The rise in property prices over the last decade has made it nearly impossible for many would-be first time home buyers. The Money Charity claims it will now take a first time buyer 22 years to save enough for their deposit. Presently the average the first time buyer is 31 years of age, up from 28 in 1995 according to Halifax data.

The scale of the problem becomes even more apparent when you consider that the average deposit put down by new homeowners is now £126,000. That’s an increase of £71,000 on 10 years ago. For parents it can be difficult to see your children struggle to get that first home, especially when it may have come a little more easily to you at their age. So, what can you do about it?

It seems the only way most potential homeowners can afford today’s staggering deposits is with help from “the bank of Mum and Dad”. In fact 60% of first time buyers now get some kind of help from their parents when purchasing their first property. Below we look at a few of the options available to you along with the tax implications.

There is such a thing as a guarantor mortgage. Although these types of products are quite rare, some banks do still offer this as an option. The mortgage works by you putting your own property up as collateral, should your child fail to pay their mortgage.

This option may seem viable if you know you can afford to cover the cost of your child’s monthly payments should something go wrong. However, the risk is very real and putting your own home on the line will not be a comfortable choice for many.

You could choose to help your child with their deposit by gifting them a sum of cash. If you are not in a position to gift the cash outright and are loaning it to your children instead, you and your child should be aware that this can decrease their mortgage options. The lender will factor in the regular payments your child will be making to you when assessing the affordability of their mortgage.

What are the inheritance tax considerations?

It should be remembered that, subject to some reliefs, gifting money to your child would be liable for inheritance tax should you die within 7 years of making the gift and if your estate is valued at more that £325,000.

Alternatively you could do a joint mortgage with your child leaving you with a share of the property. There are tax implications with this option as you would be personally liable for capital gains tax if you dispose of the property. Also if you're receiving a monthly income from the property you may be subject to income tax.

If you have a looser arrangement with your child, for example they pay you back when they move house and you don’t make a profit from the property, you may find that there are less tax implications. This could work through a linked savings mortgage (an offset mortgage), whereby your contribution is put into a savings account that is included as part of the deposit. Note that you still have ownership of the funds. Inheritance tax can be avoided because you are not gifting any money as such but the documentation needs to be clear.

And the implications?

We would always advise you to consider the legal documents that you may need in these circumstances. They can be obtained for a relatively small sum and give you a clear basis for any agreement. They can also be used to support the tax treatment for the large amount of taxed that need to be considered.

If you have a second property or holiday home for example, that isn’t getting much use, you may decide to sell the property to free up some cash to give to your children to aid their house purchasing abilities. If you do decide to do this and you give them all the proceeds from the sale, you will have to pay capital gains tax before any proceeds can be distributed. We would always recommend a review of your property portfolio for CGT purposes so that the date of any disposal is timed for your tax circumstances.

How would inheritance tax be affected by this option?

If both parents live for 7 years after the gift is made the child will not have to pay inheritance tax. Although if the property is jointly owned the transfer value is split between each parent and they are considered separately. If either parent dies within 7 years of the gift being made, inheritance tax is chargeable on their share of the house, if that share is worth more than £325,000.

If this is the case and the partner died between 3 and 7 years after the gift was made the amount due will be slightly lessened thanks to taper relief, which proportionality reduces the amount of inheritance tax due when death occurs within 7 years of the gift being made.

If you only give a proportion of the money to your child this potentially could be exempt and would be treated as if you had gifted the sum to your child, subject to some reliefs and the timing of the gifts. If you gift capital (cash) to your child it would be subject to the same 7 year rules discussed earlier.

If you gift a property to your child you will be liable to pay capital gains tax, the amount you pay will be based on the difference between the price you purchased the property for and the amount it is valued at the time the gift is made. There are some reliefs that could apply so the assessment and timing of this disposal will be key.

You also have an allowance of £11,000 for the tax year before the tax needs to be paid on the gain. After that the rate will be either 18% for basic rate payers or 28% for higher rate payers. Stamp duty is another tax to be wary of in this area. When a property is gifted stamp duty land tax does not usually occur, unless the property is mortgaged and the purchaser takes this on.

By setting up a trust you could buy a second property, allow your children to live there rent free while they save for their own home and avoid capital gains tax.

Although changes to capital gains tax law have recently been less than kind to owners of multiple properties the above scenario is still a viable option without jeopardising your full exemption on your own home. A formal written trust needs to be created, and can still be used even if you have owned the second property for some time.

The trust should name one or both parents as trustees. The purchase of the property is made via the trust - you loan the trust the deposit and the mortgage is taken out under the trust. The mortgage will probably need to be guaranteed under your own name as is protocol for most bank lending.

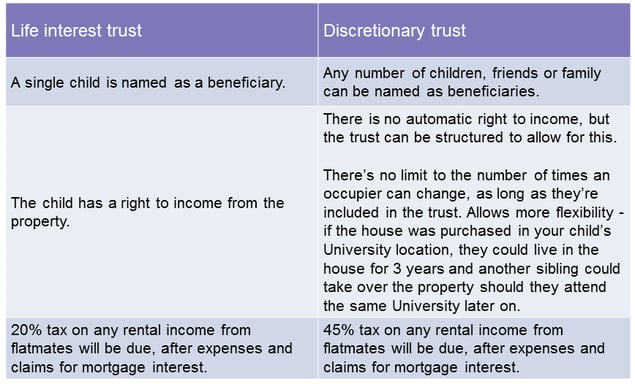

There are two types of trusts that can be used here:

The result of both types is that the named beneficiaries can become life tenants giving them the right to live in the property rent free. This gives them their own principle private residence relief (PPRR) which is the tax relief that exempts a home owners main property from capital gains tax.

Once your children have saved enough for a deposit on their own home and you no longer need the property you can sell it as trustees. You can then claim PPRR for the whole time you have owned it as long as it has always been occupied by one of the named beneficiaries. Your own PPRR is not affected and you will not have to pay income tax on the sale.

However, when the named beneficiary has moved out you have 18 months to sell in order to avoid capital gains tax. During this 18 month period you can let the property out to any tenants and your capital gains tax exemption will not be affected. That said, you will have to pay income tax on the rent you receive.

If you are reading this and already have a child living in property you have purchased for them you haven’t necessarily missed out on capital gains tax relief. If you can prove to HMRC that the living arrangement works exactly as described above you may be able to claim an implied trust, even if a trust deed was not put in place at the time the property was purchased.

However, do consider that if your child has flatmates you will be liable for income tax on the rent collected. If the rent is paid to the trust the rate on the income differs depending on the type of trust, as illustrated in the table above. Regardless, the rental payments could be paid to your child as a beneficiary- if they have no other earnings they can utilise their personal tax allowance and claim the tax back from HMRC.

If your child is paid the rent directly they can receive the net income as the life tenant but they will have to register for self-assessment and can claim the same expenses to reduce their tax liability. If this is the case you may wish to notify HMRC of the fact to confirm that the trust does not need to complete a tax return to avoid any discrepancy in the future.

If one or both parents die, the trust can continue with new trustees being appointed. If the property was left to the child/children as part of the trust on the death of the parents, the standard inheritance tax will apply. Also bear in mind that the trust is subject to a 10 year anniversary charge.

Where a trust contains property, there is an inheritance tax charge on the 10 year anniversary based on the net value of the property it contains. It's an elaborate calculation that you'll need professional assistance with. Furthermore, you need to consider that setting up a trust is complicated and has to be worded very carefully which means you'll need legal assistance. Therefore it comes with professional fees which will vary depending on the nature and intricacy of what you're trying to do.

You'll need an advisor who can bring together all of the various options and apply them to your situation in a practical and clear manner. We look to involve the people who you'll need at these different times via our network. This is illustrated as follows:

The tax implications for helping your children get on the property ladder can seem like a minefield when considering what the best course of action is. The consideration is being made earlier and earlier with some parents now buying a house for their children in order to forward plan for 20 years time in fear the situation will only worsen. If you have young children and are thinking about the future or if you have a 30 year old desperate for their own home, be sure to take professional advice on the tax implications of the options available to you.

Assess your own circumstances and what funds you have available. Then assess what property your children will need and how long before this becomes an issue. You can then set a plan in place that suits your personal circumstances and mitigates the tax and practical implications for the whole family.

The content of this post is up to date and relevant as at 28/10/2015.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -