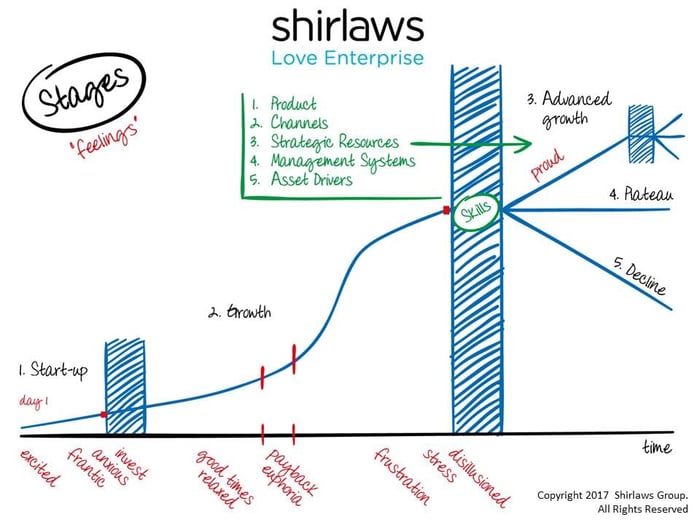

Do you need an accountant for your small business? Obviously we'd answer yes, but that belies an important point, when exactly will you need this help? How do you as an entrepreneur identify when that time has come? At what stage in your business journey (see the Stages Model below, a concept originally developed by Shirlaws) should you reach out for help? The answer will depend on your circumstances.

Ultimately the answer to this question comes down to you and your role within your business. Ask yourself these questions from day 1 of your venture:

Or a sole trader then your accounts may be quite simple depending on your trade. It’s a case of recording incomings and outgoings whilst dealing with HMRC in terms of paying your Tax and National Insurance and filling out your tax returns accurately and on time. Chances are you can do some of this yourself either with a spreadsheet or by purchasing some accounting software.

The only issue is the Excel route doesn’t allow for changes in legislation and identifying tax planning opportunities so you could alternatively go for the half way house option and use an accountant for specific tasks or services you feel you need support with.

They will set you up with accounting software and ensure you are compliant while also informing you of the latest developments and opportunities. This might include assistance with VAT returns, PAYE and planning for payment of your tax liabilities. They will then be in a position to advise you on the best way to grow your business in line with your plans.

If you’re a limited company

This will depend on your role within the limited company. If you’re of a financial background and comfortable doing bookkeeping and drawing up accounts then in the early stages of your business that will be fine. As your business expands the time and administrative burden will require taking on more people as part of the creation of a back office finance function.

However, in our experience during the initial days of many early stage businesses the owner's time will be pre-occupied with planning, production, marketing and generating sales. Correctly, most of the initial focus is on generating income and getting the business off the ground. This leaves little time for anything else, especially the protracted tasks of bookkeeping, tax and filing documents at Companies House.

In this scenario the most efficient thing you can do is hire an accountant to advise you on the best steps for structuring the company from day one. If you don't do this then the risk is your record keeping could soon turn into an administrative mess that could cost you a lot of time, money and hassle. So, it's better to plan ahead.

Remember, the key point of your management accounts is to tell you how well your company is doing. It is essential to have a system that processes this information so you can access it on a regular basis, monitor performance and review against your key performance indicators and business plan. You can then use these figures as a comparison to plan your strategy and future investment decisions.

The content of this post is up to date and relevant as at 22/01/2015.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -