Matthew Wyatt FCA explains why you shouldn't hold back when it comes to hiring a professional for your accounting and the benefit of having the right person to work with.

Accounting is an important part of owning a small business and we all know that keeping accurate and organised accounting records needs to be a top priority; but let’s face it, just because we know it doesn’t mean we practice it.

Some small business owners can be a little apprehensive when it comes to handing over the accounting reins and seeking a professional to do the job. Each business will have a different situation and therefore different needs, some more complicated then others. However, what each business will have in common is a concern for time and money; this is where a professional advisor can help you save

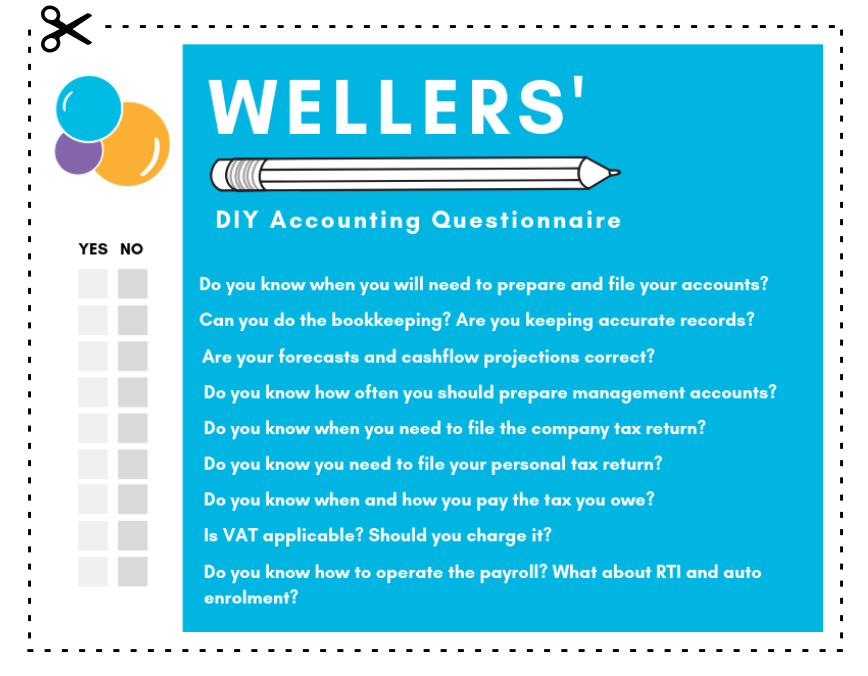

A little DIY in our lives can go a long way, but when it comes to keeping track of your finances you might not see the same benefits. You should be asking yourself:

- Do you have accounting experience and are you comfortable with the tasks to do? This requires being very organised, would you describe yourself as being organised?

- Is it just you, or does your business run on a team of supportive employees? It’s no secret that when you add more people into the equation the paperwork gets more complicated.

- Are you willing to sacrifice your time? The time you spend crunching the numbers and sorting out paperwork is time being taken away from the brand and sales. It’s important to remember you are the brand, your ideas and creativity is part of what keeps the business growing. Yes, your accounting also has a huge impact on how you’re business is operating and that’s why its important to find an advisor that’s invested in the financial health of your business while you grow the brand.

- Are you fluent enough in the regulatory requirements to ensure you are legally compliant?

Working with the right professional

As an entrepreneur you know that time is money and your advisor should also understand that instead of managing the finances, your time is best spent finding new ways to increase revenue. Working with a professional can encompass several different aspects; as a firm we have experience in assisting organisations with business planning, acquiring funding and choosing the right legal structure.

Whilst doing your own accounting may seem like a great way to save a little bit of money, it can hold your business back from value adding opportunities that a professional can help you work towards.

The benefits of working with a professional business advisor

- If you've already started managing your records yourself, you may have missed something, seeking professional advice will ensure your paperwork is in appropriate order.

- Relieving the stress of complicated bookkeeping while having confidence that everything has been completed correctly.

- Avoid causing big problems by ensuring your finances don't get out of hand.

- Uncovering opportunities like Research and Development tax credits, we’ve discussed before how many businesses don’t even realise that they qualify for R&D tax credits which is easily understandable considering there’s a lot of information to take in.

- Have a better understanding of how your business is performing with accurate numbers to help you make well informed investment and strategic decisions.

- Free up your time to build the business while a professional takes care of the numbers.

You might find yourself asking, "Well, when should I start working with an accountant then?" - the answer - it really depends on your comfort level in terms of managing the financials and how well you know your company accounts.

Consider these two scenarios, which do you feel best describes your situation?:

- You're an entrepreneur just starting out on your business journey and you're a bit nervous about all of the compliance and regulatory requirements that are involved with doing business these days. You're a little unsure when it comes to the entire scope of your business plan and you could use some advice when it comes to your financial forecasting. You know that hiring an accountant will be a big investment to take on as a start up, but the benefits of having someone with experience who can offer advice and assist with your planning to ensure you're on the road to success is just what you need.

This is an entrepreneur who seeks advice from the very start, they want to work with an advisor from planning to management and build an ongoing relationship that will see them through each business lifecycle phase.

- You've been managing your accounts since start-up and because you have a financial background, things have been going quite smoothly. You're business has started growing and all of the sudden you find yourself struggling to prioritise tasks, you're either putting all of your attention in your administration and regulation duties, or you push your financial management obligations to the side in order to keep the business moving. You're feeling overwhelmed, and that's understandable, and you now feel like it's time to seek the help of a business advisor sooner rather then later.

This is an entrepreneur who did quite well managing their books, but now that the organisation is growing it’s time to bring in some help. With the help of their advisor, this individual will expand their business through a controlled growth strategy.

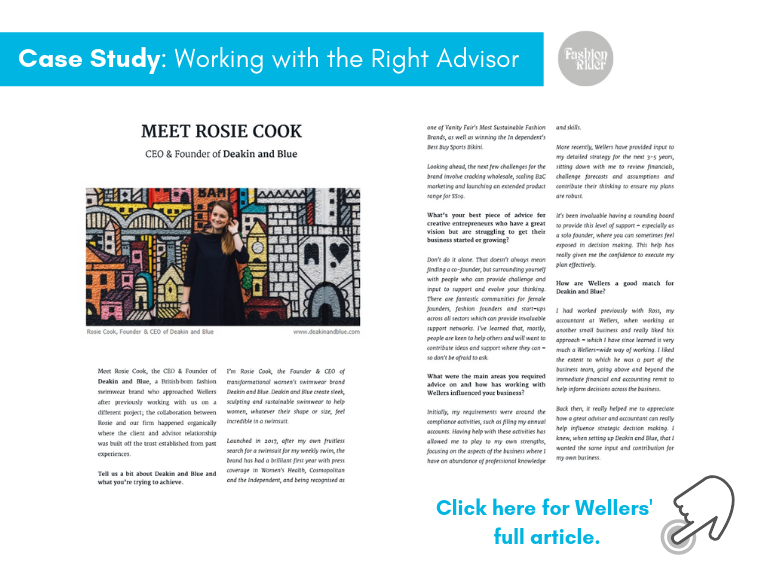

Source: This article was written by Wellers in collaboration with and for Fashion Rider, www.fashionrider.com. Thank you to Rosie Cook, Founder & CEO of Deakin and Blue, www.deakinandblue.com for working with us to share your story.

Think it might be time to reach out and hire some help? Contact a Wellers' advisor today!

The content of this post is up to date and relevant as at 17/01/2019.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

leave a comment -