Late payment is the curse not just of SMEs but the whole economy!

An innocuous oversight by a corporate business can actually turn into a vicious cycle. The result is delayed or non-payment among several organisations, each one suffering from the actions of the other.

The problem has become so acute that the government has a post of Small Business Commissioner to tackle this very matter. Overdue debts force SMEs to delay settling their own bills because they don't have the cash on deposit to pay up. It leads to a drying up of cash flow meaning owner managers can't access the funds they need to invest and expand their business.

If your organisation is growing, you're taking on more customers, and overheads are increasing then this post will detail the credit control items needed to ensure you're more likely to get paid on time.

Credit control is a business practice of extending credit only to customers who can pay for the goods or services being sold. Systems and procedures are then implemented to ensure customers are more likely to pay on time while also pursuing instances of late payment.

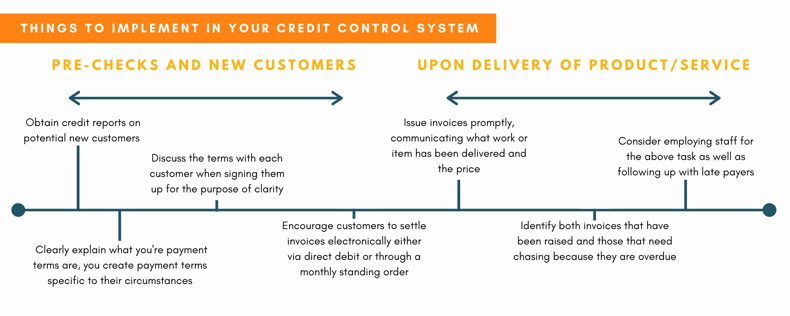

1. Use credit reports to understand if potential new customers can pay

2. Set up payment terms specific to each customer

3. Encourage payment using direct debit or standing order

4. Issue invoices promptly stating price and work delivered

5. Identify invoices raised and those that are soon to be overdue

According to research conducted by Bacs Payment Schemes Limited, 47% of SMEs surveyed are paid late by their customers on a regular basis. Worryingly the average small business is owed £32,185 in late payments! That's bad for the economy equating to £26.3bn across the UK.

The research also revealed that this resulted in a third of SMEs struggling to pay business bills including energy, rents and rates. Around 12% battling to pay their workforce on time. Consequently 29% end up using their overdraft facilities and 19% salary sacrifice at director level to make up for any cash flow shortages.

Unfortunately achieving repeat custom is so vital to the success of many early stage businesses, they're reticent to challenge their customers. After all their turnover may be built on a small number of customers, losing one through legal action could be perceived as financially harmful.

Managing cash flow and your cash position is absolutely vital. As a business owner you need to focus on this as part of your growth strategy. Be sure to read the following credit control procedures guide. Implementing theses measures in your business will help ensure you don't end up with a number of bad debts.

1. Perform pre-checks on new customers

2. Actions once the product or service is delivered

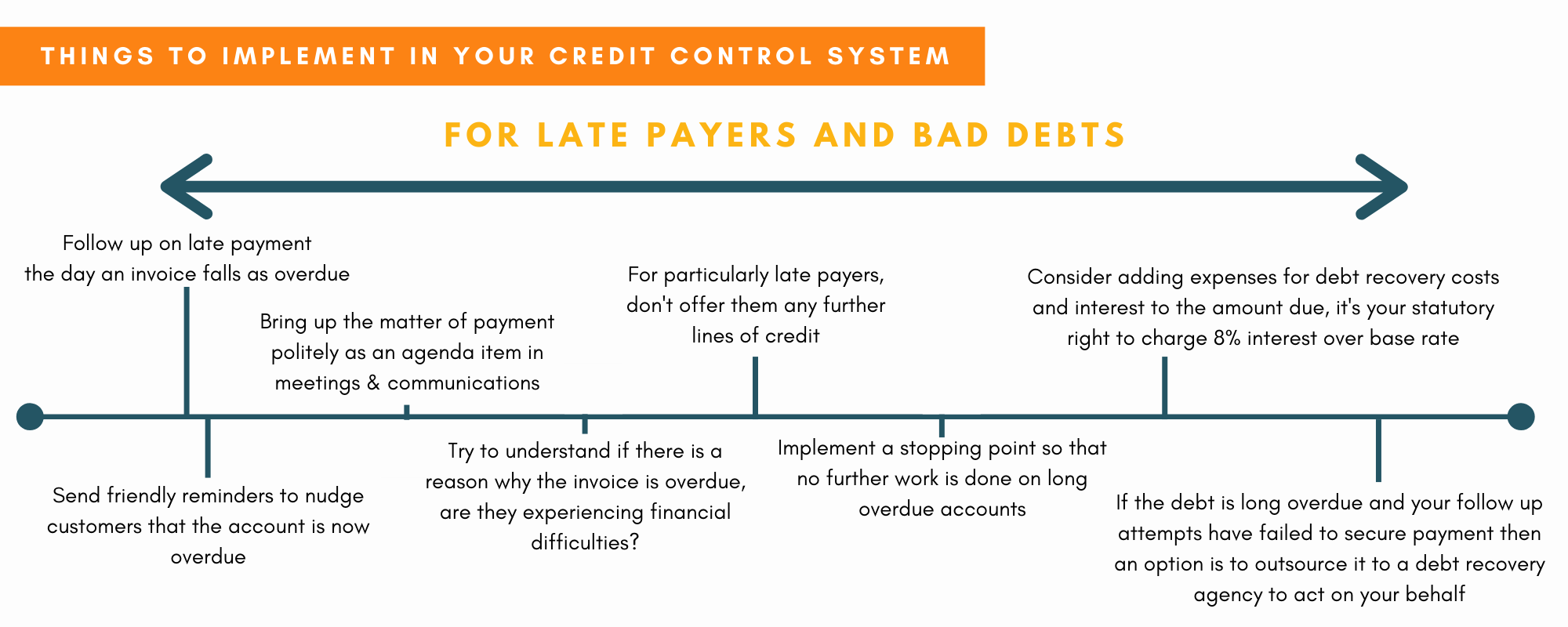

3. Dealing with late payers and bad debts

4. If a customer is in financial difficulty and struggling to make payment

5. For each customer, review their payment track record

This post was creaed on 24/04/2017 and updated on 02/11/2020.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

LEAVE A COMMENT -