A digital revolution is well and truly upon us!

We witness it in our everyday lives affecting the way we do almost everything. We’re transfixed by smartphone devices that promise to make our lives more efficient and entertaining. But what about running your business?

There are obvious changes happening in the business world that mean to stay relevant, and compliant, you’re small enterprise is going to need to embrace the digital age. We’ve witnessed a myriad of changes in many industries due to the increasing impact of technology in business.

Dealing with digital may seem like another issue, however, there are many benefits to embracing the movement. In some cases such as Making Tax Digital (MTD), it's a necessity, while going cashless is a trend that appears to be heading one way. Joining the digital movement is no longer a choice.

One of the biggest changes in 2019 for UK businesses was the introduction of MTD. This new system has begun for many businesses across the UK but the government’s tax digitalisation efforts will continue to grow. Their aim is to reduce and eventually eliminate paper records and tax submissions by 2022.

At the time of writing this blog post, MTD is only mandatory for businesses that meet or exceed the VAT turnover threshold. We’re still seeing small firms and self-employed workers jump into HMRCs digitisation project. But what makes MTD such a great change?

More often then not we hear the complaints that surround technological advancements when it comes to business. We understand it can be a pain especially for smaller operations that are used to traditoinal methods. The thinking of, "if it ain't broke don't fix it" is understandable but we now face inevitability! Technology is replacing pen and paper.

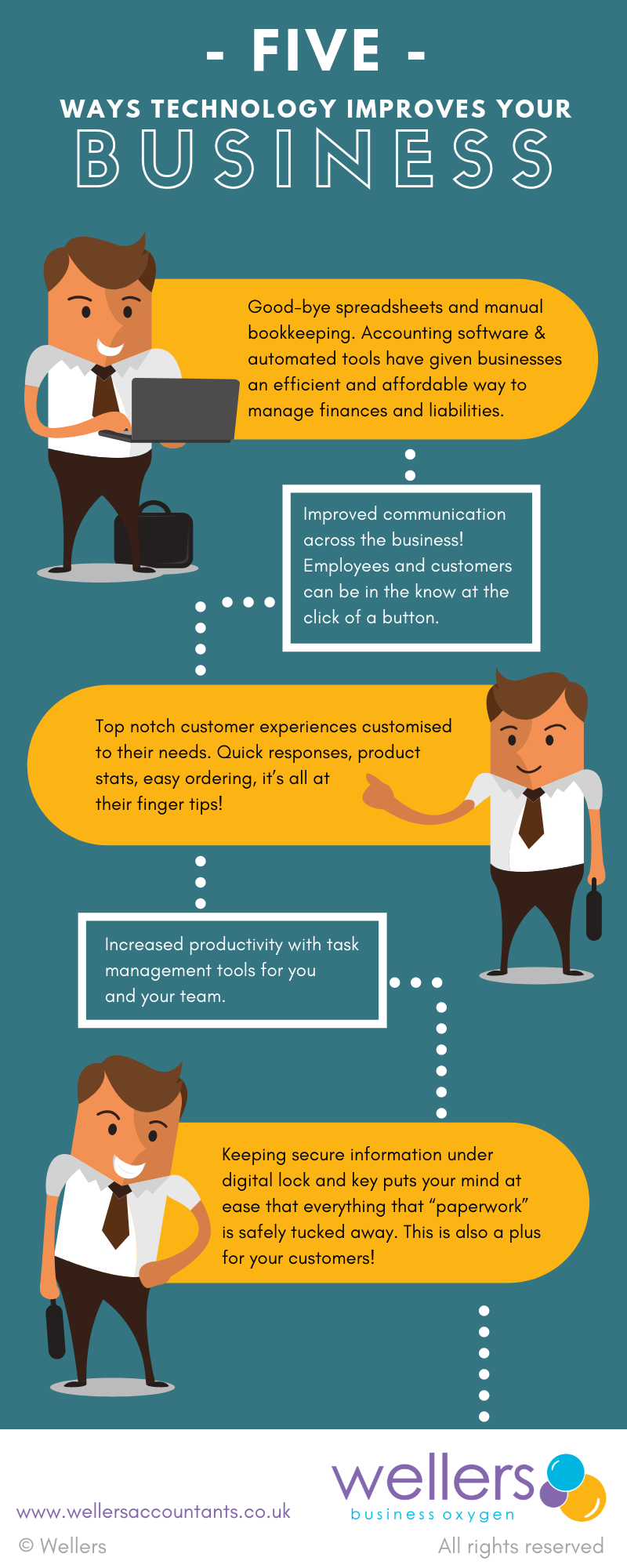

It’s far from bad news. We can see the key role of technology in business growth as follows:

Accounting software and automated tools have freed owner managers from the chaos of manual spreadsheets and bookkeeping. New technology delivers an efficient and affordable way to manage finances and tax liabilities.

Clear communication across your organisation and with customers through quick technology based solutions like email, cloud storage services, instant messaging, video conferencing, task calendars, and reminder alerts to name a few. There are no excuses for not knowing what's happening and when!

Improving the customer experience. There's the potential to deliver the highest level of service without much human interaction. Think of well designed websites, automated responses, easy online ordering, product reviews, and quantity in stock availabilities. BONUS - these all help your team out too by giving them specific insight on how the business is doing and what needs more attention.

Productivity can be tracked with task management tools for you and your team. Small business owners can now see how their teams are progressing with various tasks, not only can you see what is or isn't being done but this can give you valuable insight into information like:

Keeping financial and personal information safe is of the utmost importance when it comes to your clients, customers and employees. There are now numerous digital options to keep sensitive information secure.

If you’re looking to implement accounting software into your small business it’s important that you choose the most suitable one for your needs. If you currently have a system in place you’ll want to make sure it’s still appropriate for your growing business, as there will be some clear warnings signs that you’re produce is due for an upgrade, or replacement.

The content of this post is up to date and relevant as at 22/11/2019.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -