The world has embraced and in the main gone digital. More and more process driven business tasks are either being performed using software or, are being implemented by these programs via automation. We’ve witnessed a sea of change with the rise of online accounting software, the benefits of which are well versed:

That said plenty of individuals and organisations have maintained their traditional paper systems of accounting, after all, if it isn’t broken then why fix it!? Whilst understandable, as with all phases of change we’re fast approaching a tipping point with the introduction of Making Tax Digital (MTD)!

Back in the March 2015 Budget, the government announced a new tax initiative. Their aim was to digitise, and so end, the traditional tax return system as we know it.

It works whereby HM Revenue & Customs (HMRC) have set up a new online system, MTD, that brings the tax information of all self employed individuals and businesses into one place of storage. This means you can then register, update your information online, submit your income and expenditure figures to quarterly deadlines and pay any balance through the portal.

This means if your turnover is above the VAT threshold of £85,000, you'll have to keep digital records. The plan is for MTD to become mandatory by 2020 with a phased introduction in the meantime. Businesses and individuals can thus switch to digital record keeping at their own pace in that intervening period.

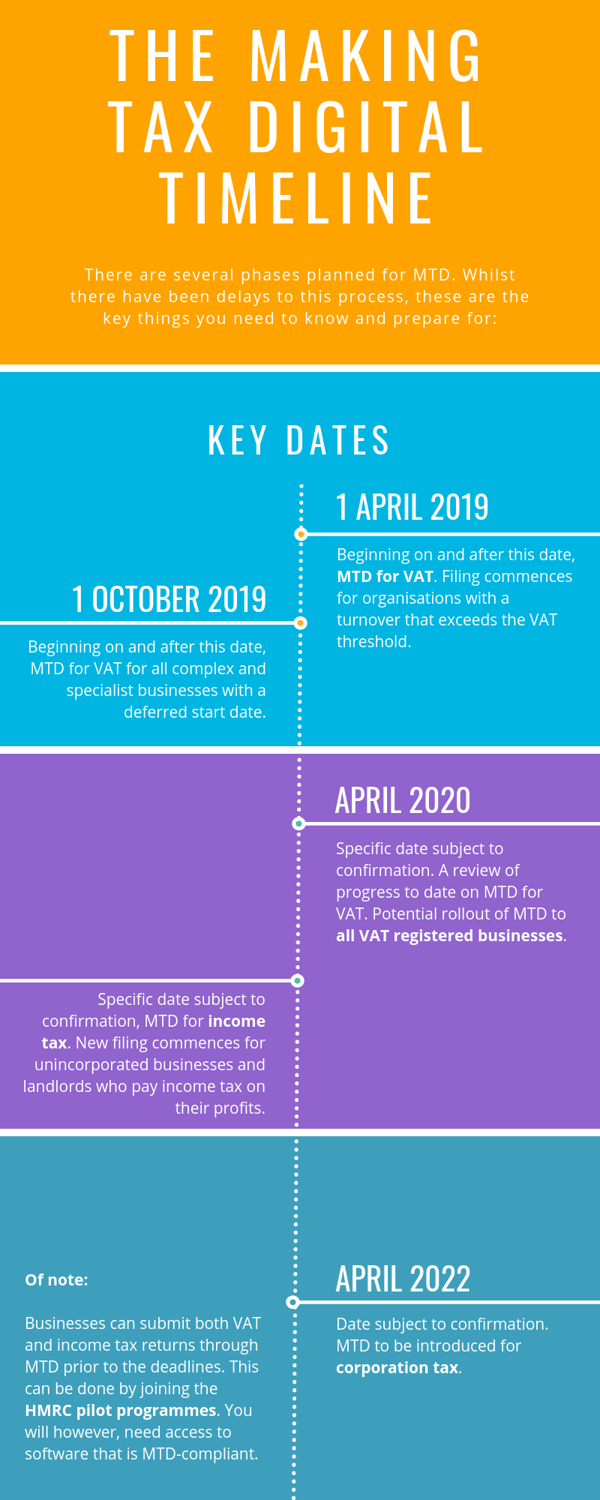

The anticipated timeline for MTD is as follows:

To record your transactions, submit your statements and pay the tax due means you will need to adopt online accounting software systems. For this reason, there isn’t a choice any longer, it has to be done to ensure you stay compliant, pay HMRC what you owe and avoid penalties.

If you’re still using desktop based software, that doesn’t connect to the internet and the cloud, then it’s time to look at the different products with a view to either upgrading or moving to a new online provider.

If you’ve continued to operate a system of paper ledgers then it’s time to embrace a sea change in how your accounting function operates. Whilst there will be a transition period of training and getting to grips with it, this can transform your finance function as you'll benefit from the real time financial insight to assist your strategic and investment decision making.

The advantages don’t just sit with your own internal accounting and bookkeeping. MTD as a system means:

The government's timetable to MTD has been subject to revision. At present, the goal is for April 2020 but given how significant the change and it's impact on the commercial world, don't be surprised if it's altered again.

If you don't already have online accounting software, or a related product, for your business then you need to plan and action this change now. The longer you leave it, the more rushed and difficult the integration could be.

The content of this web page is up to date and relevant as at 01/02/2019.

Please be aware that information provided by this website is subject to regular legal and regulatory change. We recommend that you do not take any information held within our web pages or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this website.

Click below for office location details