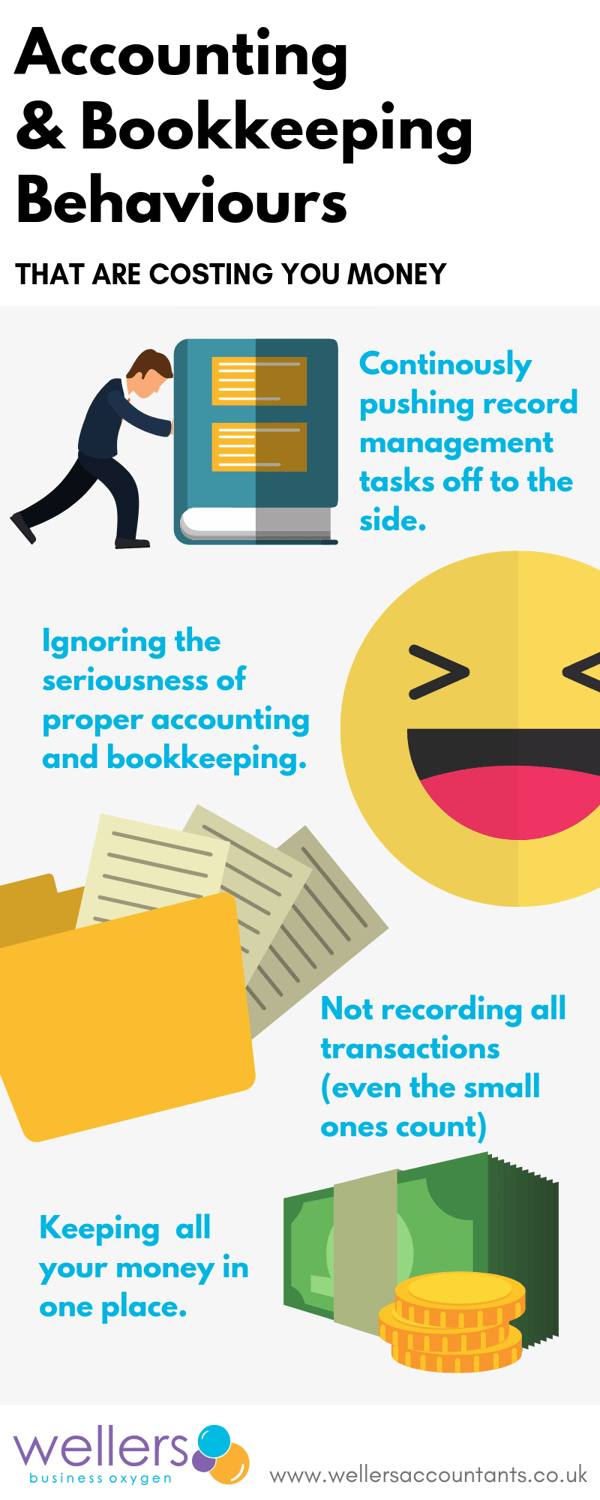

Beth Whitmore FCCA portrays 4 behaviours to avoid when managing your accounting records and how to correct these habits if you're already a culprit.

There are many reasons why you might be struggling to keep up with your accounting records. You might be short on time, maybe you lack the knowledge and confidence to do it yourself, or you could be new to using the accounting software which in turn is going to cost you more time (and perhaps even more money). Whatever the reason, it’s important that your bookkeeping and accounting records are organised and accurate…if not, you’re creating some pretty big issues with your clients, suppliers and of course, the taxman.

How to avoid wasting time and money when it comes to managing your records:

- Be consistent – Business consistency is one of the most important aspects to ensure your business is growing and will continue to do so. So why is it often overlooked? Sure it keeps the business functioning in a productive way, but consistency is tricky to keep up with for a lot of business owners since it's not as obvious or attention grabbing like other tasks such as contacting suppliers or helping customers. It's easy to let consistency fall behind when other business responsibilities become hectic, but it's important to remember that this behaviour can be perfected with practice so making it a part of your everyday routine is key in keeping it a priority.

- Schedule in time – Avoid having the 'I'll get to it later' attitude because, quite frankly, will you remember to get back to it? It's better to design a realistic schedule around the accounting needs of your business and to be strict with the time you've dedicated for accounting and bookkeeping. Of course there needs to be some flexibility in case issues in the business arise (anyone experience a crisis lately?), when everything comes to a halt and you’re “putting out fires” it’s important to set reminders to make sure you complete the tasks on hand sooner then later. Try setting alarms on your smart technology, add the tasks to your email calendar, or keep it simple and leave yourself reminders that aren't easily lost (how many sticky notes have you misplaced in the last few months? This might not be the option for you). If you’re going the DIY route make sure to schedule time daily, weekly and monthly to complete bookkeeping tasks, or, if you have an employee to do this for you their schedule should reflect the time needed.

- Keep on top of invoices – It's seems pretty simple right? Send invoices and collect the balances…if only it was always that easy. The first important step in this process is making sure to send out all your invoices even if you think the amount is too small, it's essential for all clients so that expectations are clear for everyone involved. Secondly, make sure you're collecting the amounts due. Nobody likes having to chase clients for payment, it’s uncomfortable, but unfortunately this is a part of being a business owner. By being consistent with sending your invoices and remaining clear with the terms, you'll start building a relationship with clients that is transparent with defined expectations and this will hopefully help you get paid on time and without reminders.

- Hire a professional and communicate – If you’re struggling to manage all of the accounting on your own hire a professional who can help keep your business stay organised, informed and growing. It's important to find the right match for your business needs and to keep communication consistent. This isn't just about finding someone to balance your books, the right professional will help you manage your accounts while offering you advice and taking a genuine interest in the success of your business.

The content of this post is up to date and relevant as at 02/01/2019.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

leave a comment -