Sales, moving into profitability and brand traction mean you’ve successfully moved beyond the start-up phase. Congratulations, you've proven the credibility of your business plan.

Now it’s time to prepare for expansion and all the trials that come with growing a business. Scaling up means you're going to need to develop a strategic direction.

Shifting from a start-up operation to a growing business will require a significant change in your mindset. It means moving away from the original emphasis of product/service and market fit. You may be taking on employees or moving into new premises, but the most important aspect in all this will be you and what you focus on!

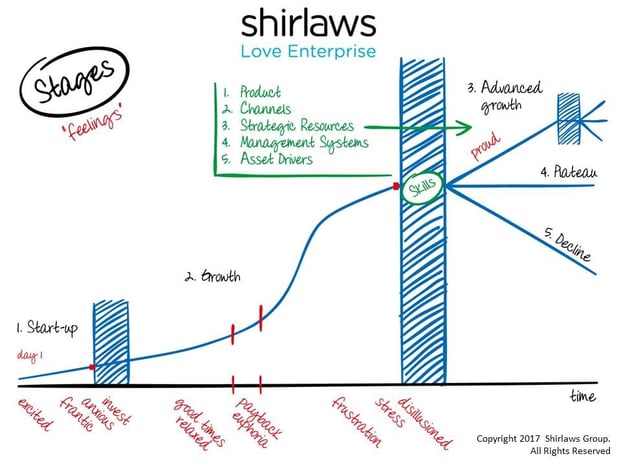

In our time advising clients, we’ve seen plenty of what does and doesn’t work. When entering the "growth" phase (see the Stages model diagram below, a concept originally developed by Shirlaws), founders can become engulfed in numerous tasks. This leads to stress and lack of clarity in decision making. So we’ve written this blog on the importance of strategic direction to help you achieve and sustain growth.

Strategic direction refers to the plans that need to be implemented for an organisation to progress towards its vision and fulfil its goals. It ensures owners and management can communicate the importance of employees work and their contribution to achieving business objectives.

Often in the early days an entrepreneur’s approach will be dominated by turning their idea into a commercially viable business. That means establishing a new or different product/service that dovetails to a particular market.

It’s a case of innovating, testing and developing to better address the needs and wants of customers.In many ways however, this isn’t really a strategy for your business! What entrepreneurs are actually doing here is establishing their business.

Once your concept is proven to sell and make money, it’s time to move into the next phase of the business lifecycle. It's time to develop a plan for how sales will grow and correspondingly how you will scale your operations to meet this demand.

Growth entails becoming a lot bigger while protecting your intellectual property from competitors. Sounds simple however, it’s anything but! Strategic direction usually requires considerable thought, careful planning, and time.

It needs to come from you as the owner manager and founder or, from you and a small number of people such as an executive team. Only a few people should be involved in developing a strategy. It’s unlikely to be something that can be done well democratically, or via a lot of compromise and appeasement.

In undertaking this task you should look to answer the following questions and so revisit your business plan (if you have one, if you don’t then it’s time to write one):

The last question is vital because the answer will involve addressing resource requirements which takes us nicely on to the second essential area of focus…

Taking on and managing the right people is critical to business success. Get it right and you’ll see how a team is absolutely intrinsic to growth. That's because as your organisation develops you will become increasingly reliant on your employees to:

Your people will bring the strategy to life. The emphasis therefore is to get the right people on board to implement the necessary things to achieve your vision. Crucial in all of this is to retain your best staff and their continued development is at the heart of that process.

When hiring look for the right attitude, fit and aptitude for the tasks required. If you have someone with the right mindset and personality traits for your organisation then don’t forget that you can potentially train and develop skills for the role. This might be why some organisations hire predominantly around attitude and cultural fit.

Ultimately you’re looking to develop an executive team that can in time perform the vital tasks and run most things without your input. The business should not be entirely dependent on you. Far from it, instead it should be able to run normally in your absence.

As an example, if you have plans to eventually sell, a potential buyer will usually query how well things will operate when you depart. Unfortunately the likelihood is in the early days you’ll get the hiring side of things wrong and learn valuable lessons. This highlights why it’s so important to develop the strategic direction to help you envisage what kind of person will work within the culture of your business and what you’re trying to achieve.

Remember to revisit regularly with the team, your vision and how the business is progressing towards it. Inspiring and keeping people motivated is essential and this means frequent communication with your workforce. You’ll need to be empathetic to the issues they face, while showing them how the end goal remains achievable no matter what the challenges or level of current progress towards it.

Always check your margins regularly and carefully against your business budget, so that you can either reduce costs or alter prices, when the time calls for it. Forward plan by considering how changes in the political climate and economic developments might impact on your profitability. You should review your cash position, via the working capital formula, regularly to ensure the business doesn’t run out of money.

Careful financial management means understanding cashflow today and what it will look like in 6 months time. Ultimately working capital and profitability are key financial dynamics that must be accessible frequently via your management accounts. Unless it’s your core area of competency (and even if it is you probably shouldn’t do it), avoid the time and effort of putting these reports together.

The reason being you’ll be far too busy developing a long term strategy, communicating it, recruiting the right employees and keeping them motivated and happy. Leave the production of financial reporting to either a back office finance team or, more likely, outsource it to a good accounting firm.

In the early days of growth, lots of things will happen and crises may occur that require your immediate attention. This will take your focus away from these three competencies. Be sure to return to them as soon as possible and build the business in such a manner that eventually that is all you do. In our experience, owner managers who achieve that level of focus are usually getting it very right.

This post was created on 10/03/2017 and updated 20/11/2023.

Please note that the names and characters used in the examples mentioned above are hypothetical. Please also be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

LEAVE A COMMENT -