Are you aware of how corporation tax changes will impact on your company?

How closely have you looked at the rules around subsidiaries, or associated companies?

You're probably aware that the corporation tax rate will change from April 2023, but these changes also contain some sophisticated legislation that will impact what rate of corporation tax you will pay. The result being where you're deemed to have associated companies then the new rates will potentially accelerate the point at which you pay the main company rate.

This is why we've written this blog post, to help you understand what associated companies are, and how corporation tax is applied to the profits that they make. By reading this you'll then be better placed to understand your potential tax liability and discuss possible tax planning options with your accountant.

Corporation tax is applied to the profits that companies make. From April 2023, the main corporation tax rate will rise from 19% to 25% but this will be dependent on your annual profits. The rate of corporation tax payable is covered in the table below, if your profits are £50,000 or under then you'll be subject to the small company rate:

| Profits | Rate of corporation tax |

|

Small company rate ≤£50,000 |

19% |

|

Marginal rate >£50,000 - £250,000 |

20% - 24% (26.5% effective rate) |

|

Main rate >£250,000 (applies to all profits, even those below this level) |

25% |

The risk HMRC faced with this change was of companies then splitting elements of their trade between different companies as a strategy to reduce their corporation tax liability. For example, if a business makes £120,000 of profit then it could theoretically split into 3 to pay a lower rate of tax at 19% on £40,000 of profit per company.

This is why there are specific regulations for what is referred to as associated companies, and these will be implemented from 1 April 2023.

A company is considered associated with another if, over the prior 12 months, both companies have had a significant level of shared control, or influence, over them. Association applies to subsidiaries of the same parent company, joint venture companies, or companies where one holds a minority stake but has a seat on the board of directors.

As well as companies underneath a parent company, association can also apply where both companies are under the control of the same person, or persons. This is a change to the existing 51% subsidiary rule that applies to quarterly instalment payment calculations, as companies can now be associated with another, even if they are not part of the same corporate group.

The rule of association can also register if companies have a relationship of substantial commercial interdependence. This occurs if the companies are:

Splitting your activities into multiple companies is unlikely work to reduce your corporation tax liability. Where companies are determined to be associated, the upper and lower limits are reduced, whereby the profit limits are divided equally among all of the associated companies.

These revised limits are also used if the marginal relief calculation is applicable.

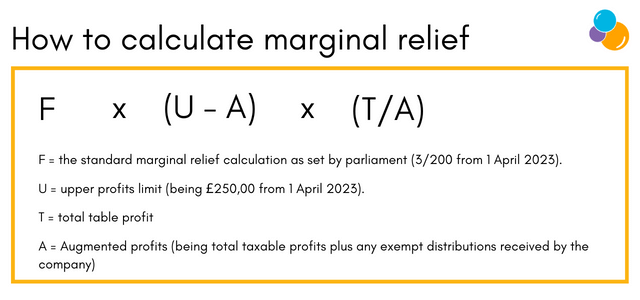

To calculate marginal relief, use this formula.  If we assume company A has total taxable profits of £100,000 and exempt distributions of £10,000, and no associated companies, the marginal relief available would be calculated as follows:

If we assume company A has total taxable profits of £100,000 and exempt distributions of £10,000, and no associated companies, the marginal relief available would be calculated as follows:

3/200 x (250,000-110,000) x (100,000/110,000) = £1,909

If however, the same company with the same augmented and taxable profits had 1 other associated company, the calculation and relief would look as follows:

3/200 x (125,000-110,000) x (100,000/110,000) = £205

If your accounting period crosses the 1 April 2023 date, then your profits will be time apportioned, whereby they're split into 2 notional periods.

Understanding if you have associated companies, as the above has demonstrated, is quite complex. Start by looking at whether you, your family members, or business partners have stakes, or interests in multiple companies?

Should that be the case, then it would be wise to seek professional advice to comprehend if associated company rules apply. From there it may then be possible to review the structure of your businesses, to ensure compliance with the legislation, while exploring if any potential savings can be achieved when calculating your corporation tax liability.

The content of this post was created on 17/03/2023.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -