Are you trying to obtain finance so that your enterprise can grow, and scale?

Has your limited company been offered a loan but on condition that you sign a personal guarantee, as the director?

If so, then that's why we've written this blog post, to explain what a personal guarantee is, how they work, when they apply, and the legal matters around them. We've helped countless clients raise finance for their businesses over the years, and often personal guarantees can be a requirement of those deals.

Our article will equip you with everything you need to know, especially concerning the personal, and financial, risks involved. Whether this is the right choice for you will depend on your appetite for risk, and your personal circumstances. Be sure therefore to read on so that you're as well informed as possible, and know what to look for in the terms and conditions, before making any commitment.

This post covers:

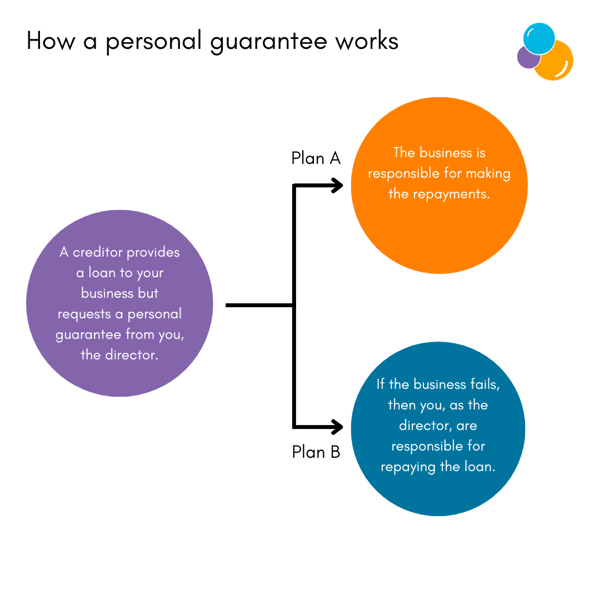

A personal guarantee, also known as a director's guarantee, is an agreement between a limited company director, and a lender. It works whereby the director, pledges to be personally liable for repaying a loan, in the event that the company is unable to service the debt.

In making this commitment as a director, you're providing the lender with an additional layer of security. It also means, should the need arise, then the lender may be willing to extend you more credit in the future. This is because there is a backup plan in place should your business fail to meet the conditions of the agreement. The guarantee shows them you're confident in your business, and its commitment to making repayments.

From your perspective, a personal guarantee can be considered potentially risky. This is because, if things don't go according to plan, then you might face legal action and have your assets seized in order to pay off the debt. However, if you have faith in the direction of your company, the reward will hopefully outweigh the risk.

2. How a director's personal guarantee works in the UK

2. How a director's personal guarantee works in the UKTypically directors that commit to agreements like this will have confidence that their business will perform well. This means that whilst they may acknowledge what could happen if things go wrong, they don't view that as a likely scenario. They feel the chances of having to use their own money to pay back the loan are, slim.

However, agreeing to a personal guarantee is a big decision that should never be taken lightly even if you have the upmost confidence in your business. The reason being that trading can peak and trough with economic conditions, and there's always the potential for a one-off disastrous event that can harm business performance. Think of the COVID-19 pandemic as a perfect example of this.

There will always be a chance that repayments need to default to the guarantor and their personal capital. However, committing to a personal guarantee can help unlock funds that may otherwise have been unattainable.

This means you risk treading a fine line between your personal, and business finances. It will ultimately come down to how comfortable you are with this, and assessing the risks involved. Also, a lender may request more than one personal guarantee on a business loan. This is likely if the amount being issued is high, and it's not secured against any tangible assets.

Where there is more than one personal guarantee, this is known as a joint and several personal guarantee. These types of guarantee mean that a group of directors, not just the individual director, are responsible for paying off any outstanding liability. Where one director doesn't pay, the remaining guarantors would pay off the full amount.

Most lenders have a preference for a personal guarantee when it comes to business loans. Lenders use personal guarantees as a means to see if the director believes in their business. The theory goes, if they do, then they will commit to this to secure finance.

Think of it this way, why would a lender commit money to a business if the owner is, in effect, not prepared to put their personal assets and finances up for this? As a director, you'll the everything about your business, the lender on the other hand doesn't. They're new to your organisation.

The guarantee provides them with that extra confidence to provide finance. The reason being lender's will always look at how likely your business is to go bankrupt. The other consideration is, if the business folds, how likely are they to recoup their money? The answer to that question also dictates the personal guarantee, if there are no tangible assets in the business then the guarantee ensures the lender can get their money back should your business cease to trade.

You should check carefully about the level of assurance a lender requires relative to the business loan. Some may ask for the full loan amount, while others can sometimes request just 20% of the total lending. This will in part depend on whether you have taken out secured, or unsecured, finance. Typically unsecured lending, and/or little to no credit history will see lenders demand a guarantee.

Personal guarantees tend to be applied to the following:

Personal guarantees are unbreakable, and this applies in an insolvency. This means other than settling the debt, there is only one other option. You could try to renegotiate the terms of the agreement, so that your lender will no longer insist on a personal guarantee.

If the lender requests it, you will have to settle the debt and come to an agreement to pay it.

Personal guarantees are enforceable if the contract has been completed properly, and in the correct legal manner. However, it occasionally happens that the paperwork goes missing or the guarantor wasn’t fully aware of certain items in the document they were signing.

The latter circumstance can be challenging to establish because the director (the signatory) is held to a higher standard than is typically the case with other contract signatories. It is dangerous therefore to assume that a personal guarantee cannot be enforced.

In the event that you did want to challenge it, you'd have to ask yourself, do you have the financial means to file a lawsuit with all court proceedings that would entail?

The first and most important items to understand is how much are you potentially going to be personally liable for? If the business can't settle the debt and defaults then this is the sum you'll be responsible for paying back.

As mentioned earlier, is the level of assurance unlimited, whereby you are liable for the full amount owed? Or is it limited to a percentage of the total debt?

Be sure to check carefully the terms of the loan, or credit facility, your business is taking out. What is the repayment schedule? If the business fails to keep up with a payment one month, what are the potential penalties, and how financially onerous are they?

What constitutes a default? What exactly do the terms of the guarantee specify this as?

If your business defaults, what are the lender's rights? Is there a condition whereby they have a right to demand payment? If this is stated in the T&Cs then it means the lender could demand payment of the full amount of debt should your business default.

Does the contract state that there is a remedy period? This means in the event of default, do you have a period of time in which to remedy the situation and make the required payment(s)?

What is the lender's rights when it comes to pursuit of the borrower, and other guarantors, for repayment, if the guarantee is put into effect? This is known as right of subrogation.

Does the guarantee specifically state that the lender (creditor) can only make personal demands on you, as the director, as a last resort?

If you as the guarantor go personally bankrupt, what is the potential impact on the state of the guarantee? Will it remain enforceable, or not?

As you can see from the above, there are many things to check in the T&Cs, and look to negotiate them in if they are missing, or not to your satisfaction. This means you'll probably need legal advice to help you assess the level of personal risk, and prevent any unwanted surprises cropping up.

Making the choice to accept a personal guarantee, and it's potential implications, is challenging. However, it's definitely something to think about because it may open doors that were previously unthinkable, or out of reach. Going down this finance route will potentially:

1. Provide you with the opportunity of obtaining funding

2. Ensure you have the means to acquire the necessary resources to progress towards your business objectives

3. Potentially secure you a higher loan amount

Entering a personal guarantee means you provide the lender with more security by pledging your personal capital and assets. This might just be what is needed to get your funding application over the line. By offering that security, you may be able to borrow more in the long run.

You need to understand the legal implications of a personal guarantee, preferably prior to any approach you make to a lender. These are:

1. Future ambiguity

2. It's a burden you could bear alone

Even if you are certain that your business will be able to make the repayments on time, things might not always turn out that way. Remember, the unexpected can occur in business with little, or no notice at all.

It will be your responsibility to step up and make the repayments, potentially on your own, if the business goes bankrupt. If you're unable to do so comfortably, this can lead to personal bankruptcy and/or your assets being seized in order to pay off the loan.

You can potentially obtain an annual insurance policy to provide you with cover in the event that your lender calls on the personal guarantee. This would be to make up for any shortfalls the business may owe the lender, following insolvency. The insurance is a possible means of helping to prevent any loss in your personal wealth as a director.

This is usually specified in the agreement. Some personal guarantees have a time limit meaning after this date it becomes ineffective, thereby ending the creditor's right to make a claim.

It ultimately depends on the type of contract in question. You need to read the agreement carefully and potentially take legal advice before signing anything. By their nature, every personal guarantee is unique.

It's possible that you might have to sign a personal guarantee in the application for a business credit card. This is potentially more likely if the application is for a small businesses, the reason being smaller firms pose a greater risk to the credit card issuer.

It's worth doing some research on this because there may be various cards available that don't require a personal guarantee.

If all the payments on the debt are fulfilled by your company over time, then signing a personal guarantee shouldn't have an impact on your personal credit score. However, if your business is late with its payments then you may be responsible personally for paying off the loan, and this could have a negative impact on your personal credit rating.

If you then fail to keep up with payments this could impact on your savings, your assets such as your house, and potentially the freezing of your bank accounts in a worst case scenario. In the instance where your personal assets are insufficient to pay off the debt, bankruptcy proceedings could be issued.

This highlights why it's very important to consider all the implications, before committing to a personal guarantee to raise finance for your business.

It should be noted that whilst many lenders require a personal guarantee as part of extending finance to SME businesses, this isn't your only option. Firstly, you may not necessarily have to raise debt to secure finance, you might look to consider obtaining investment as an alternative.

Be sure review our debt vs equity blog for more on this. To summarise briefly, your options if you pursue the path of equity financing are:

Angel investors are affluent individuals who invest their money into very early stage, and start-up businesses that may have uncertain prospects.

Venture capital firms purchase equity in businesses they believe will scale-up and achieve fast growth. Unlike angel investments, the organisations they invest in will have proven their concept and traded for a period of time. Typically therefore they will invest larger sums.

Crowdfunding is where you raise money for your business by pitching for a large number of small contributions from individuals through platforms based on the internet. This can be equity based where they each receive a share, reward based, or debt based in the form of repayments and interest.

You could combine with another organisation to develop both businesses into a single enterprise, or pool resources to achieve a common goal. It may involve creating a separate entity to carry out the joint objectives, with ownership shared by the 2 parent businesses along with returns or losses, and risks.

Alternatively, the following options may also help, but aren't guaranteed, to prevent the need for a personal guarantee:

If your business has tangible assets, such as machinery, equipment, or owns property, then this could be used as collateral to obtain a business loan.

Invoice finance uses unpaid invoices as security for lending. Your business can therefore borrow against the accounts receivable, to obtain money potentially far quicker than the usual payment terms.

If you present an evidenced based business plan to lenders, this may help prevent the need for extra security in the form of a personal guarantee. Are your revenue forecasts, and profit projections, realistic and backed by solid trading history? Does this then prove your ability to pay off the loan? Does the value of your business and it's credit score eliminate the need for a guarantee?

If you've been looking at finance to purchase equipment, or a property, then you could consider the alternative of leasing it, instead of ownership. This then may eliminate the need for funding.

There may be various government, or local authority, grants available that you could qualify for. These all provide finance without the need for a personal guarantee.

The content of this post was created on 20/02/2023.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -