The introduction of the National Living Wage (NLW), which increased the National Minimum Wage (NMW) under a new name, is yet to be felt in full by the hospitality industry. An increase this year from £6.95 to £7.20 per hour per adult (3.5%) might not sound much but over a 35 hour week that means another £8.75 per NLW worker.

The move to £9 per hour by 2020 would be a big concern for independent operators. As a comparison to 2016, it would mean each NLW worker would be earning £63 a week more. The question then is how much would this cost the industry as a whole and could independent operators, especially those outside of London, live with it?

It's impossible to answer that question because the number of hospitality workers on or below the NLW is not widely held information. We can guestimate based on People 1st figures. As the table below demonstrates, the average hourly pay for the three lowest paid occupations in the industry was equal to or, just under NMW.

There might actually be 1.5m hospitality workers on the minimum wage but we don’t know how many of them are under the age of 25 and thus not affected by the legislation. What we do know is that to bring the 885,000 workers as listed in the table up to the 2016 NLW rate of £7.20 will cost the sector millions.

It’s almost certain that payroll to turnover ratios will rise inexorably. A significant rise in prices is unlikely to be possible particularly for those operating in the provinces. Employing more workers under 25 or an attempt at a massive improvement in productivity is again unlikely to work given the sector’s reliance on manpower and poor history when it comes to training and upskilling staff.

So what are the options available to the trade? An argument to keep wages low would be seen as politically unacceptable and wouldn’t endear the industry to the government or those working within it. Wages aren’t low because businesses are enjoying huge profit margins. They’re low to ensure prices can be contained at a level to meet demand.

In London hotels and restaurants are having to offer wages above the NLW due to the difficulties of recruitment and retention however, the high prevalence of migrant labour in the capital has helped to keep salaries lower than they would otherwise have been.

London hotels currently enjoy operating in a market of very high demand. They tend to operate in the region of 26% payroll to turnover. Their occupancy rates of 80 - 85% are levels that the provincial hotels can only dream of. London hotels can therefore increase prices more easily to accommodate wage rises. It’s far harder to do this outside the capital and increases in the NLW will have a serious impact on hoteliers’ businesses.

Wage ratios in the restaurant sector tend to be higher, usually at least 35% to turnover and often they’re more than that. The nature of their operations demands high levels of staffing and the London market is particularly competitive with new businesses opening every year.

This has created real demand for skilled workers while reducing the ability of existing restaurants to increase prices if they are to maintain a competitive edge. The NLW also exerts pressure on workers earning salaries further up the pay scale. Once the £9 per hour rate is achieved by 2020, pressure will be enacted by other workers who want to maintain the difference in their earnings.

Perhaps it’s time to re-examine the minimum wage legislation. When it was introduced in 1998 the then Labour government argued that implementing regional variations would be too costly and difficult to administer. That was debatable then and doesn’t apply now because software systems enable businesses to cope with different levels of pay, taxation and entitlement based on industry sector.

Those with longer memories will recall the Wages Boards (later Wages Councils) which routinely set minimum wage rates for different sections of the hospitality sector in different parts of the country. There were no technical difficulties in implementing this legislation back then.

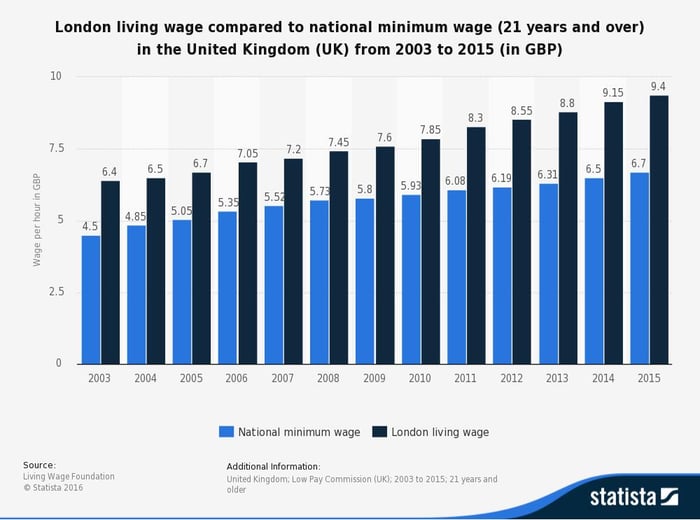

The result of not going down a regional wage route is the less profitable businesses outside of London have been forced to carry a heavier wage burden than those in the capital. In fairness this is something the Living Wage Foundation has always recognised by its proposed £9.40 per hour rate for London and £8.25 for the regions.

Given this argument, the hospitality trade should forget arguing for a VAT cut and instead lobby in favour of regional variations to NLW. This could be as simple as one for the regions and another for London or something based on the three countries and English tourism board regions. It would take account of higher living costs in London and the South East while justifying lower rates for businesses in the regions where living costs are less onerous.

The hospitality sector might just find plenty of other friends on this matter. After all sectors including agriculture and care homes are dependent on employing large numbers of staff and they’re already feeling the hit from the new national rate. Through a combined voice, pressure will mount to consider solutions around regional and sectoral variations as further increases in the Living Wage are introduced.

The content of this post is up to date and relevant as at 31/01/2017.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -