How prepared are you for the various events that life can, and will, throw at you?

Are you aware that you can use the law to help design the life that you wish to lead?

'Nothing is certain except death and taxes' proclaimed Benjamin Franklin! Whilst this statement is somewhat true, it is in fact possible to plan for certain eventualities that life is likely to throw at you. This is because there are various events that are likely to be common to most of our lives. It's this very commonality that means it's possible to put arrangements in place, via wills and lifetime planning, to help deal with some of these challenging scenarios.

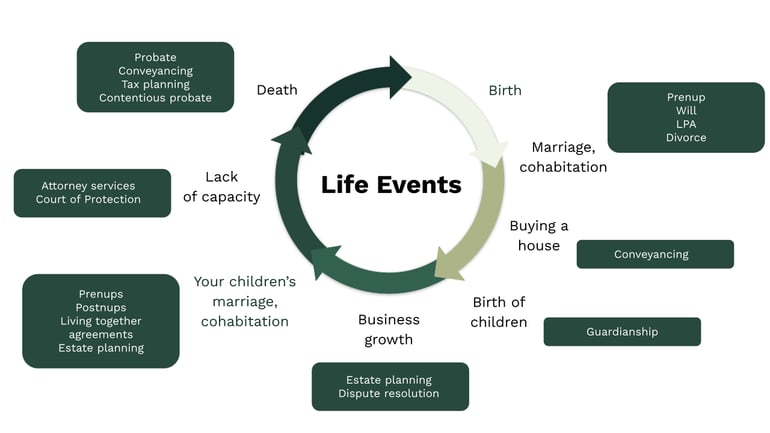

This is why, at Hedges Law, we've developed the circle of life diagram (below) demonstrating the events most likely to take place in your lifetime. Combined with the various legal options available to you, it's a means to potentially future-proof your affairs to provide you, and your family, with peace of mind.

Failing to plan, on the other hand, can lead to complications such as contested wills, divorce cases disputed in court, and even confrontations at funerals. Did you know, 1 in 4 UK funerals ends in a physical fight?! That's probably not the united family picture you had in mind.

Read on to find out more about how you can go about securing your future.

Review the events carefully in this circle of life diagram. This blog covers the legal planning and considerations for each phase.

| 1. About to marry, or living together | 4. Business growth |

| 2. Purchasing a property | 5. Getting married again, or living together |

| 3. The birth of children | 6. Lack of capacity |

If you're about to move in together, or get married, there are various matters you may need to think about carefully. As a starting point, consider the following questions:

A prenup is a signed agreement which you as a couple prepare prior to marriage, or civil partnership. It specifies what you would like to happen with your assets in the event of separation and divorce/dissolution of your civil partnership.

The terms of such an agreement are designed to provide clarity. Whilst not strictly speaking as legally binding as contracts, they are highly persuasive to the family courts. This means they are often upheld as a way of respecting a couple’s autonomy to choose how their assets should be addressed.

Without a prenup, a court may view your assets, gifts, or any inheritance received as a marital asset to be shared with your spouse upon separation. There are, of course, fundamental safeguards that need to be in place to ensure that these agreements are fair to each party and ensure that they can each meet their needs (and those of any children) in both the short and long term.

Prenups must only be signed when those involved have a full understanding of the implications of such an agreement prior to signing, and are not put under any pressure to do so.

Purchasing a property for the first time, as an individual or as a couple, is a big life event that represents an investment in your future. The process of buying a property can be long and uncertain.

However, the right advice, research, and preparation can make this a rewarding experience. Understanding all the legalities is key to ensuring the purchase fulfils what you're actually looking for.

Be sure to obtain legal advice, in the form of conveyancing, to help provide you with answers to the following:

If you have a child then it is essential to be clear about the legal responsibilities that you have for your child. These will continue regardless of whether your relationship endures. It is critical when a child is born that you consider carefully who is named as their parent on their birth certificate. Doing this provides that named person with Parental Responsibility for the child, and that can only be removed by an order of the Court.

You should also consider the appointment of a legal guardian to take care of, and make decisions for your child, in the event that something happens to you, and you are not capable of making these decisions, or should you die. The guardian would then be responsible for your child’s health, safety, and well being. This means legal, financial, and medical decisions fall under their remit too.

As your business develops, and you earn more money, you may also accumulate more assets. Your estate consists of all your assets - property, money, investments and personal belongings. Consider the following questions around various scenarios carefully:

If you're going to marry again then be sure to get a prenup as we covered earlier. If you're already married, in a civil partnership, living together with children, or considering marrying again, then it's worth reviewing the following:

Unlike those who are married, co-habiting couples do not have any legal right to claim financial support from the other partner in the event of a breakup. The only claims that can be made are in relation to the distribution of jointly owned property, or in limited circumstances property that is owned by one of them, but where there has always been an intention to share this asset.

It is important that you understand the limitations of these claims, as in many cases the law will expect you to be self-sufficient. The potential on separation is different to that on death, as there may be instances where one partner dies and their estate has an obligation to support the survivor, if they have been financially dependent.

If, as a couple living together you have children, then you both have a legal responsibility for their care and upbringing. This in turn, includes financial support. To protect your legal rights, and responsibilities, you may look to put together a cohabitation agreement. This establishes arrangements for finances, property, and clarifies your rights and responsibilities. It may also provide some legal protection if there is a breakup.

If you're already married, have you considered getting a post nuptial (post-nup) agreement?

This is a legal agreement that is put in place after your wedding establishing who owns what assets, and property, as well as the arrangements for children, and details spousal support should the marriage subsequently end in separation, or divorce. Whilst not legally binding in UK courts, post-nups are often considered highly persuasive when they are drawn up correctly and provide for everyone to meet their needs.

What topics would you look to potentially address in a post-nup?

Do you have business, and personal, assets you're looking to protect in the event of death, divorce, or separation?

What inheritances, assets, and other property do you own? Who will inherit them should you die?

Does your spouse have clarity, and certainty, as to the arrangements that are, or aren't, in place in the event of your death?

Sometimes the passage of time can lead to challenges in our later life. It is wise therefore to forward plan for your future and for these challenges so that should they occur, and you lose mental capacity or simply need extra help with your affairs, you can make life as easy as possible for your family and loved ones.

Legal incapacity applies when a person is unable to make decisions that are legally binding. Reasons can include mental health issues, disability, and dementia to name a few. This renders you unable to sign contracts, make important financial decisions, or engage in legal activities without the assistance of a legal guardian.

Have you considered a Lasting Power of Attorney (LPA)?

An LPA is a legal document where you appoint another person to act on your behalf if you become incapacitated, either permanently or temporarily. It has to be registered with the Office of the Public Guardian and the person nominated as the 'attorney' must act in your best interests.

Do you know what would happen if you were to lose capacity and you did not have a Lasting Power of Attorney (LPA) in place?

Do you understand the role, the Court of Protection would then play in your family's lives and the obligations and duties the Court would impose on them?

Who should you consider for the role of Attorney?

Should it be more than one person? You can have more than one attorney, in fact there is no limit to the number of people you can appoint, but it is common to have up to four. You can also name replacement attorneys should one of the original attorneys be unwilling, or unable, to act of your behalf.

If you have an LPA in place, have you checked if it's registered with the Office of the Public Guardian (OPG)?

When did you last review your LPA, does it require changing?

Is the Attorney aware of their duty to consider potential tax implications of their decisions in their role?

Decisions attorneys make can have a positive, or negative, impact on your tax exposure. Selling assets for example, could incur capital gains tax charge. Careful use of allowances and gifting, on the other hand, could help reduce exposure to inheritance tax.

As we've demonstrated, thoughtful and effective lifetime planning is essential to building a future in which your family, wealth and assets are taken care of, and passed on to your beneficiaries. It is essential to make use of the legal tools at your disposal to ensure the plans and goals you have for your future, and that of your family, are achieved and made as easy and uncomplicated as possible.

This is why it's essential to work with legal, and tax advisors to create, review, and update your plans regularly. This then ensures you are protected during your lifetime and that you can provide for your loved ones through inheritance.

The content of this post was created on 11/05/2023.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -