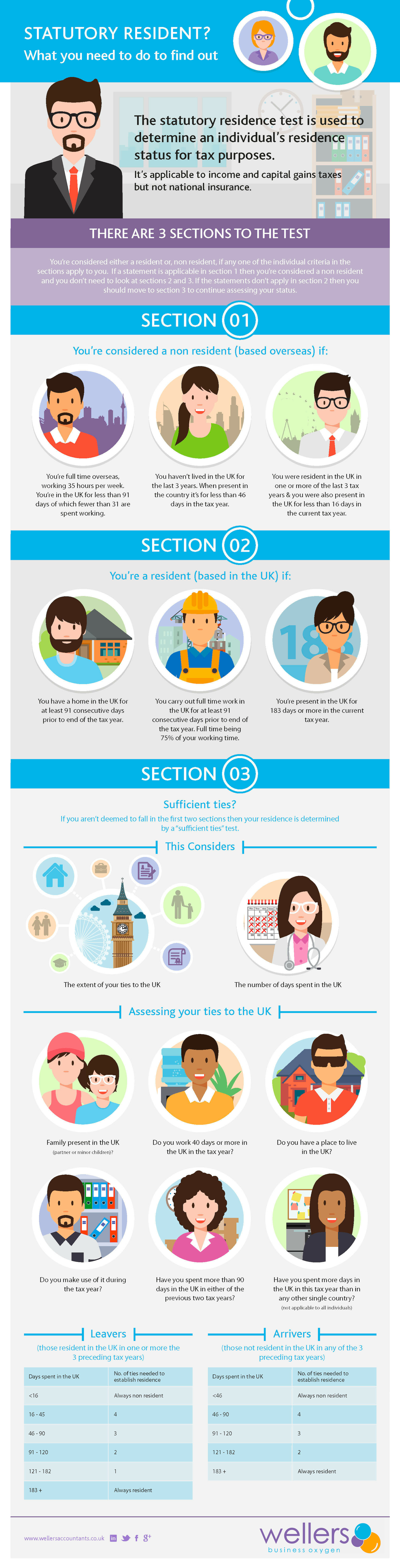

From 6 April 2013, the Statutory Resident Test has been used to help individuals determine if they’re resident in the UK for tax purposes, namely but not exclusively for; income tax, capital gains tax and where relevant; corporation tax and inheritance tax.

Each tax year is to be considered separately and the above tests should be applied in order.

The sufficient ties test makes a clear distinction between ‘arrivers’ defined as individuals who were not resident for all of the previous three tax years and ‘leavers’ defined as individuals who were resident at anytime in the previous three tax years.

Click on the image to view as a PDF.

It may be helpful to have records of when you were in the UK to hand.

There are also other tax status to be considered when determining where you stand with respect to tax rules.

If during a tax year you started to live or work abroad or you came from abroad to live or work in the UK, as a UK resident ‘split year’ treatment may apply to you. To be entitled to ‘split year’ treatment there are conditions which you must meet.

The SRT isn’t straightforward to determine residence in the UK and therefore advisable to seek advice from your accountant to correctly determine your residency status. The test above is of a general nature and is for guidance only. It isn't intended to address the circumstances of any particular individual, as such it shouldn’t be used solely for your decision making process. Your residence status can only be determined through facts and circumstances. The results are also based on you providing accurate information.

The content of this post is up to date and relevant as at 03/04/2017.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -