment firms that supply high risk capital to businesses they believe will scale and grow. Their aim in doing this is to achieve a significant return on investment (ROI). VC exists because often growing, albeit early stage, businesses are limited by the funding options available to them.

A VC business raises money to fund, and mentor, entrepreneur's, as well as the owners of early stage, potentially high growth, private enterprises. They make use of capital raised from limited partners, consisting of individuals and organisations. Usually they will take a minority stake in the business of less than 50% while the venture capitalist (see below) applies their skills and operational experience to help guide the business owner.

VC firms contain investors, referred to as venture capitalists. They find and research investment opportunities in early stage businesses. They may also help raise money to contribute to the investment funds in the firms they work for.

For SMEs traditional institutions, such as banks, are likely to charge significant interest on any loans and/or demand security in the form of physical assets. However, many of today's organisations are information and service based, this means most of their assets are intangible (non-physical).

Then factor in that both banks and capital markets (such as stock and bond markets) are highly regulated so as to protect their public investors. This means more often than not these avenues of funding are inappropriate to most SMEs because the rules are more appropriate to larger corporate organisations who have the money, time, and resource to be able to adhere to them.

Other earlier forms of finance (such as friends or family, overdrafts and business angels) will help an entrepreneur bring a concept to life. The VC's aim however, is to help further commercialise an entrepreneur's current concepts and innovations.

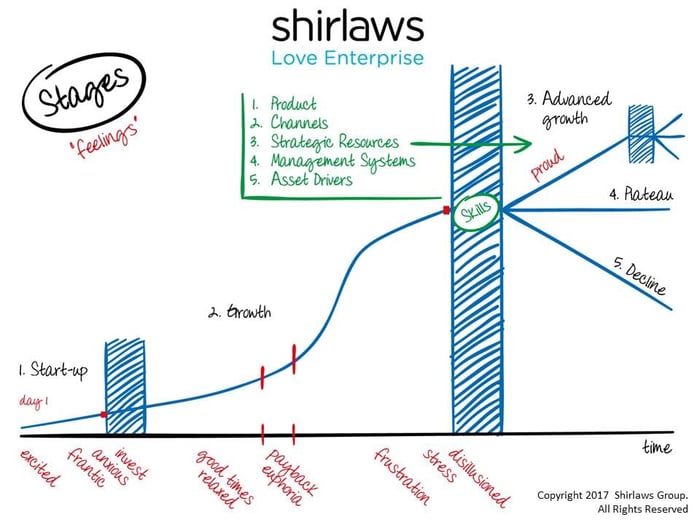

VC's focus on early stage organisations, usually around, or after, the 'payback' phase per Shirlaws stages diagram above. Often, this is where the most rapid and substantial growth will take place in the business journey. It's also the phase where there's the most significant chance of failure should the business grow too quickly. That means taking on risk for the potential of very high returns in the event the investment proves successful.

A VC firm consists of:

General partners are members and managers of the investment fund. They take an active role in the business and bear responsibility for it's liabilities. In the venture capitalist mould, they will find what they think are good businesses and negotiate on the terms and conditions for investment. Secondly, they will then work with the owners of those businesses to achieve their growth targets.

Limited partners consist of both the people and organisations that put up the capital for the general partners to make those investments. Examples of limited partners include pension funds, and even hedge funds. A VC fund tends not to invest the money of its own partners, instead that of the limited partners. General partners may, of course, invest their own money but this usually makes up a very small amount of the total size of the fund.

VC funds make money via what is called the carry (carried interest) and management fees. If an investment is successful then the share of the profits is distributed to partners. This is known as 'the carry' and it usually works along the lines of 80% distribution to limited partners with 20% going to general partners.

Management fees are often charged at 2-3% per year to limited partners. However, undertaking the actual investments doesn't come under this charge meaning there can also be arrangement fees of 2% for each investment made.

Such charges are quite common because the tax reliefs for investors are generous however, they require a minimum investment period of 5 years for them to enjoy the tax advantageous dividends, and capital gains on offer. Finally there are also performance fees which can be structured in numerous ways. An example would be the level of uplift in the net asset value of the fund.

The expectation from investors is a return of around 25% - 35% per year over the lifetime of the investment. This is a crucial point for business owners because the critical question is how do venture capital funds go about choosing organisations to achieve such significant returns?

The answer lies both in their investment portfolio and how their deals are structured, another key area you need to understand when raising this type of finance.

A funding round occurs whenever money is raised from one or more investors for a business. Funding usually starts with the seed/angel round. Often, this is at the concept and idea stage, either getting to a prototype or proof of concept, or launching from conception stage into the market.

VC firms don't usually engage in this round because the business in question is often just starting out. This means funding will usually source from friends, family, and angel investors.

After this, the organisation could issue share options in the start-up phase, usually known as a Series A round. Angels will still be interested at this stage however, VC's are also potentially likely to invest as the business may now have a proven tack record.

Typically funding rounds are labelled A round, B round, C Round etc. with each investment following the other. The letter identifies which number in the rounds the business is at. If your business is at B Round then this means you're at the second round of funding.

The type of funding round will also depend on the type of shares are being offered, such as ordinary, or preference shares. By a series B round, the organisation is likely to have a higher valuation given its trading history. Risk for investment will therefore potentially be lower meaning the price of investing will be higher.

At series C round the business is likely to be moving into fast growth. It's likely to be successful in its market, increasing its market share, and/or developing new products and services. At this stage it's a case of securing investment to fund the infrastructure to secure advanced growth and scale.

Evidently money is the dominant theme for the backers of VC funds. Their sole purpose is to make a very significant return on their investment. That means VC investment isn't necessarily long term in nature, usually lasting not much more than 10 years, although there are exceptions.

The role of venture money is to invest in the infrastructure of an enterprise to further commercialise its innovation and potential. This often means bringing the following into a business:

Once the business reaches a certain size and/or has developed a credible reputation then a VC firm will look to exit. This can take several different forms namely:

A key takeaway here is the power of people. This is the key to appealing to VCs! They are looking for entrepreneurs who they believe will be able to run and take an organisation to the next phase of growth. Confidence in you as the owner and the ability of your management team to deliver to the point where they can exit, is essential. That's because with so much vested interest in your success, VC's will be looking for people and teams that they can work closely with.

By understanding the nature of venture capital, how it works and what venture capitalists are looking for you'll be able to gauge whether this finance option is right for your business. If that's the case then you'll also understand their motivations and pressures - key components to address and solve in any potential future pitch for funding.

This post was created on 04/09/2017 and updated on 05/10/2022.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -