The buy-to-let (BTL) market has witnessed a whole host of government interventions in recent years. Many have been tax based and designed to hit the pockets of landlords.

These measures included the limitation of tax reliefs on finance costs, new rules regarding wear and tear allowance, and changes to stamp duty, capital gains and the annual tax on enveloped dwellings (ATED) rules.

Unfortunately the news isn't getting any better in 2020. If you're considering selling your property or you have plans to do so then there are further important developments you need to be aware of. Read on to find out about upcoming restrictions to lettings relief and principal private residence, and the impact this is likely to have.

For years buy-to-let has been one of the most popular investments in the UK. However, we’re seeing landlords paying more tax of late, and this is a trend that looks set to continue:

Where part, or all of a home is let out, then the gain from selling it could be subject to taxation. If the owner lived in the property then letting relief can be applied, potentially, to help reduce the capital gains tax (CGT) bill.

Principal Private Residence is a tax relief designed to protect main homes from exposure to CGT. It works on the basis that where the property being sold was a main residence for the full duration of ownership, then there is no CGT liability.

There are two significant changes in the latest set of tax announcements that will have an impact on landlord's investments:

Lettings relief is available to individuals where the let property was once their principle private residence. This fundamentally means that at some stage of ownership the owner had to reside there.

HMRC conveys that you can get the lowest of the following:

From April 2020 the government will reform this relief meaning it will only apply in circumstances where the owner of the property is in shared occupancy of the tenant.

Couples who own a property together, which they've lived in as their main residence at some point, and let it out are entitled to two individual allowances of lettings relief, which means a couple could make a substantial gain and pay no tax on the sale of their property. The major change in the rules should prompt you to review your buy-to-let property investment now.

It might be worth considering the sale of your rental property before April 2020 to ensure you receive as much relief as possible. This is particularly the case for married couples or civil partners who would see a significant potential relief benefit.

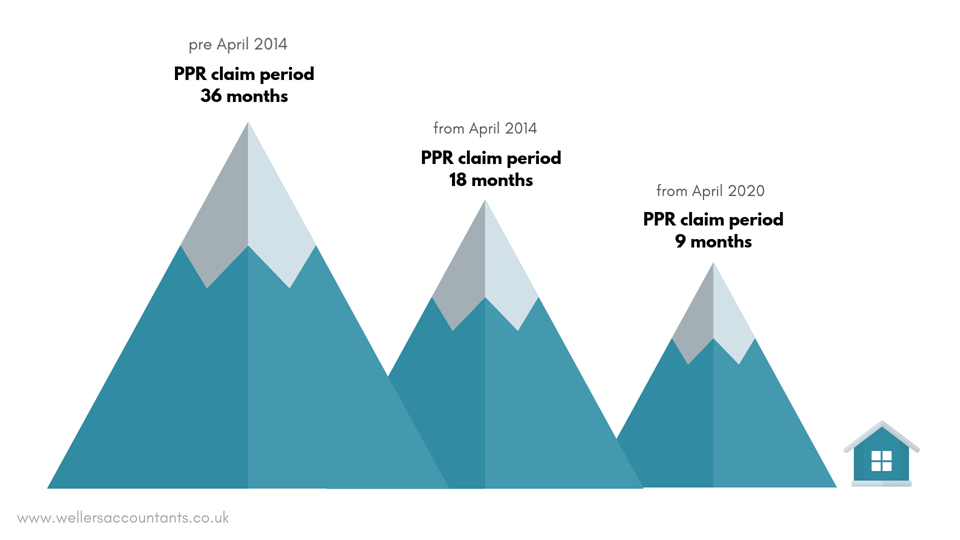

The second significant change is the final period exemption will be reduced from 18 months to 9 months. What does this mean? For the last 18 months of ownership, even if the property was rented out you get PPR relief. This means you don't have to pay capital gains tax on gains made during that 18 months period; but this will be changing to the last 9 months as of April 2020.

A little back history on PPR relief: The eligibility time frame to claim PPR has seen a reduction over the years. At one time PPR could be claimed for 36 months, and then from April 2014 this was cut from 3 years to 18 months. Now we're set for the shortest amount of time at only 9 months.

No one can say for certain what effect the final exemption period change will have on the market. Without the benefit of a longer timeframe, buy-to-let landlords may look to unburden themselves.

This means we may yet see a flood of dwellings hit the market which might put downward pressure on house prices due to a surplus of inventory. Furthermore, as we've highlighted in this post, the PPR changes bring significant potential tax implications for couples in the midst of the divorce process too.

If you’re a property investor trying to decide the best plan of action to deal with these upcoming changes, it may be wise to adopt a proactive approach and speak with a professional. Some landlords may decide it’s best to try to sell prior to the reform dates, while others will consider retaining their BTL properties.

It’s important that in either situation you are appropriately informed and plan accordingly, if you have questions and need advice on how to prepare for these changes you can book a meeting with a Wellers’ advisor.

This post was created on 09/11/2018 and updated on 03/02/2020.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -