It’s undeniable that cash has taken a back seat to card transactions in the last 10 years. More then ever we’re seeing banks leave the high streets, ATMs disappear and consumers embracing tap technology to make purchases.

Convenience and security are two of the significant reasons for the rise of cashless payment, but what effect will this have on small and medium sized business across the UK? Despite the rise of card transactions, there are still businesses that are cash only, or more commonly offer card payments with a minimum spend amount.

In the wake of the “I don’t carry cash” era these small business owners are going to have to prepare to take the leap because convenience and speed are everything in today's tech driven consumer society.

Traditionally money in the form of material coins or banknotes has been used for people to pay for things. With cashless payment, the physical element is removed from the sale, instead digital information representing money is moved over the internet between the transacting parties.

The cashless concept has become popular and the norm for many businesses around the world, particularly in Sweden where the movement has been implemented and accepted quickly. UK Finance estimates if things were to carry on at the same pace we could start to see a sharp drop in cash by 2026.

In 15 years’ time, the report estimates cash transactions will account for just 10% of all transactions.

It’s been a much debated topic recently, and two answers have been the predominant focus when it comes to understanding why some businesses still prefer cash:

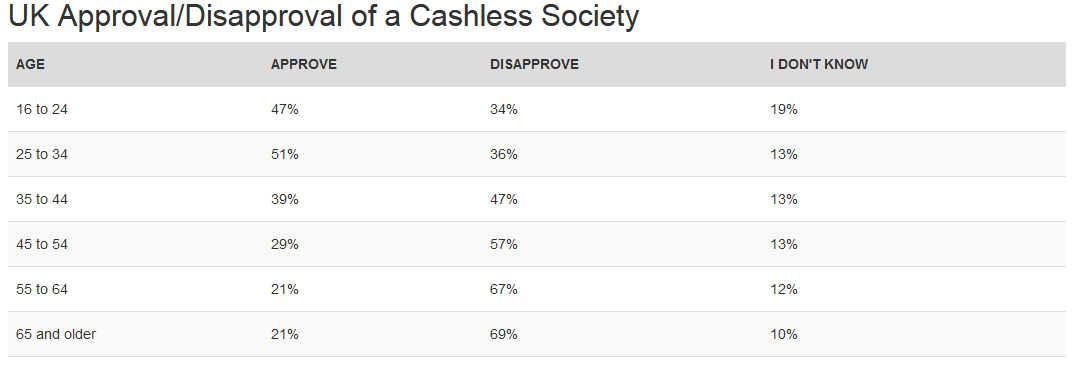

Image & Data Source: merchantmachine.co.uk/going-cashless/

Image & Data Source: merchantmachine.co.uk/going-cashless/

Despite these two factors, it can’t be denied that the UK is heading towards a cashless way of life. Even if we don’t become 100% reliant on card only payments, SMEs will still have to adapt to the new way of paying or risk loosing customers.

This leads us to the next question, why should businesses go cashless?

This leads us to the next question, why should businesses go cashless?

While a few businesses have opted to go card only, it’s more common for organisations to accept both cash and card payments. If your business only accepts cash you’ll need to come to terms with the fact that cashless isn't the future, it's the here and now.

Regardless if you’re planning to just start accepting card payments or if you’re finding your card transactions are increasingly outweighing your cash intake and think it’s time to go completely cashless, there are some ways to best prepare:

1. Planning is key

Going cashless will take a lot of preparation, not only for your business but also for your customers. It is imperative that this decision is a part of your strategy, your business plan should outline not only how this will impact your business today, but what about 3-5 years from now?

2. Get to know your options

There are quite a few options out there for accepting non-cash payment methods such as iZettle and Worldpay. It’s important that you research and choose what's best for your business. Consider the costs, equipment and services provided for each option:

3. Spread the word

There’s nothing more frustrating than a customer ready to make a purchase only to find out they can't pay by their preferred method. Just like a customer might be upset that your establishment is cash only, the same goes for being card only. It might be worth starting a marketing campaign to let your customers and potential customers know that you’ve you changed the way you accept payment.

This won’t be as much of an issue for businesses using a combined method of cash and card payments, although announcing that you now accept card and contactless payments can often be a bonus particularly for new customers.

Going cashless wasn't a business commitment, this was a decision made by society as the option became available. Yes people still use cash, and yes businesses are likely going to take cash payments for quite some time, but be warned for the world is increasingly becoming digital and cash could be on the way out due to new, quicker, effortless payment options.

The content of this post is up to date and relevant as at 15/04/2019.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -