HM Revenue & Customs (HMRC) are on a mission to eliminate the tax gap!

Their initiatives don't just look at methods for collecting more tax but also the use of tax breaks and instances of fraudulent claims. There are 1,000 or so tax breaks offered and their use results in money not being collected for the government's coffers. It's for this reason that the tax treatment of research and development (R&D) projects is set to change.

The Budget 2018 saw significant announced changes to the UK R&D tax credit for small and medium-sized enterprises (SMEs). In a case of the government looking to the past to move forward, the re-introduction of a PAYE and NIC cap for R&D tax credit rules for SMEs claims is a rewind to legislation first introduced in 2000.

HMRC see this reinstatement as the route to combat cases of fraud. The reason being, in respect of this tax credit, they've detected and prevented fraudulent claims amounting to £300m in recent years!

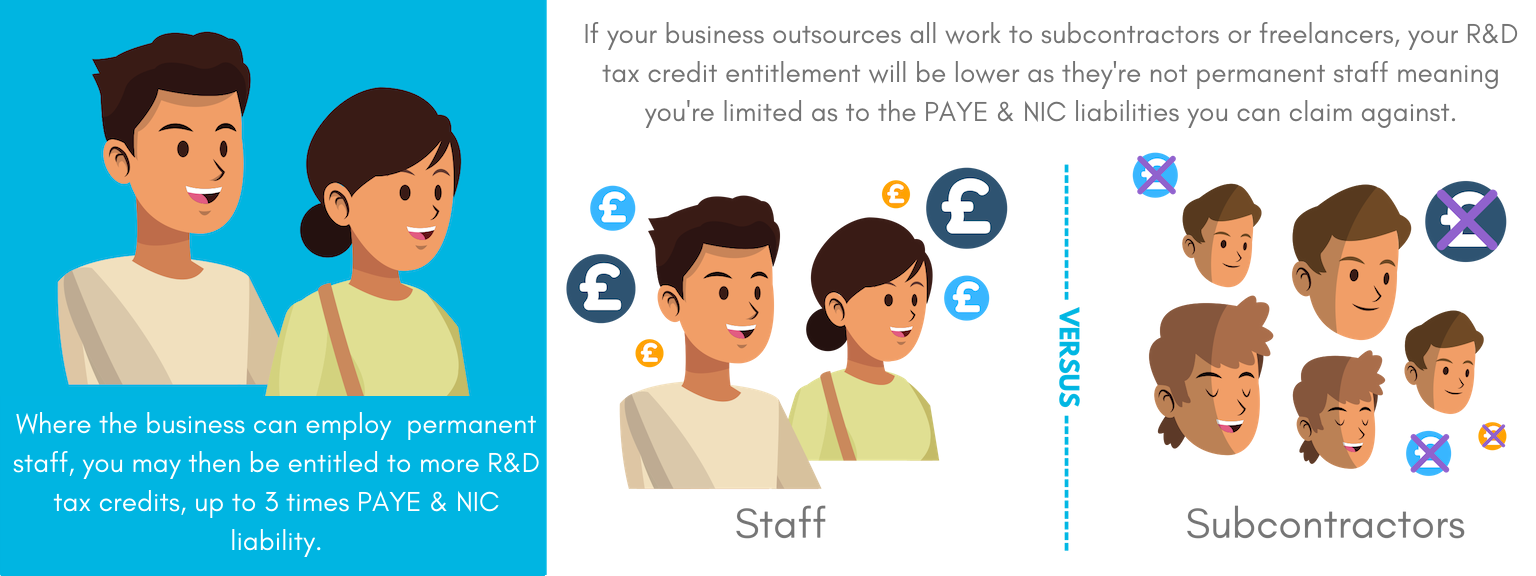

For claims from 1 April 2020, the repayable credit under the SME R&D scheme will be limited to three times the company’s total PAYE and NIC liability for that year. That's the PAYE and NIC liability for all your staff, not just R&D qualifying employees.

At present, if your business is loss making but engaged in qualifying R&D activities there has been no cap on the repayable credit that you could claim from HMRC.

HMRC discovered instances where businesses were set up in the UK purely for the purpose of claiming the repayable credit. It transpired these organisations didn't have any real UK ‘substance’, meaning they weren't undertaking any significant trading. Hence the cap will be used to prevent abuse of the scheme making it an anti-avoidance measure!

Limiting the repayable credit to three times the PAYE and NIC liability for the year will target those businesses that have very limited UK operations. After all such entities are unlikely to employ high numbers of people.

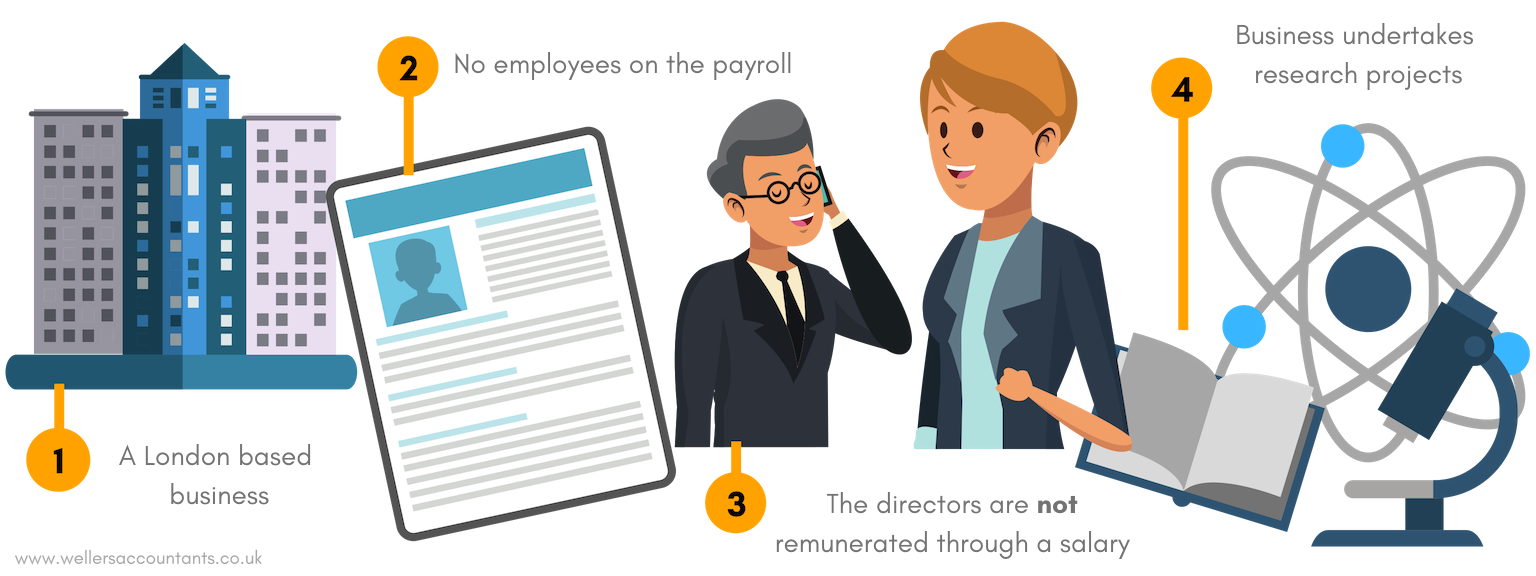

Say you're a London based business undertaking research and development activities to develop new software and technology in the medical sector. The software coding and technology developments have all been worked on by you as the directors with assistance from subcontractors. This means you don't have any permanent employees on the payroll.

As directors you're not remunerated through a salary! What then will happen to your R&D claim? Since your business has very little in the way of salary costs, these new rules will have a significant, negative impact as to how much R&D tax credits you're eligible to receive.

We can therefore see that in an attempt to uncover those who are disingenuous when it comes to claims for R&D work, this is likely to disrupt and create issues for organisations genuinely UK based but operating a low salary payroll.

The government is anticipating the introduction of the cap will only impact about 5% of businesses currently claiming the repayable credit. Time will tell how optimistic or otherwise this projection really is.

Staff vs. Subcontractors:

Given the new legislation means the tax credit a SME business can receive is based on their PAYE/NIC liabilities, start-ups in particular could suffer. Often theses early stage businesses are juggling tight budgets and competition for resource. This means they're not in a position to afford hiring permanent staff instead utilising subcontractors. Be sure to also check that these off-payroll workers don't fall outside of IR35 tax rules otherwise you could face fines.

R&D has been a reliable source of funding for so many SMEs and that may well dissolve unless they can find the means to hire some permanent staff.

The content of this post is up to date and relevant as at 24/01/2020.

Please note that the names and characters used in the examples mentioned above are hypothetical. Please also be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -