The business world has seen several changes throughout the last few months and one thing that is for certain, after a time of uncertainty, is that SMEs across the UK are looking for ways to save money!

With big changes on the horizon, have you considered spending money in order to save tax in your business?

We're talking about trading in your existing petrol or diesel vehicle for the long term benefits of electric cars. Not only are they the future of road travel, but the government is considering a £6,000 incentive for motorists who upgrade to electric! It begs the question, why not?

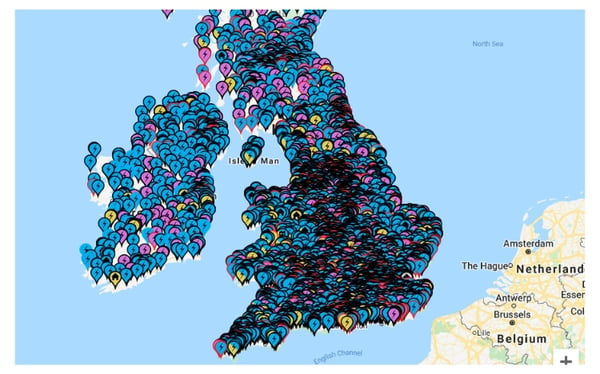

Following the budget in March 2020, Chancellor Rishi Sunak unveiled a £1 billion green transport package which included a huge £500 million for electric charging points over the next 5 years to deal with the envisaged demand. Already there are 32,000 in 11,500 spots nationwide.

Go Ultra Low which is the Government and industry official electric car campaign promises there will be 6 fast charging points in every service station by 2023.

Image Source: Go Ultra Low, map of electric car charging point

Image Source: Go Ultra Low, map of electric car charging point

There are several significant savings for those who invest in electric vehicles. With lower running costs, exemption from road tax, reduced fuel and maintenance costs, and other incentives the cost benefits of purchasing an electric vehicle add up.

To put it simply, making the change to electric can put money back into your business in the long run.

There's no denying that electric vehicles are an expensive initial purchase when compared to petrol or diesel vehicles, but they can also save you money.

It's also important to recognise that electric car prices are not where they use to be. Now with more financial benefits and tax efficiencies for those who make the switch to EVs for their company fleet, and a subsequent increase in supply and demand, we're seeing more manufacturers begin to embrace the EV trend and prices are starting to reflect a more competitive market.

You can now buy a fully electric car for as little as £26k. Whilst still more expensive than petrol and diesel it’s a far cry from the Tesla models.

It's important to also keep in mind that there is the added expense of charging ports and also electricity usage, but as we mention below there are incentives available to help offset these costs.

Savings will varying depending on individual circumstances, but there are some inherent saving features that are common amongst EV owners, as well as important tax benefits and government incentives.

General savings: |

Additional incentives: |

|

|

|

|

|

|

When it comes to purchasing an electric vehicle the government has been offering a plug-in vehicle grant to help cover some of the cost. According to Go Ultra Low, they will pay up to £3k towards a new electric car that:

In fact, transport Scotland funds interest free Electric Vehicle Loans of up to £35k

You will also have to pay to install charging equipment at home which can cost approximately £1k, but there are government grants available to help with this expense.

For those purchasing vehicles with CO2 emissions of less than 50g/km that can drive at least 10 miles with zero emissions £350 is available through the Electric Vehicle Homecharge Scheme. This estimates that charging your car at home can add between £450-£730 to your annual electric bill but this can be claimed through the business.

The government introduced tax changes from 6th April 2020 to help reduce the company car tax bills for those provided with an electric company vehicle. Benefit-in-Kind (BIK) taxation from 2020 to 2023 is quite low which allows employees/drivers to take home more of their pay.

Tax Year |

Company Car Tax BIK Rate

|

|

2020/21 |

0% |

|

2021/2022 |

1% |

|

2022/23 |

2% |

Organisations that purchase and use low emission electric vehicles in their fleet will benefit from:

For those running owner managed businesses that have cash on their balance sheets, who may suffer from the dividend tax extracting money out of the company, this is definitely something to consider. You can purchase the car out of pre-taxed income rather than post-taxed income.

Most people pay for their car out of their own pocket, that being ‘post-taxed’ income. For a director in the higher rate tax band they would pay 32.5% on any dividends extracted from the company.

If their company buys the car, the company will receive corporation tax relief and the director pays a very small amount of BIK tax. This certainly beats the 32.5% dividends tax.

For those wishing to improve their staff’s remuneration package this is a good deal for company cars for non-business owners too.

There are many options in terms of the funding available to help you with the initial expense of adding electric vehicles as an effective travel solution for your fleet. We recommend that you speak with your business advisor to discuss the cost and savings involved, as well as the grants you may be eligible for moving forward.

The content of this post was created on 08/07/2020 and updated on 20/07/2020.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -