We’ve highlighted previously the dangers of consuming free content online in relation to accounting and tax. Thankfully professional bodies are now endorsing select web profiles and recently the ICAEW listed Wellers as a UK top 10 online influencer in accountancy! Given some of the high profile names within the industry who made it into the top 20, this is something of an achievement.

However, what you will discover is this isn’t just a good bit of PR for Wellers, it’s also great news for you as our clients, network of contacts, subscribers and social media followers. Read on to find out exactly why and the values we exuded to achieve this accolade.

The ICAEW is a membership organisation that delivers qualifications and professional development for over 144,000 accountants. Their role also involves protecting the integrity of the accountancy profession by sharing expertise and technical knowledge.

As part of this they observed that regulatory change, rapid technological advancements and the ever evolving business scene has provided an opportunity for discussion. Therefore they wanted to find the individuals in the industry who are early adopters to see what can be learnt from them and to bring new ideas to life for the profession.

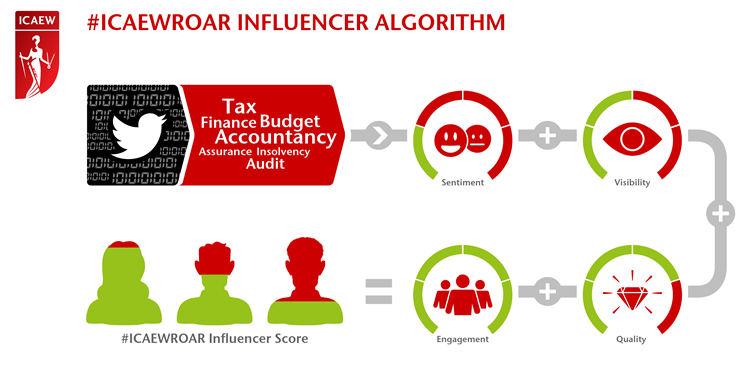

To achieve this they reviewed the twitter profiles of accountants and applied an algorithm to decide who ranked where, naming it #ICAEWROAR.

You can view the full #ICAEWROAR list here.

Reproduced with the kind permission of ICAEW © ICAEW 2015. First published on (http://www.icaew.com/en/about-icaew/icaewroar-top-online-uk-influencers); and (http://www.icaew.com/en/about-icaew/icaewroar-top-online-uk-influencers/icaewroar-methodology-and-algorithm). No reproduction or re-distribution allowed.

Reproduced with the kind permission of ICAEW © ICAEW 2015. First published on (http://www.icaew.com/en/about-icaew/icaewroar-top-online-uk-influencers); and (http://www.icaew.com/en/about-icaew/icaewroar-top-online-uk-influencers/icaewroar-methodology-and-algorithm). No reproduction or re-distribution allowed.

Whether you’re a client, part of our professional network, considering becoming a client or a consumer of our content – this is great news for you as well. Why? Well a few years ago we relaunched our website and embarked on a new communication strategy.

We decided to produce regular, relevant content specifically addressing the issues and specific needs of our clients. This meant highlighting the latest legislative changes, delivering insight into sector developments and providing opinion on topical items for you. Empathy is at the heart of our blog and what we do. It's about helping you to understand all the considerations, arguments and analysis concerning business, accounting and tax matters.

Our twitter account @WellersSME is simply a tool (an extension of our blog and ethos) to communicate digitally with our audience (you) online. The listing as an influencer is therefore evidence and industry credibility that what we're communicating is current, relevant and helpful. Now you can be sure that what you're reading on our blog, as opposed to the free content you may consume elsewhere on the web, is truly authentic.

The content of this post is up to date and relevant as at 25/02/2016.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -