With the amount of changes happening in the farming industry and the potential framework for what British agriculture might look like post-Brexit, the need for farmers to start working towards a plan to prepare their business for the future market is at the forefront of industry conversation.

For some in the sector, this will mean organising their businesses for the upcoming changes, while for many others it will be a shift from working on the farm to handing the reins over to someone else.

Succession planning involves selling a business or handing over the reins is a unique occurrence for most people and is shrouded by complexities.

The process of succession can take several months to implement in a straightforward situation, but in farming such transactions are typically more difficult.

The line between personal and business is often crossed in the farming industry and this is why planning your exit can be a little more complex.

There are two important factors that you need to understand when it comes to running your farm and also planning for succession:

Farm ownership & activities

The ownership position of your farm will have an impact on the succession (or sale), as well as tax planning. Is your farm business structure:

For proper tax planning, an advisor will not only need clarification on the ownership dynamic, but also on your specific farming activities. This can affect: Income Tax, Capital Gains Tax, and Inheritance Tax.

An increasingly complex tax regime combined with more emphasis being placed on individual taxpayers responsibilities, means it is likely that you will need professional advice to negotiate the obstacles of regulation to protect your wealth and assets when passing down to the next generation.

Working with the right team is vital in ensuring that your succession is implemented properly and a practical and tax efficient plan is key to avoid placing burden onto the next generation.

Bringing together the right team for professional support and advice will help maximise the value of your business and implement a smooth handover that all family members and partners are comfortable with.

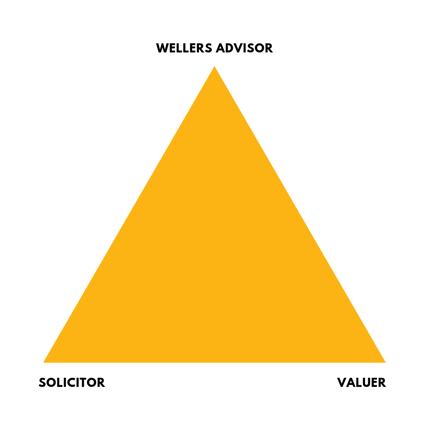

Your team should consist of your Wellers Advisor, a Valuer and a Solicitor.

A valuer will provide your Wellers Advisor with essential information so they can prepare the most accurate calculations for your succession.

The content of this post is up to date and relevant as at 11/02/2020.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -