However, the statistics reveal that such casual attitudes can prove very costly with certain sectors, such as hospitality and retail, vulnerable to one particular threat called "Insider Fraud". Here's everything you need to know and what to do to counteract the threat to your enterprise.

Insider fraud takes place when an individual/employee uses his/her position within an organisation to obtain money or information unlawfully for the purpose of personal enrichment. Whilst the vast majority of an organisation's staff is trustworthy, there will always be a few exceptions that can cause immense damage to your financial and reputational wellbeing.

This is especially relevant to businesses where there is a reliance on temporary workers, particularly during busy seasonal trading periods such as Christmas. At this time there is often a lot of cash around such as bar takings as well as easily portable stock including alcohol and hotel consumables. The potential risk therefore of fraud taking place is that much higher.

You may well be asking at this point, is this really relevant to me? Perhaps then consider the following questions:

How would I know if a fraud was being perpetrated in my company?

Do I know where to check for potential fraudulent activity and when did I last check?

What would I do if a suspected fraud was brought to my attention?

What am I doing to prevent this problem taking place?

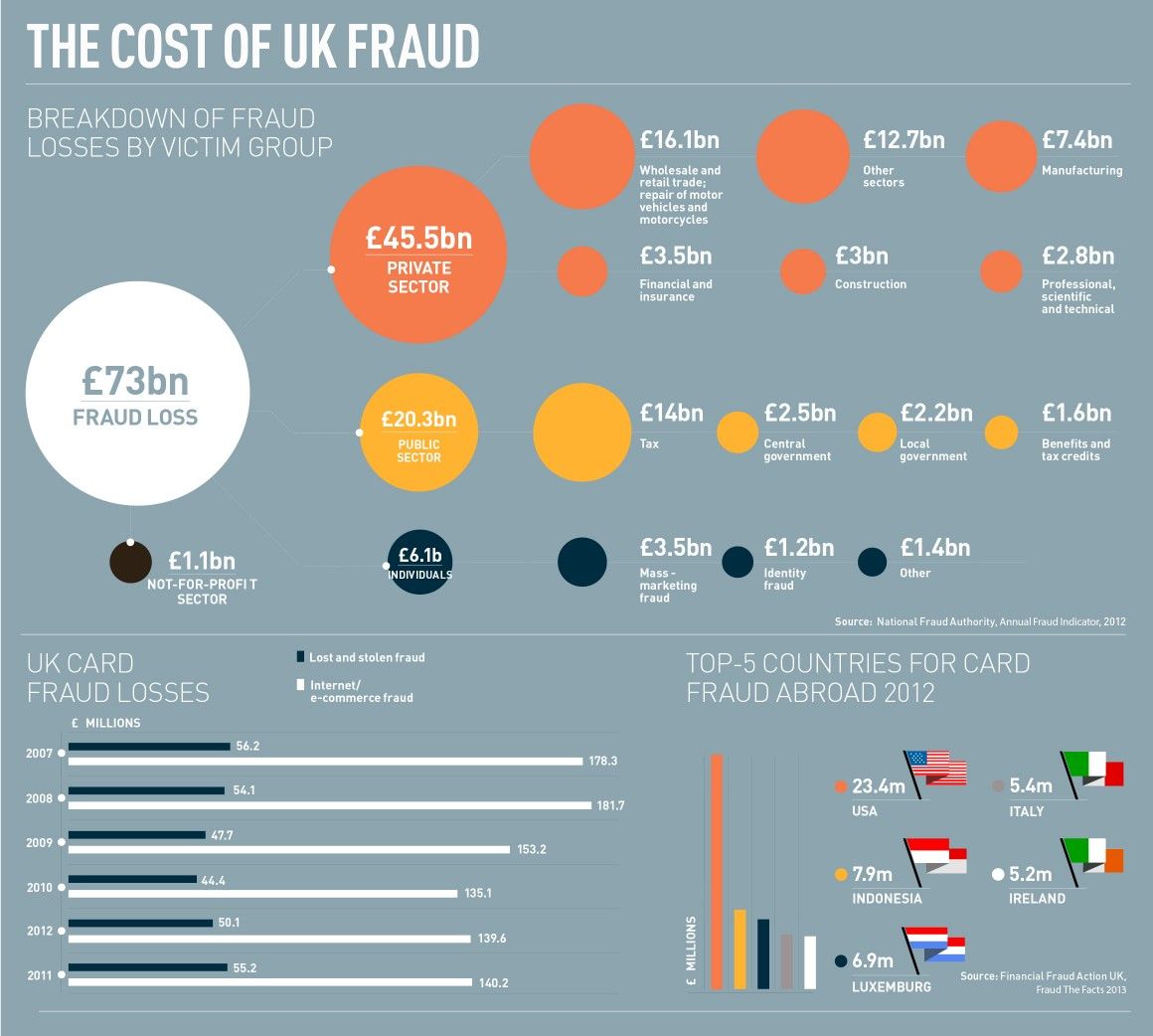

According to a report by CFAS (the UK's Fraud Prevention Service) on the "True Cost of Insider Fraud", this crime ends up costing three times more than the initial estimated loss. Furthermore fraud perpetrated by either management or employees accounted for 80% of the financial loss through fraud experienced by UK businesses in 2012. In the hospitality trade according to research conducted at Portsmouth University, fraud has become such an issue that it is costing the UK hotel sector along a staggering £2billion annually.

This all highlights the need for businesses to be pro-active in their approach to tackling this issue. Responding and reacting to individual incidents is simply not enough!

You can reduce the risk of insider fraud through good recruitment procedures and separating the duties performed by your staff. If staff are recruited on a temporary basis and have no history of previous dishonesty there is a better chance that they will, in fact, be honest. To this end certain procedures should be undertaken to help ensure their honesty, particularly if they are going to have responsibility for or authority over the company's assets. No matter what time of year here are 5 areas you should be looking at to protect yourself:

1. Background checks - Implement a vetting procedure for new and agency staff, especially those in "risky" roles, such as cash handling positions and those with access to personal details such as customer credit cards.

2. Identify red flags (warning signs) - Do staff seem to be living beyond their means (expensive clothing, car and gadgets)? If so, this could be a sign of fraudulent activity.

3. Educate your employees - Inform your employees about your policies and procedures related to their role, the internal controls in place to prevent fraud and your organisation's code of conduct.

4. Create an anonymous reporting system - Every organisation should provide a reporting system for employees, vendors and customers to anonymously report any violations of policies and procedures. Promote and encourage it wherever possible, and take all reports seriously.

5. Lead by example - Senior management and business owners need to set an example for the organisation's employees otherwise known as 'tone at the top'. A cavalier approach toward rules and regulations by management will soon be reflected in the attitude of your staff.

During high seasonal trading, recruitment is critical to avoiding these kinds of potentially expensive problems. Here are some top tips for you to follow:

The content of this post is up to date and relevant as at 06/01/2014.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -