It was a day of both more spending and tax rises!

The Budget 2021 was the biggest tax raising set of announcements by a Chancellor since Norman Lamont's final budget in March 1992. These measures will result in the tax burden reaching 35% of GDP in 2025-26. That will be the highest level it has stood at since the late 1960s.

These measures have to be seen in the context of the current environment. The COVID-19 pandemic and subsequent lockdowns mean Rishi Sunak has had borrow more in his first year as Chancellor than Gordon Brown ever did in his entire tenure in the role. The business support bill has hit £53 billion and Sunak is concerned by both the level of UK borrowing, and the impact on national debt which now stands at £2.1 trillion!

If interest rates were to rise, the cost of servicing this debt could increase significantly. Given the nation endured a decade of a form of austerity, the emphasis has now shifted to the use of future tax rises to stabilise the UK's finances.

The Budget 2021 broadly fell into 4 headers:

1. Extended coronavirus support measures

2. Changes to taxes for businesses

3. Changes to taxes for individuals

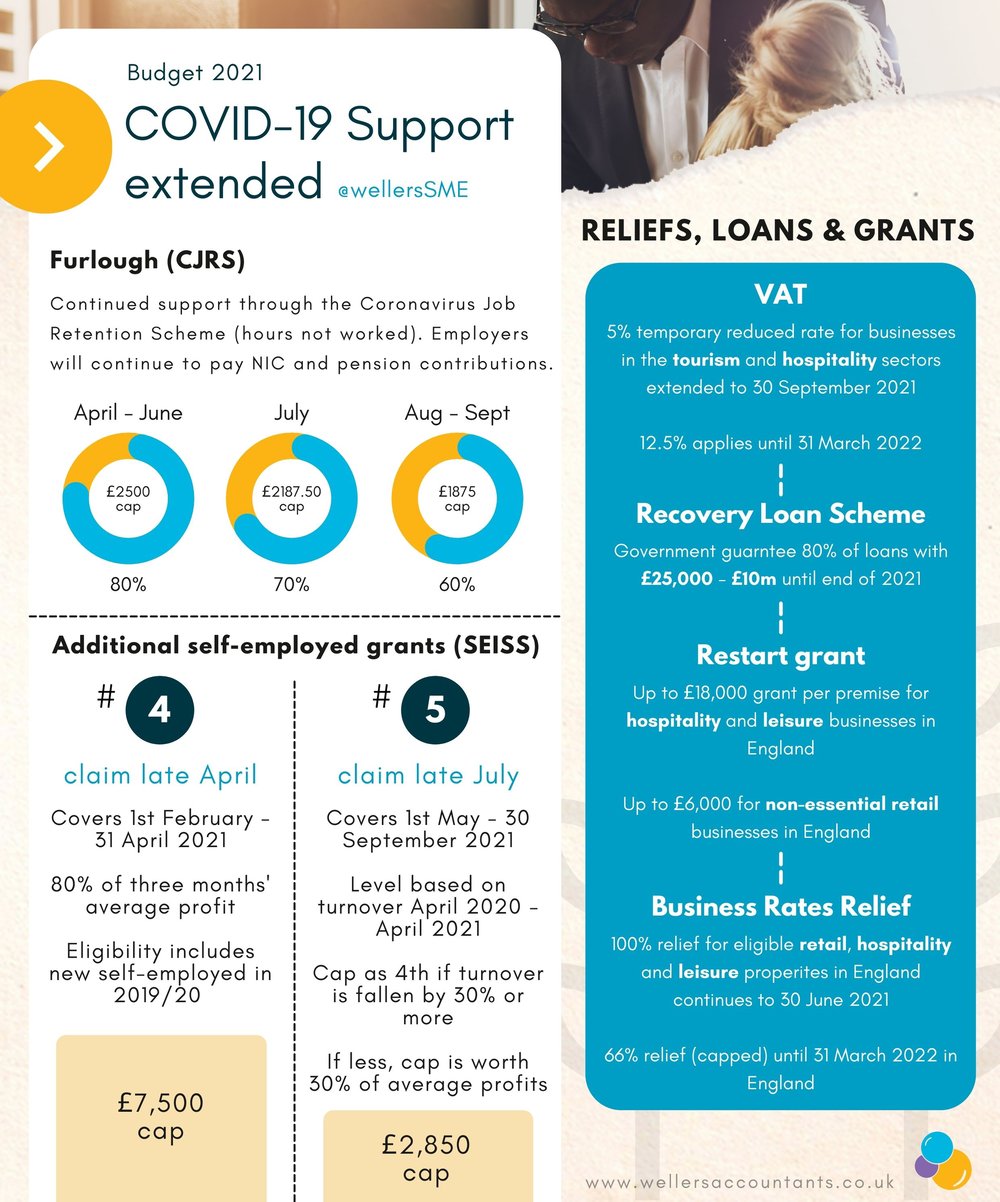

Whilst COVID-19 restrictions are set to end in June 2021, the furlough scheme will be extended until the end of September 2021. It will continue to pay 80% of employees wages up to £2,500 a month. From July employers will be expected to make a 10% contribution. This will then rise to 20% in August and September.

There will be a 4th and then 5th payment of the SEISS grant. This 4th is worth 80% of 3 months average trading profits (capped at £7,500). This covers the period from February to April. To qualify you must have completed a 2019/20 tax return and this had to be filed by midnight on 2 March 2021 to make a claim.

The 5th grant will be made available to cover May to September. This will be determined by a turnover test. If your turnover has fallen by 30% or more due to coronavirus, then the grant will be 80% of your average 3 months of profits. It will be capped at £7,500.

Where your turnover has fallen by less than 30%, the grant will be 30% of average profits and capped at £2,850.

There is an extension of the temporary 5% reduced VAT rate until 30 September 2021. There will then be a transition period between 1 October 2021 and 31 March 2022 where a new reduced rate of 12.5% will be applied. The rate is then set to return to the standard rate of 20% from April 2022.

100% business rates relief for the retail, hospitality, and leisure sectors will be extended to 30 June 2021. This will then be followed by a 66% business rates relief for the period from 1 July 2021 to 31 March 2022. It applies to properties that were required to be closed from 5 January 2021.

The temporary £500,000 nil rate band threshold is set to be extended by three months to 30 June 2021. This was previously due to end by 31 March 2021. From 1 July, the nil rate band will be reduced to £250,000 before then returning to the usual £125,000 threshold from 1 October 2021.

In a further bid to get the economy up and running again, up to £6,000 of grants will be available per premises for non-essential retail businesses. Up to £18,000 will be available per premises for hospitality, accommodation, leisure, personal care, and gym businesses.

From April 2023, corporation tax will increase to a headline rate of 25% if your taxable profits are above £250,000. The Chancellor claims that just 10% of companies would have to pay the full higher rate. Corporation tax will remain at 19% for businesses making taxable profits less than £50,000. Tapering will be introduced if your business profits are between the two thresholds, whereby a rate between 19% and 25% will be applied.

Sunak stressed that despite the rise, the UK rate of corporation tax would remain the most competitive in the G7 nations.

The policy marks the return of an old system of marginal relief that used to be in place before April 2015, albeit the threshold levels are now lower. It applies from April 2023 so companies have 2 years to plan for these changes when the economy is likely to have fully recovered from the pandemic.

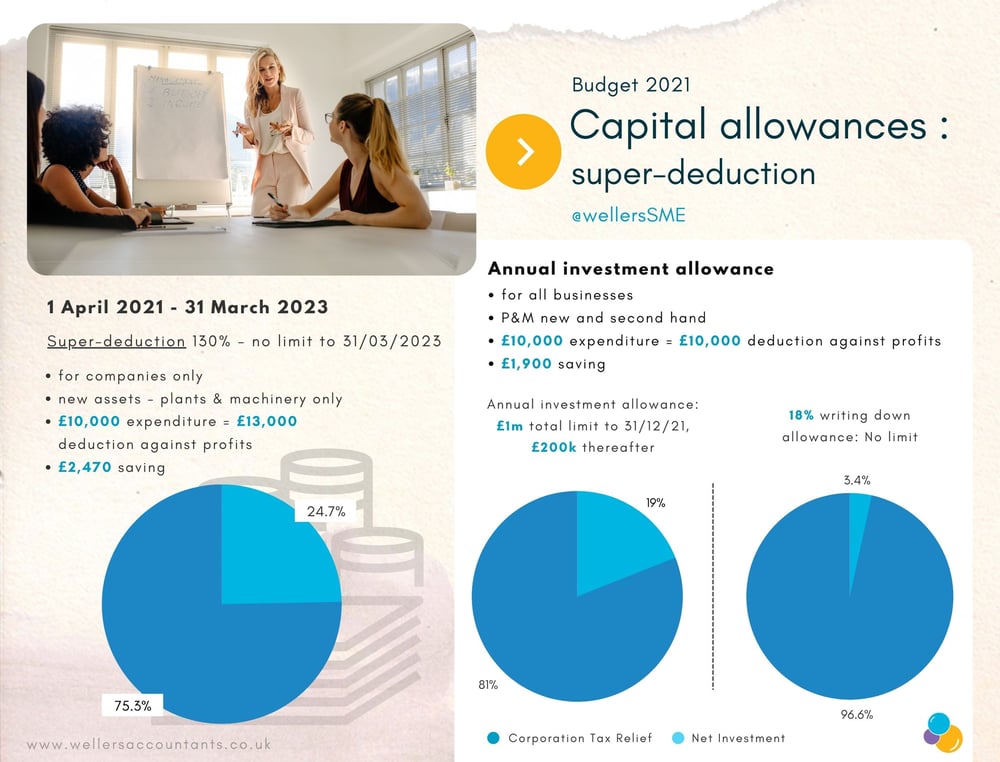

To temper the increase in corporation tax, the Chancellor announced a "super deduction" policy. This means companies can claim capital allowances equating to 130% of expenditure on qualifying plant and machinery between 1 April 2021 and 31 March 2023. A company can offset the full cost of new equipment against tax, plus an additional 30% on top of the outlay. The Treasury claims organisations can reduce their tax bill by up to 25p for every eligible £1 they invest.

There will also be a 50% first year allowance available for special rate pool assets (including long life assets). Questions remain over whether or not this is in addition to the Annual Investment Allowance (AIA).

There is a temporary relaxation to carry back losses meaning businesses can carry back losses for up to three years rather than just the previous year as is currently the case. Usually, you can only carry back for 3 years if you cease to trade and therefore this is a significant relaxation of the loss relief rules.

Of note however, the rules will be subject to a cap of £2m on the amount of losses that can be carried back. The announcement means businesses can potentially benefit, in cash terms, for losses made during the pandemic by offsetting them against previously profitable periods.

The relaxation of the loss relief rules may have a significant benefit for loss making companies who have qualifying R&D expenditure as it will mean losses can potentially be carried back further, meaning a greater tax benefit compared to surrendering losses for a current year credit.

There is an extension of this scheme and increased payments are to be made available to employers in England who hire new apprentices. If you make new hires between 1 April 2021 and 30 September 2021 then you will be eligible for a £3,000 payment per new apprentice. Previously the payment was £1,500 per new hire.

Income tax

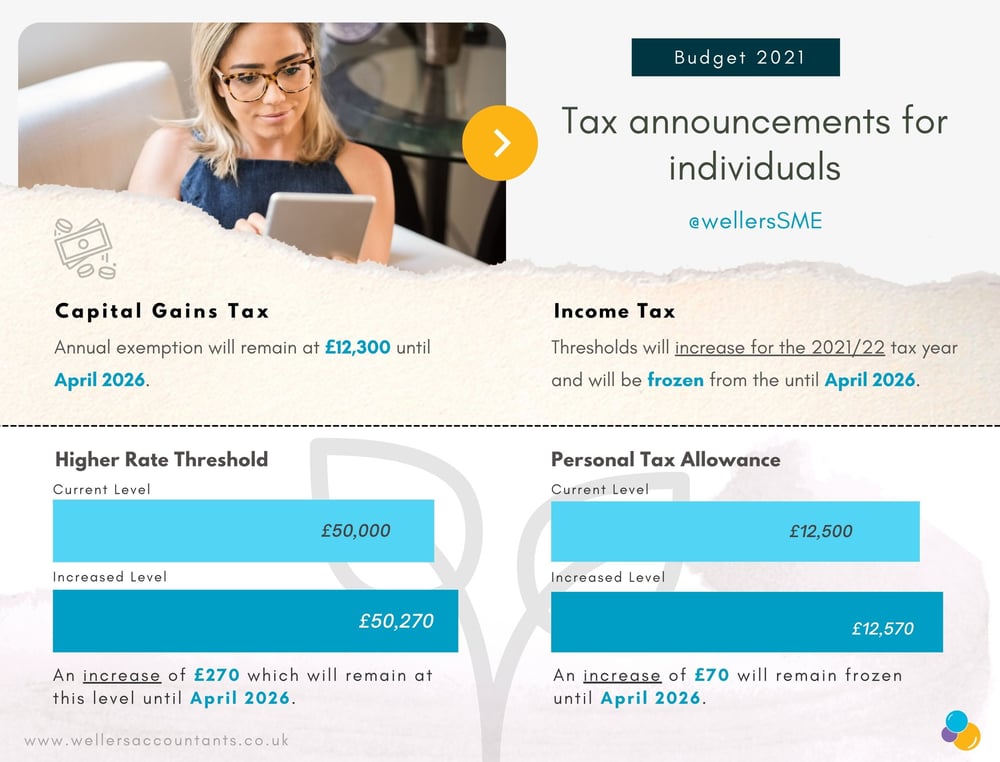

Income tax thresholds will increase for the 2021/22 tax year and then be frozen from then until April 2026.

The personal allowance will increase by £70 to £12,570 and will remain at that level until 2026. Also the threshold at which higher rate tax of 40% applies will increase from £50,000 to £50,270. It will also remain at this level until April 2026.

Whilst this does not mean a direct increase in personal tax, it will indirectly result in a greater tax burden on individuals assuming earnings increase over the next few years whilst thresholds remain frozen. This will mean an increasing number of people are expected to become subject to tax on earnings or even become subject to a higher rate of tax.

National Insurance

Similar to income tax thresholds, national insurance thresholds will increase in 2021/22 and will then be frozen until April 2026.

The primary and lower thresholds are set to increase to £9,568. The upper earnings limit and upper profits limit will increase to £50,270. Both will then remain at this level until April 2026. This will again result in a greater number of people become subject to national insurance contributions payments assuming wages increase from their current level.

Despite much speculation prior to the Budget about the potential reform of CGT, the only announcement made was that the annual exemption will remain at £12,300 until April 2026.

The Lifetime allowance will remain at £1,073,100 until April 2026.

The nil rate band and residence nil rate band will remain at £325,000 and £175,000 respectively until April 2026. The nil rate band has been set at £325,000 since April 2009 despite rising asset prices.

Rishi Sunak confirmed the new government backed mortgage guarantee scheme enabling people to buy a home with just a 5% deposit. This applies to houses up to a value up to £600,000. The question is, could this ramp up demand, leading to further inflation in house prices and therefore not solve the very problem it is designed to tackle?

Of interest this scheme is similar to the help-to-buy scheme introduced by George Osbourne in 2013.

The Chancellor committed to invest more in HMRC by providing £180m of funding in 2021/22. This is designed to assist the targeting of non-compliance and includes recruiting up to 1,600 additional compliance staff as well as upgrading IT systems. Expect to see an increased number of tax investigations moving forward as the government attempts to cut the tax gap.

The content of this post was created on 04/03/2021 and updated on 12/03/2021.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

LEAVE A COMMENT -