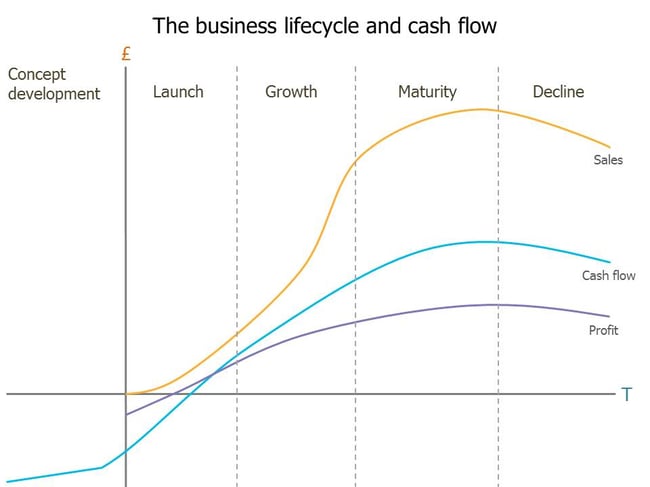

As the diagram demonstrates, it’s a significant amount of time, money and effort in order to realise sufficient turnover to generate a profit. However, the strain of operating your business in the early days can potentially be alleviated through the HMRC research and development tax credit for startups. This can result in substantial cash flow benefits for qualifying SMEs. Read on to find out more.

For tax purposes, R&D is deemed to occur when a project seeks to achieve an advance in science or technology through the resolution of scientific or technological uncertainty. What does that mean? The key is the word advance which typically means progress in the overall knowledge or capability where comprehension is not readily available to a competent professional working in the field.

Whilst the intention of the project must be to achieve an advance in science or technology, achieving this is not actually a requirement in order to claim R&D tax relief. If the project therefore fails in its goals, your business can still make a claim under the R&D scheme.

Whilst the number of R&D claims being made by organisations has been increasing in recent years, there are still a number of organisations who would likely be eligible for this tax relief but don’t realise it. Typical reasons are often that they are unaware their activities qualify as R&D or do not understand how to make a claim.

Such businesses are therefore missing out on an extremely generous corporation tax relief which can make a significant difference to start-up SME’s cash flow positions. September 2017 HMRC statistics revel that the ‘Manufacturing’, ‘Professional, Scientific and Technical’ and ‘Information and Communication’ sectors have the greatest number of R&D claims. However this is not to say that other sectors are not undertaking qualifying R&D activities.

To qualify for R&D tax relief under the SME scheme, the business must meet the following criteria:

Where an entity forms part of a group, it may be necessary to aggregate the groups results in applying these thresholds.

R&D tax relief can be provided in two ways depending on whether your business is profitable or loss making for corporation tax purposes.

For profitable SMEs, R&D tax relief is provided by way of an enhanced deduction from taxable profits at a rate of 130% of the qualifying R&D expenditure. To illustrate, a business with £100,000 of qualifying R&D expenditure would obtain a tax deduction for the £100,000 of expenditure and an additional deduction of £130,000. The total corporation tax deduction is therefore £230,000 even though the business has only incurred spend of £100,000.

Loss making SMEs can surrender all or part of the loss for a 14.5% repayable tax credit from HMRC. You can therefore obtain a cash flow advantage by receiving an immediate cash payment from HMRC. A calculation needs to be performed in order to determine the loss that can be surrendered but as a simple illustration, if a business has £100,000 of R&D qualifying tax losses, these losses can be surrendered for a cash repayment of £14,500.

Given the corporation tax rate is currently 19% (falling to 17% in 2020), loss making organisations will need to weigh up whether to surrender the available losses for an immediate cash repayment at a rate of 14.5% versus carrying forward the tax losses and obtaining tax relief at a higher rate in future periods when the business becomes profitable.

The immediate cash benefit may however, provide important breathing space for working capital needs.

For some businesses such as pharmaceutical organisations, it will be obvious whether or not they undertake qualifying R&D activities. For many entrepreneurs it may not be as clear cut as to whether they are engaging in R&D activity. Seeking the advice of a tax professional with specialist R&D knowledge would likely be preferable.

Careful consideration should be given to your projects and some key questions to ask yourself include:

The content of this post is up to date and relevant as at 06/10/2017.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -