Every entrepreneur will likely at some stage in the life of their businesses have to take care of the financials of the company and, it's likely that they will have to take charge of the payroll. This means you’ll be saddled with the responsibility of making sure that your employees get paid. An efficient and timely full service payroll function is important for many reasons beyond just remuneration.

Not paying employees on time can have a severe impact on organisation morale. Not only will staff be demotivated by the lack of a consistent pay cheque, but in smaller businesses employees generally have a better idea of the finances. So if their pay is consistently late, they may begin to question the financial strength and future prospects of the business they work for.

The problem is that operating a payroll scheme is a time consuming job for owner managers. It needs to be done as and when employees get paid (weekly or a less frequent cycle) and the information needs to be perfect so that the employees are paid the right amount with the correct sums allocated to the tax man. Get it wrong and you could incur significant penalties.

It's possible to outsource your payroll almost anywhere and the UK has proven to be one of the world’s most prolific outsourcers as businesses seek to cut costs and increase productivity. As soon as it was universally identified that there was cheaper labour abroad, organisations started to outsource everything from manufacturing to admin, and transactionary services.

Outsourcing has become so common, that apparently it’s even possible to outsource letter writing? Not that we recommend it! The advantages and disadvantages for handing over this compliance work to an external provider are covered in the table below.

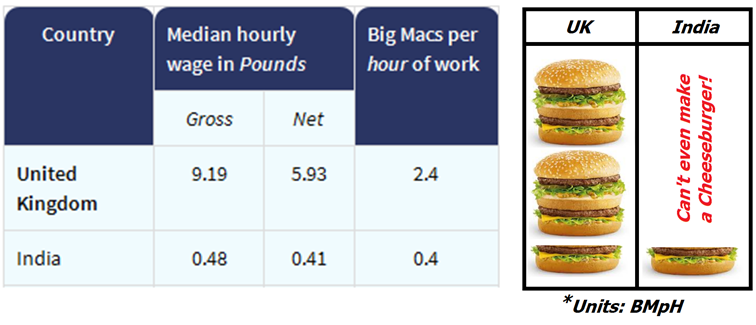

When outsourcing these tasks overseas however, many of these points are amplified, with a significant number of new disadvantages arising. The primary reason for outsourcing overseas is greater cost savings! With average wages considerably lower in countries such as India, the apparent benefits appear clear for all to see.

Unfortunately this can come with notable drawbacks as well. The majority of these are associated with the work being done in a land far, far away operating under very different laws and people with very different levels of knowledge and skills to our own.

Source: WageIndicator.co.uk

Source: WageIndicator.co.uk

The main issues that arise include:

Security

Data breaches are a common threat to businesses everywhere. Admitedly breaches can be quite simple to prevent (to some) so long as the relevant software is in place. Keeping the work in the UK means that companies can be better assured that security procedures are part of the service and being adhered to.

Local knowledge

Dealing with someone in a foreign country can be challenging due to a difference in cultures, time zones, language barriers and levels of aptitude.

Accuracy and accountability

In the event of a problem, there should be provisions in place to deal with issues and for the accountable party to take responsibility for any errors that occur under their jurisdiction. It becomes very hard to chase up issues that arise on the other side of the world.

Compliance

Third party payroll providers in the UK usually only work with British tax legislation, financial regulations, national insurance and general employment laws. Third party providers overseas could well provide these services to many different countries and consequently they have to work with a range of different systems. Things can be readily confused and errors easily made.

All of these issues are extremely serious. They can lead to fines, loss of data, and inaccuracies.

As if the risks of outsourcing overseas weren’t enough, the emergence of better protected workforces in these locations combined with the adoption of minimum wage policies, has in some instances markedly reduced the cost benefits.

It’s led some businesses to make the decision to move services and/or production back to the western world. Such a strategy has become increasingly viable when you take away the advantage of the cheap overseas labour and combine it with the removal of language barriers and physical distance.

It’s for these reasons that we have seen some providers moving payroll services back to the UK and, in-house.

RTI (Real Time Information): Real time information doesn’t make any changes to the way that PAYE is calculated. It just means that you need to make more regular submissions – each time you pay your employees you’ll need to submit information to HMRC instead of once a year at the end of the year.

Pension Auto Enrolment: The law on workplace pensions has changed and every employer in the UK must put certain members of staff into a pension scheme and contribute towards it. This requirement is being phased in gradually.

Employers need to understand these changes and be aware of the impact on their internal procedures. UK based professionals that provide full service payroll services will be well versed in the latest regulations and the correct procedures that need to be followed. As a business owner you can then concentrate on other areas in your organisation, comfortable in the knowledge that these statutory tasks are in safe hands.

So if you’re outsourcing your payroll to an accounting firm, or considering doing so, be sure to ask and find out how exactly they will handle and operate these tasks. If it does involve the service going overseas then you will want to check thoroughly that the third party involved isn’t susceptible to any of the potential, common weaknesses outlined earlier in this post.

Otherwise, the outsourced service could prove a lot more expensive than the cost savings it was supposed to achieve.

The content of this post is up to date and relevant as at 25/05/2016.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -