It’s expected that those running labour-intensive businesses, typically those who spend very little on goods - defined as limited cost traders (think; consultants, farmers, hairdressers, IT contractors, lawyers and driving instructors), could be quite significantly affected.

In 2004, sector specific VAT rates were introduced with the intention to simplify the record keeping and VAT process for small businesses – with the intention of saving time and administration costs. The rate paid by those under the scheme is dependent on the trade sector with the aim to reflect the balance between input (what they buy) and output (what they sell) VAT of different types of businesses.

Businesses under the scheme charge standard VAT to its customers and then they pay VAT to HMRC as a fixed percentage of their turnover, with limited ability to reclaim any VAT on their purchases and expenses.

This differs to organisations who aren’t on the flat rate scheme as they deduct the VAT on what they buy (input) from the VAT charged on what they sell (output). Differentiating from this two stage process, the flat rate scheme is simplified to a one stage process to make it easier for businesses to administer, whilst potentially giving the government approximately the same amount of VAT.

However, because it's an approximation, some businesses will pay more and some will pay less – leading to concerns that some businesses are paying less VAT than appropriate.

At the heart of the proposed changes is the flat rate percentage for those who fall under the definition of a limited cost trader, who are businesses with a very low cost base and they will be seeing a fixed flat rate of 16.5% VAT from 1 April 2017, irrespective of the business sector they operate in.

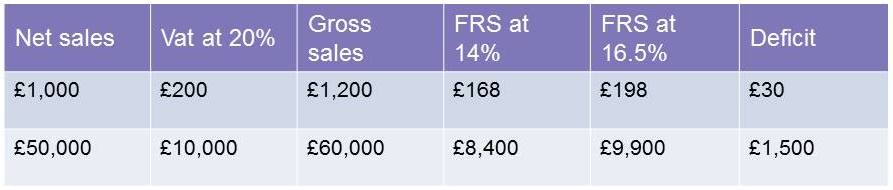

See below a simple example of the impact and saving for a business falling within the new 16.5% rate.

All businesses that take advantage of the Flat Rate Scheme of VAT will have to assess whether they fall within the definition of a limited cost trader: one that spends less than 2% of its sales on goods (not services) in an accounting period, every time they prepare their VAT return.

These exclusions are to prevent traders buying either low value everyday items or one off purchases in order to inflate their costs beyond 2%, to be disregarded as a low cost trader, thus enabling them to use a sector specific VAT flat rate.

Organisations who spend less than £1,000 in a year on goods (if the accounting period is one year – if not, the figure is the relevant proportion of £1,000), but more than 2% of their turnover will also be considered a limited cost trader.

Something to bear in mind is forestalling - in this instance, paying or invoicing in advance of 1 April to avoid an increase in tax is known as forestalling. The anti-forestalling legislation should be read to ensure you’re complying with the regulations.

Whilst welcoming the government’s attempts to clamp down on the misuse of the scheme, the VAT rate for many low cost businesses will see a change in what they’re taking home. For those businesses that are within the lowest of flat-rate tax, the difference will be considerable.

The example below shows the impact for a business that is taking advantage of the Flat rate scheme under the ‘management consultancy’ business sector:

As the illustration shows, this may mean the business may better off being on the standard VAT scheme and reclaim some of the input tax that may be charged on their purchases. Also remember that the assessment is to be done every Vat period and hence the rate may fluctuate within the year depending on the costs incurred.

Despite changes to the FRS, even if your business does fall under the definition of a limited cost trader, it's possible that you’ll still benefit from the 0.2% VAT difference.

In addition, the scheme may be of non-monetary benefit in terms of; less admin as there's no need to track input VAT, and more time to focus on what’s important to you in your business.

The content of this post is up to date and relevant as at 20/02/2017.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -