A question, for work purposes are you classified as either:

If your answer is yes to either of those options then you need to know about basis period reform and what it will mean for your finances. These alterations will apply from the 2023/24 tax year which means how you report your profits to HMRC for the purposes of taxation, will change.

In this blog post we explain what basis period is, how it's potentially alters your tax calculations, and what you will need to do when reporting your income in your tax return now that the reforms are in place. Read on to find out more.

This post covers:

Basis period refers to the accounting period for your business and is currently used for calculating the profits of self-employed individuals, and partnerships, for the purposes of taxation. It's worth noting that many individuals have businesses with different accounting periods to the UK tax year, which runs from 6 April to 5 April the following year.

Currently individuals are typically taxed on the accounting period which ends during the tax year and therefore not necessarily the taxable profits that occurred during the entire tax year.

Basis period reform now requires all UK self-employed individuals to change the way they calculate their tax liabilities for their businesses. This has significant implications if you're self-employed, or in a partnership, as you'll have to report your earnings (your profits) to HMRC on the basis of the tax year, regardless of your accounting period.

The reform means from 6 April 2024 you'll have to disclose earnings in your tax return for the tax year in which they arise, for example 6 April 2024 to 5 April 2025. Given not all self-employed individuals, or partnerships, prepare their accounts to a 5 April year end, there will also be a transition period to the new basis for assessing profits.

The transition, if applicable to you, means you could report profits in your 2023/24 tax return for a period longer than 12 months and therefore have to pay your tax bill earlier. To compensate for bringing tax forward there are a number of transitional rules put in place by HMRC that may allow you to split the additional tax over a period of 5 years from 2023/24 to 2027/28.

If your accounting year ends between 31 March up to 4 April, then you're fortunate that HMRC will treat it as aligning to the tax year. This means, in effect, your accounting period is seen by the taxman as ending on 5 April. This is referred to as 'late accounting date rules'.

If this is the case then the potential complications arising from the transition period shouldn't apply to you. You can carry on with business as usual, namely reporting your earnings from 1 April 2024 to 31 March 2025, if for example you have a 31 March accounting year end.

If you have generated earnings, or incurred certain tax deductible expenses, in the intervening days in the tax year, say from 1 April 2025 to 5 April 2025, then this will be included in your 2025 accounts and tax return.

If your business doesn't have an accounting year end between 31 March to 5 April then you will need to report your earnings based on the tax year commencing in 2024/25. This also means transition rules will be applied in the 2023/24 tax year.

As a consequence you'll need to obtain your earnings from 2 sets of accounts in order to complete your tax return accurately for each tax year commencing from 2024/25 onwards. You'll then pay Income Tax and National Insurance contributions based on your profits for the 12 month tax year in question. This will then be different to your earnings in your accounting year.

The challenge with this is that some self-employed individuals and partnerships may not be able to finalise their second set of accounts in time for the tax return filing deadline. How then do you calculate your taxable profits? If this is the case for you, you'll need to supply estimates in your tax return, and these may need to be altered once your accounts have been signed off.

You will then have 12 months after the online filing deadline to alter your self-assessment tax return with the corrected figures. An alternative option available to you, that may help prevent such complications, is to change your year end. As a result of aligning your accounting year with the accounts year, you will pay tax based on the profits of a single set of accounts

Click on this link for more details.

As mentioned above, additional tax payments, and some complex tax calculations could occur due to matters such as overlap relief. To keep things as simple as possible, you'll need to first calculate your profits, as usual, for the 12 month accounts year 2023/24 known as the standard period.

So, if you have a 31 December year end then that's for the accounting period 1 January 2023 to 31 December 2023. Any profits in this time frame are referred to as your standard part profits (SPP).

You'll then need to calculate your transition part profits (TPP). These are the earnings you made from the end of the standard part to the end of the tax year. So, in the example we've used, your transition part profits would be calculated from 1 January 2024 to 5 April 2024.

If you have overlap profits (more on this below), then you can use overlap relief (OR) to help reduce the earnings that are subject to taxation in the transition period.

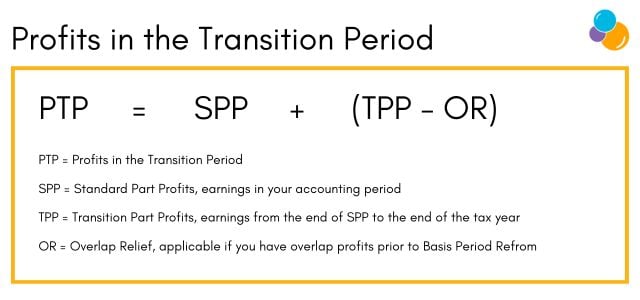

Calculating Profits in the Transition Period (PTP) can be done using the following formula:

You may have made a loss in the transition period but been in profit in the standard part. If, based on the calculations, this results in an overall profit then unfortunately the option to spread the early tax over 5 years won't be available and the profit for the entire period will be taxed in the 2023/24 tax year.

If you made a loss in the standard part, but a profit in the transition period resulting in an overall profit, then you would have to pay the early tax over a 5 year time frame.

Overlap profits arose where prior to basis period reform, earnings were taxed twice at the start of a self-employment business, or partnership, where the accounting year didn't match the tax year. This was unsurprisingly, because the earnings applied to 2 tax returns.

This occurred when a tax year ended prior to the end of the accounts period of the self-employment or partnership. At the time you would be taxed on the profits that arose from the trade up to the end of the tax year. These profits would be taxed again during the following tax year assuming the accounting year ended in that period.

During the transition period you were allowed to offset any overlap profits you were carrying against the profits of the extended period.

If the calculation of earnings in the transition period after deducting the overlap profits resulted in a loss then something called terminal loss rules could apply. As a result the loss could be offset against the profits made in any, or all, of the 3 years leading up to when you made a loss

If your accounting date doesn't match the tax year ending 5 April, then a straightforward option may be to change your accounting year to align to the tax year. By doing this you'll avoid the time consuming complications of having to calculate earnings and your tax liability from 2 sets of accounts, one of which may be a draft meaning estimated numbers that could be subject to change.

To do so you'll have to satisfy the following conditions, and failure to do the below means the new period won't be recognised:

The content of this post was created on 07/12/2023.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -