You may recall we examined how well HMRC are doing in light of the HSBC tax avoidance scandal. This touched on the increasing use of taskforces by the revenue to target specific high-risk areas of trade and business where tax evasion or avoidance is suspected to be prevalent.

Taskforces are composed of various HMRC compliance and enforcement teams, who visit traders to analyse their records and carry out tax investigations. In this post we take a closer look at how effective they have been in creating additional revenue, as part of the Government’s £917m investment to improve tax receipts and eliminate the budget deficit.

Firstly it’s important to understand the difference between HMRC’s campaigns and their taskforces. Campaigns consist of heavy marketing via radio, TV and poster advertising that provide taxpayers with the opportunity to come forward and bring their tax affairs up to date within a specific timeframe. The taskforces on the other hand (which were introduced in 2011) target taxpayers where there is a strong suspicion that tax evasion has been taking place.

If a team determines that a taxpayer is guilty of evasion then potential substantial fines and even a criminal prosecution could ensue. The revenue’s thinking was that the existence of these teams would act as a deterrent to tax cheats. For example, a plumber upon hearing of other plumbers being prosecuted may be more likely to check that their tax is correct and up to date.

|

How much do HMRC aim to raise each year as a result of these kinds of projects? |

£7bn |

|

Government investment to tackle tax evasion, avoidance & fraud |

£917m |

|

How much have HMRC collected since 2011 (as at October 2014) |

£200m |

|

How much is the projected additional revenue for 2014/15? |

£90m |

|

What was the original target for projected revenue for 2014/15? |

£50m |

|

How many criminal cases have been brought as a result of these projects? |

80 |

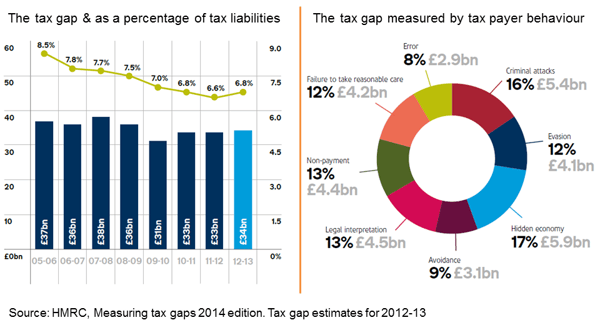

The revenue collected as a result of taskforces is only 1% of the £34 billion UK tax gap. The tax gap refers to the actual amount collected compared to the amount that HMRC estimate should have been collected. The problem for HMRC is that calculating the tax gap is quite theoretical and therefore open to interpretation.

The Public and Commercial Services Union published a report by Richard Murphy of Tax Research UK, which estimated the tax gap in 2013/14 stood at £119.4bn. If we use this figure then the revenue collected equates to just 0.2% of the tax gap.

How much of the government’s £900m spend on improving the tax take went on taskforces has not been revealed. Of course the reality is in some cases where the teams have honed in on a tax evader they may still be unable to collect the sum owed due to the business or individual being declared bankrupt for example.

Although HMRC have not published how much each team costs to run, it is understood that as a general guide for every £1 that is spent on an investigation, £10 is then collected in tax. There have been 80 taskforces since 2011 and most have responsibility for specific areas and sectors. The geographical locations are highlighted in the map below while the sectors are covered in the table at the end of this post.

Certain industries have been allocated a team because HMRC deem them to be at high risk of tax evasion. A number of their tax investigators rely on local knowledge to choose who is worthy of a full investigation.

For example, if they know there are two takeaway restaurants on one road, restaurant one has a higher footfall than restaurant 2 because it is located next to a train station, but restaurant 2 is paying higher tax bills, there may be a tax evasion issue with restaurant 1 to investigate. Those areas that stand out particularly include the hospitality trade, building and materials, landlords and services.

The very first team was created in November 2011 for the ‘Restaurant sector in London, North West of England and Scotland’. In total 531 restaurants were investigated and £634,000 of unpaid tax was identified.

The ‘Fast food outlets in London’ team identified within six months of operation £9m in owed tax. Interestingly this was not only from small businesses, some of the multi-million pound enterprises were also at fault. One contributing factor was that the tills were not programmed to capture VAT on eat-in sales.

The Plumbers Tax Safe Plan focussed on plumbers, heating engineers and gas fitters. It closed for voluntary disclosures in August 2011 and since then there have been five successful prosecutions. Finally, a task force into the legal profession in London resulted in two barristers being sentenced for deliberate tax fraud.

One argument is that more successful (and better publicised) prosecutions would lay down a very clear marker in the sand for tax payers. Building a case that proves deliberate deception is time consuming and intricate however, it would demonstrate that HMRC are not only serious about collecting money owed but also implementing the rule of law.

It could be an instance of short term pain in establishing and bringing cases to court with a view to longer term success in changing attitudes to tax evasion and avoidance. The desired result being people will think twice and be less likely to conceal their financial affairs from the revenue if they see clear evidence of the potential threat of a criminal prosecution hanging over them. That in itself would in turn reduce the time and cost of HMRC chasing down unpaid tax revenue.

| Hospitality |

| Restaurant sector in London, North West of England and Scotland |

| Fast food outlets in London |

| Fast food outlets in Scotland |

| Indoor and outdoor markets in London |

| Restaurants in the Midlands |

| Scottish pubs and nightclubs |

| Restaurants in South Wales and South West |

| Alcohol industry in Scotland, including Aberdeen and Inverness |

| Fast food outlets in East Anglia |

| Holiday industry in Cornwall, the Isles of Scilly, Devon, Somerset, South Wales, Blackpool, the Lake District and North Wales |

| Restaurants in Lincolnshire and Tyneside |

| Restaurants in London and East Anglia |

| Construction |

| Scrap metal dealers in Scotland |

| Construction traders in North West of England and Wales |

| Construction Industry in London |

| Construction Industry in the Midlands |

| Property |

| Landlords, owning or renting 3 or more properties, in the North West of England and North Wales |

| Property Transactions in London |

| Property rentals in East Anglia |

| Property rentals in London |

| Property Rentals in Yorkshire and North East of England |

| Rental property sector in the South East |

| Property Tax Evasion in the South West if England and South Wales |

| Motor trade |

| The motor trade in South Wales, South West, Yorkshire, Nottinghamshire and the North East |

| The motor trade in Scotland |

| Transport |

| Taxi firms in Yorkshire and East Midlands |

| Haulage industry in the Midlands |

| Other sectors |

| Hair and beauty businesses in Northern Ireland |

| The rag trade in the Midlands, North Wales and North West, including manufacturing, wholesale, retail and textile recycling |

| Jewellery trade in the Midlands |

| Fishing industry in Scotland |

| Security Guards, bouncers and their employees on London and the South East |

| Second-hand motor traders in the Midlands |

| General |

| Fraudulent repayments in London |

| Individuals/businesses not submitting their statutory returns in the South East of England |

| Tax evasion in London and the Southeast |

| Tax evasion in Northern Ireland |

| Hidden wealth/’means’ issues in the Midlands |

| Fraudulent VAT repayment claims in Scotland and Northern Ireland |

| Hidden wealth/’means’ issues in London and East Anglia |

The content of this post is up to date and relevant as at 14/05/2015.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -