It's not uncommon these days for people to have more then one source of employment. In fact, the Office of National Statistics says that over 4 million people in the UK work more then one job.

This could mean you work for multiple employers, or the more increasingly popular option, developing a side hustle by starting to work for yourself.

If you've been dipping your toe in the entrepreneurial pool, or are thinking about starting a business, it's important that when HMRC asks the question, "Do you have a second source of income?" you're forth coming and prudent in declaring your second income.

If you're a UK resident, in employment and also earning income through another source which has not been declared to HMRC, then it's up to you to make sure you're remaining complaint.

There can be several reasons why you haven't told HMRC about money earned through a second income but the bottom line is that not declaring your additional revenue can lead to big problems between you and HMRC... that most likely end up hurting your bank balance.

A second income refers to any circumstance where you have more than one source of earnings. A second income can come from an additional employer, or from self-employment. It's possible, and quite a regular occurrence to be employed and self-employed at the same time.

Self employment can take on different forms and is most often associated with entrepreneurs, freelancers and contractors. Your additional income may also come from sources like renting out property or parking space(s).

If this is the case then it is your responsibility to register for self-assessment tax returns with HMRC to declare your self-employed earnings, whilst your employer should be using the PAYE system for your employed income.

Income tax is based on your combined income, this means if you're making a second income that is not automatically taxed through the PAYE system then you owe tax on any amount earned above your personal allowance amount, which is currently £12,500.

Tax is collected and pooled to fund all sorts of government projects and essential public services. This means you have to declare any extra income for tax purposes, if you don't inform HMRC about it then you'll likely face stringent penalties.

Such a process shouldn't come as a surprise as it's the same for all employment; the only difference is you're responsible for telling HMRC about the additional income that’s not tracked through an employer.

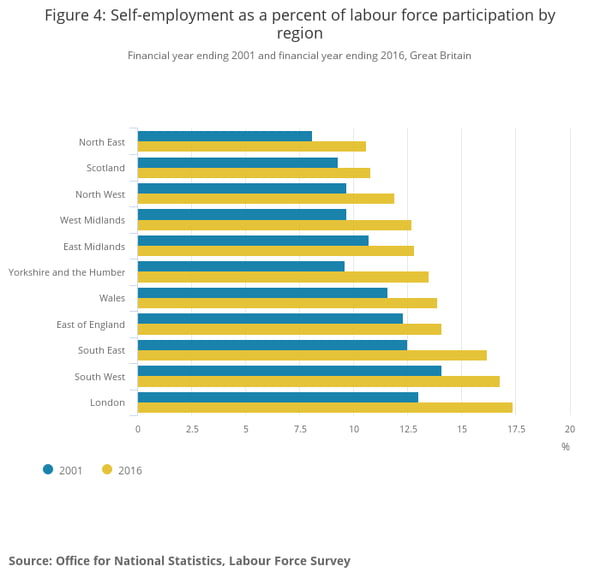

With the rapid growth of self-employment in the UK in recent years, HMRC have stepped up their pursuit and implemented smart data processes such as data mining to identify individuals who have undeclared income. They've become very good at finding out about undisclosed income through various, sophisticated technologies, meaning not declaring your second income is a non-option.

When your extra income is earned through another place of employment, tax is little simpler. If you're employed by multiple employers your tax should be documented and deducted automatically through the PAYE system.

In this case, unless you feel that the amount of tax you're paying is incorrect, you will not have to submit a self-assessment tax return. That being said, errors can occur such as incorrect tax codes which means it is possible that you may over or underpay your tax. If you are concerned that this may be an issue you should contact HMRC.

If you're working solo as a freelancer (or something similar), welcome to the self-assessment club! Completing a tax return doesn't always mean you'll have to pay additional tax; you may qualify for a refund depending on your circumstances.

Self-assessment comes with its own set of complexities and it's important to stay organized and informed to avoid missing deadlines and risking penalties.

Completing and submitting a self-assessment tax return can be a struggle for many taxpayers, and the worry is that you might complete it incorrectly. With changes to legislation and the complexity of filing, you may be at risk of incurring penalties by failing to complete it accurately or, on time.

The only person who can know for certain if you have the ability to DIY your second income declaration is you. When in doubt...talk to a professional.

Although many individuals, sole traders and partnerships consider or attempt their self-assessment on their own, unless you have significant knowledge in this area you will likely miss some of the vast number of reliefs available, that may be applicable to your circumstances.

Preparation is the key to managing the stress that can come with annual tax returns.

The content of this post is up to date and relevant as at 11/06/2019.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -