With some early stage businesses receiving valuations this year of around ten figure sums, speculation has grown concerning the long-term sustainability of the tech scene and London's start-ups within it. Take Uber for example, this massive global taxi app was last valued at $51bn with global demand for its service scaling hugely in the last couple of years.

However, according to Bloomberg, you may be surprised to hear that Uber is making losses and these amount to $470m off $415m of turnover. The company is said to be burning through $100m per quarter to fund their growth having raised a further £1.2bn this year. What is more, they’re not the only ones with hefty valuations based purely on potential future profitability.

Airbnb, Dropbox and Snapchat also received valuations in excess of $10bn. In the case of Snapchat (reportedly worth $12.8bn) not only does the company not make a profit, it has generated hardly any revenue to date.

The world is seeing a rapidly evolving technological landscape, and with mobile technology and cloud development still being relatively new to the tech industry, there remains vast potential for future opportunities in this sector.

For innovative start-ups it means the opportunity to offer something new and exciting coming to the market. With so many start-ups emerging however, many businesses will simply not be unique, ‘new’ or revolutionary enough in what could emerge as one of the most competitive sectors ever witnessed.

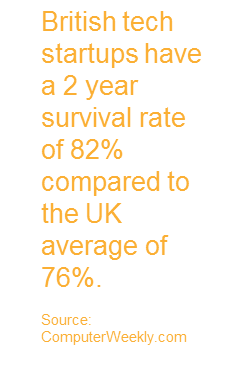

It is not generally thought by analysts that we are experiencing a bubble as yet. Research reveals that tech start-ups survival rates are above the UK trend standing at 82%, despite start-up numbers rising by over 40% year-on-year. That could be because technology is now integral and an increasingly essential part of everyday life, as witnessed by the emergence of the “the internet of things”.

Social media combined with more connected devices infiltrating people’s lives means this is a revolution that has and will continue to change the world for some time yet. It’s a stark contrast to the dot com bust of 1999 when early websites had limited professional and social influence.

With a wide number of opportunities for growth, and many different exit routes open to them, it has proven to be a good time for tech companies in the UK and London. There is a lot of money around, and the thought that you could be the next big thing is too tempting for some investors to pass up.

This is witnessed by the amount of venture capital being attracted to the capital from not just the UK, but across the world. It means many new enterprises are being kept private for much longer than in previous times.

Investors are looking at the potential of new tech start-up in two ways. Firstly, as a possible ground-breaking success with a promising future, or more often than not as a company of interest that would attract the attention of an already well-established company for a lucrative future acquisition.

The problem with the first point is you’re very unlikely to become the next Google or Facebook. The ‘big players’ are too large and powerful to allow a start-up to establish as serious competition. They simply acquire them and incorporate the technology into their own or they cherry-pick the skills of the people behind them.

A new term for this has evolved out of Silicon Valley called the 'acq-hire'. That means you should follow the lead of the majority of start-ups and build an exit strategy into your business plan. Very few of today’s tech businesses are looking to develop into global brands.

The London tech start-up landscape is still considered to be relatively niche in the UK when compared to the US, but that doesn't mean large scale investments, as well as any serious European tech start-ups, aren’t coming here. There’s a number of investors backing tech companies in London right now and it is widely acknowledged that if you can crack London, you can crack the US and vice versa.

London saw record breaking investment in the capitals technology firms with $1.4bn of venture capital financing secured in 2014. This was double on the previous year and accounts for over 65% of the UK’s total investment during that period.

One reason why companies such as Airbnb and Uber aren’t yet profitable but achieving huge valuations could be due to their primary focus which isn’t yet on profits. That may sound odd but in the internet world these companies are referencing the Facebook model as a key part of their business plan.

First and foremost they’re looking to achieve critical mass. It’s all about attracting as many users/consumers as possible onto the platform. Facebook for example has over 1.4bn monthly active users but Twitter has hit problems recently because despite 304m tweeters, quarterly growth has been slowing.

That’s a big problem for Twitter because for tech companies mass brand recognition is seen as the key to then achieving sales and profitability. If for example you go to a property website and there aren’t any properties listed for sale or rent, then as a user you simply go to another site straight away where you will find some. Looking at the social media scenario, if all your friends are on Instagram but not on Twitter, which platform do you think you’re going to use?

So for these sites their key aim is to generate huge amounts of traffic, user subscriptions and listings by spending vast amounts of money on marketing and advertising. They need to create significant brand awareness and loyalty to achieve the sacred critical mass. From there these companies can then make use of their vast amounts of user data to achieve profitability.

Another reason for investor appetite in the tech market is the economic circumstances of the last 5 years. The low interest rate environment since the credit crunch has made it very difficult for savers and investors to achieve a decent return. In the pursuit of better rates this has led to greater investor appetite for risk.

The tech sector has benefited greatly especially as investors risks in many cases has been partially offset by the availability of tax reliefs such as the Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS).

Unfortunately this needs to come with a warning! The flow of money tends to be dictated by the risk environment. Whilst the recovery is well underway and the world embraces economic growth, riskier plays such as the tech sector remain trendy and in favour. During downturns however, money tends to flow from riskier assets to more defensive investments such as the dollar currency, gold and established pharmaceutical companies to name just a few.

The potential problem for tech firms is a change in the economic environment could see a lot of money flow out of the sector. How likely is another recession and could investors shift their positions?

Whilst the UK is enjoying growth it’s clear that there are still many areas that pose a significant threat to the economy. A bursting of the credit led buy-to-let bubble, the slowdown in China’s economy, continued Greek turmoil and possible exit from the Eurozone, the uncertainty of a referendum over the UK’s membership of the EU, tensions with Russia and instability in the Middle East are all very real and significant hazards. UK growth doesn’t stand on particularly secure foundations.

How well would the business models that make up the tech industry cope with a recession? The risk behind tech investments is that many aren’t profitable and achieving critical mass is likely to come with a considerable timeframe. That means the investors punt is at the expense of any immediate or short term payback.

How well would the business models that make up the tech industry cope with a recession? The risk behind tech investments is that many aren’t profitable and achieving critical mass is likely to come with a considerable timeframe. That means the investors punt is at the expense of any immediate or short term payback.

Many of the more established players in the tech industry have still yet to make any money after several years of trading. Take Box for example, the file sharing site has been in operation for 10 years and in that time it has listed on the New York Stock Exchange, racked up $500m in cumulative losses and, is yet to register a profit. Or, consider Ocado which was trading for 14 years before it registered its first profit in 2014. That money was ploughed straight back into the business meaning investors continue to wait on a dividend payment.

Admittedly investments through SEIS and EIS are very illiquid and they come with a minimum period of 3 years for any form of tax relief to then apply. This may come as a reprieve for tech owners but it also doesn’t provide them with much time to prove their concept is a solid, long term, viable opportunity.

You may believe you have the greatest idea since the invention of the wheel, but it still has to be structured as a business, and will need the same advice and guidance as every other business out there. Your idea is only 5% of your enterprise, you need a lot more to construct a successful commercial venture.

First and foremost, research your target market very carefully to understand if you have a compelling solution to a particular need. Take your time and consider how competitive the business arena is that you’re trying to break into. Don’t rush ahead while you are full of enthusiasm, or you may hit a wall. Avoid making rash decisions with your investors money. Prioritise very carefully where the budget will be spent and what will be achieved at each tranche of investment.

Ensure you get sound advice and guidance to help you grow and mature your company. Make sure you have the necessary back office financial systems in place so that you can measure performance, analyse trading trends and conduct projections as accurately as possible based on established historical data. Remember, presenting this information will be critical to maintaining healthy relations with your investors after fundraising.

Be careful who you choose to collaborate with. It is fine for certain elements like coding and resources which exist in the same community. For accounting, tax, legal and business advice – you will need someone with qualified experience from outside the tech world in order to comply with financial regulation and ensure things like your terms and conditions, patents and trademarks are legally enforceable.

The content of this post is up to date and relevant as at 19/08/2016.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -