Electric Vehicles (EVs) are the hot topic of late. Given the regular proclamations about the climate crisis and the effects of human damage to the planet, it's obvious to see why EVs are becoming so prominent in our thinking.

Then there's the lasting effects of VW’s ‘Dieselgate’ scandal, central Government policies including Grants and 0% Benefit in Kind taxation as well as more local policies such as Clean Air Zones (CAZs). The world is converting over.

If your growing business is operating a company car or a fleet, EVs can provide real benefits in terms of fuel and maintenance savings. There are 60 different types of EVs currently available on the market. Furthermore the average range on a single charge now exceeds 150 miles! They've become a very real substitute for your petrol or diesel equivalent.

In this guest post we explore why businesses should make the shift and how to do this.

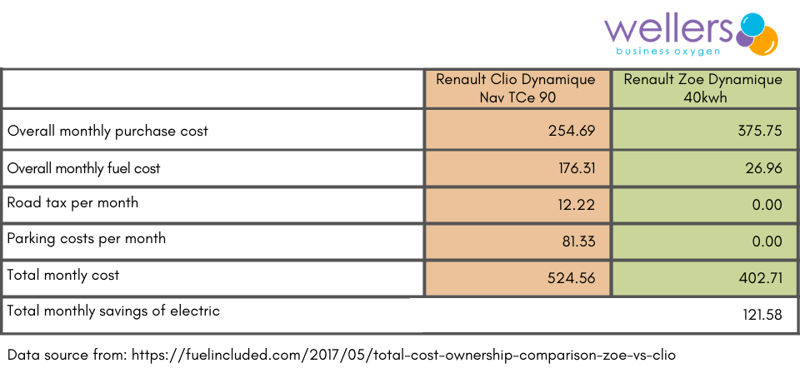

EVs are known to have a high upfront cost. That is to only look at a small part of the picture. Take a whole life cost approach to owning, operating, and maintaining an EV compared to a petrol or diesel vehicle and you'll see significant savings.

Charging your car with electricity is a lot cheaper than filling it up with petrol or diesel. The Energy Savings Trust worked out that, depending on make and model, filling up 100 miles of range can cost between £4 - £6 using electricity but around £13 - £16 using petrol or diesel.

Further reductions in the cost of electricity can be achieved by using smart meters and off-peak energy tariffs as well as solar panels and battery management storage. These use energy from the sun for later.

Further reductions in the cost of electricity can be achieved by using smart meters and off-peak energy tariffs as well as solar panels and battery management storage. These use energy from the sun for later.

What’s more there are fewer moving parts in an EV meaning there's less to go wrong. So the Service, Maintenance and Repair costs can be as much as 70% less than petrol or diesel alternatives. Studies have shown that electric car owners could save over £300 a year on maintenance. This really adds up when applied across a fleet.

London’s Ultra Low Emission Zone charges up to £12.50 per day for the dirtiest vehicles. Many more cities throughout the UK are going to introduce their own Clean Air Zones. Oxford for example, is expected to do this from 2020.

If you work or make deliveries in these areas and continue to drive diesel vehicles you will experience higher operational costs. EVs however, are exempt from these charges. Moreover, London has just introduced an on-street parking scheme whereby it costs more to park if you have a petrol or diesel and less if you have an EV. So there's further savings to be made from parking if other areas follow this model.

Corporate Social Responsibility is crucial in today’s working environment. Employees and customers alike are assessing how their suppliers work under scrutiny. Increasingly people are working towards a healthier environment.

The fumes from diesel and petrol engines are being linked to higher incidents of asthma, cancer and dementia. People are moving away from the things that may hurt them or their children in later life. Moreover, caring for your employee’s wellbeing while they are out at work or travelling to work should be a priority. To do so will likely result in fewer sick days and a more content, focussed group to carry out the work.

There is an employee retention element to all this too. The younger part of the workforce want to work somewhere where people care about what they do. They want to make an impact by improving on the current situation. Climate protests might be evidence of this.

To attract candidates and help keep hold of your best people, it is worth introducing EVs into your fleet. You'll be seen as forward thinking and mindful of the environment and people's health. That's powerful when combined with policies to reduce waste and energy consumption, and reuse resources where possible.

No business wants to get left behind. Failing to keep up with a trend can be damaging, financially and operationally. There are major developments in energy and transportation that will be linked to EVs in the coming 5-10 years.

In May 2019 the Committee on Climate Change recommended that the government bring forward the diesel and petrol car ban from 2040 to 2030. It's worth preparing for these changes sooner than later to get ahead of the curve. Why not do so now given the financials clearly make sense?

The Times has begun a clean air campaign and is fighting for a range of measures sooner. This includes no diesel or petrol cars outside schools. It's not beyond the realms of possibility that a ban on diesel and petrol could happen sooner still.

Then there's the technological trends such as Vehicle to Grid (V2G) and battery management. These could not only reduce the cost of charging your EVs but be a revenue stream! V2G enables the energy stored in your EV that you don't need to be sold back to the grid when the grid needs it.

Battery management storage is usually accompanied by solar panels which allow you to store energy from the sun. This can further help to decrease the costs of charging a vehicle if you are using your own energy coupled with a smart electric charger.

Parking and congestion problems are already a huge problem in urban areas. This will continue to grow as more people commute to towns and cities for work. It will likely result in more car sharing, pooling, and use of public transport if we want to keep traffic jams to a minimum and spend less time looking for parking spaces.

Car sharing is a great way to also utilise a vehicle better. Your business can introduce a shared EV through a keyless booking application. This then helps further reduce costs and allow four stand-alone vehicles to be replaced by one shared one if utilised correctly.

At helloEV, we help businesses go electric. We do this by carrying out an analysis of your fleet to understand the benefits of going electric or introducing shared EVs. We can provide information about government grants, BIK and benefits. We can also provide test drives of an EV for you and your fleet drivers to help increase awareness.

In our next guest posts we'll be talking about company cars and the change in Benefit in Kind taxation as well as costly ‘Grey Fleet’ mileage expenses and how shared EVs can be a solution.

The content of this post is up to date and relevant as at 29/08/2019.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -