As your business grows from the early stages of starting out, you will reach a point we describe as "payback". This is where your investment of time, effort and money in the business will have paid off. Income in the business will be both consistent and improving thereby allowing you to reward yourself by extracting money from the operation to pay yourself.

This will usually be in the form of a combination of salary and dividends. With that mind we’ve put together this blog post to explain how the dividend tax rate works. That way you’ll then be able to plan your finances accordingly.

Let’s start with the basics. A business makes a profit on its trading activities. Once taxation along with any other adjustments is accounted for, the company can then pass on its profits to its shareholders. Usually, a percentage is paid to the owner of each share of stock. Shareholders must then pay tax at a specific rate on the dividends they receive, depending on their individual circumstances.

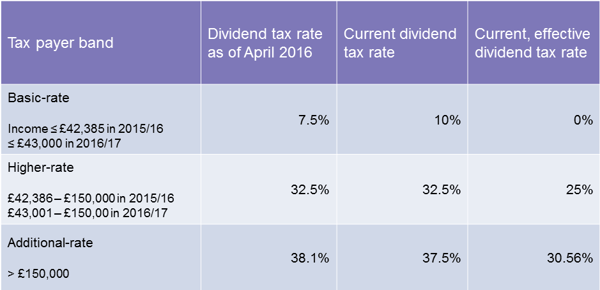

A £5,000 tax free allowance is applied whatever your income along with the rates as specified in the table below. The far right column represents an effective curren tax rate because it accounts for the 10% tax credit. More on the tax credit later in this post, but the main point for now is the effective rate is more useful for the purposes of a direct comparison.

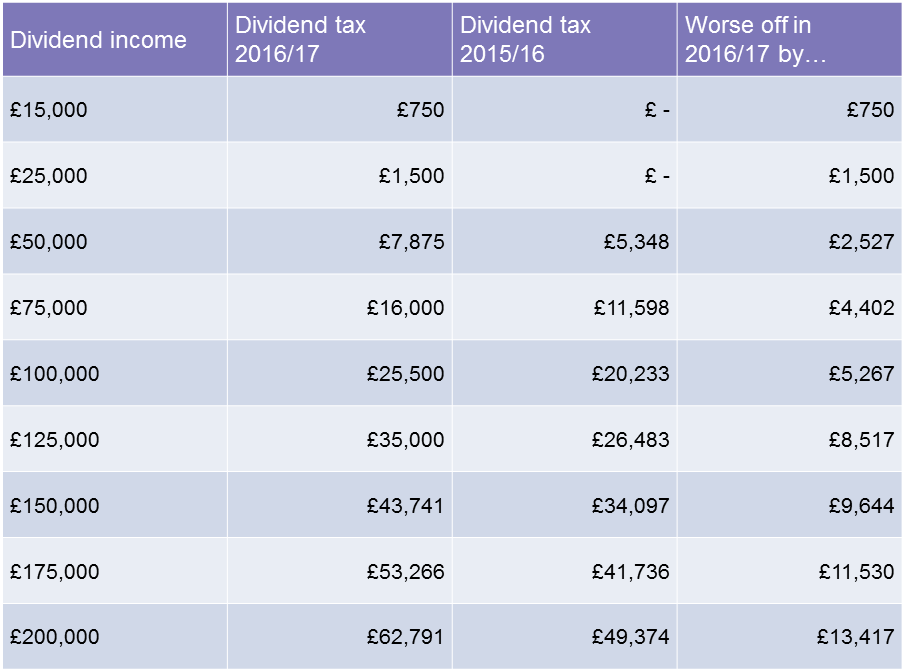

Now let's assess what that means for your dividend drawings when compared to the current system. The following table is based on a director of a limited company withdrawing the tax free allowance as an annual salary (£11,000 for 2016/17 and £10,600 for 2015/16) with the remaining distributable reserves paid out as dividends.

The way dividends have been taxed has proven somewhat confusing. So we’ve tried our best to simplify this. If you look back at the top table, we've applied the effective rate because of the application of a notional tax credit when calculating your net dividends. This works on the principle that limited companies are charged corporation tax on their profits before dividends are distributed. The notional 10% tax credit is applied to your dividends because your company has already been taxed on its profits.

This means a 10% reduction in the tax on your dividends. It’s a strange method and was probably introduced instead of reducing the dividend tax rates, possibly for political acceptance.

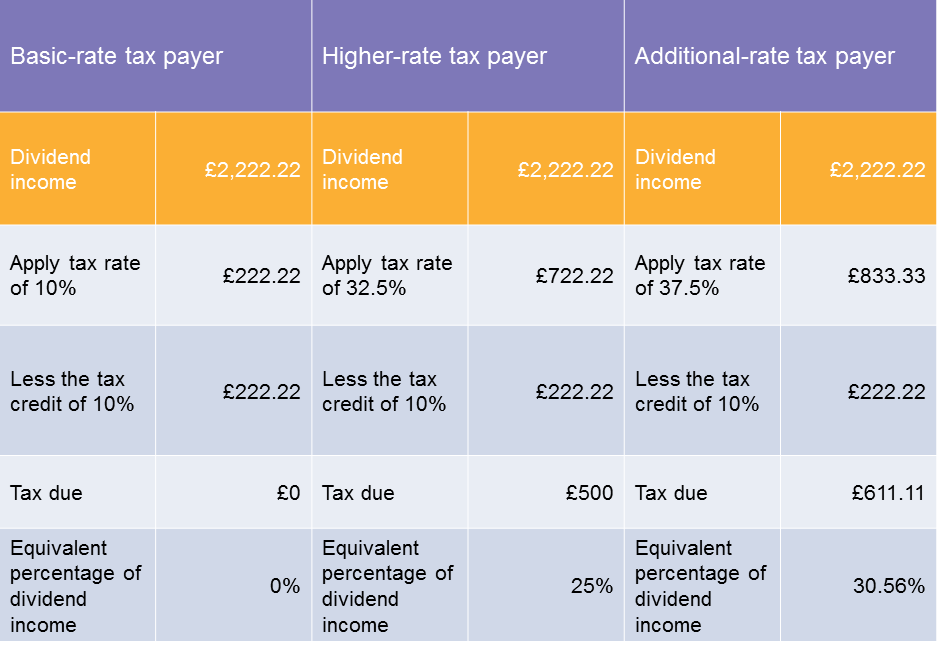

Still with me? Let's look at an example of how the calculation works:

Director X earns dividend income of £2,000 from his limited company. The tax credit means the £2,000 paid is net of the notional tax credit. So, the £2,000 is divided by 90 and then multiplied by 100 to give you the true amount for taxation purposes. In this case that means the dividend income is £2,222.22.

Then we apply the tax depending on which band you fall into.

The current (soon to be old) system of calculating dividends, as per the above table, created a very roundabout way of getting to effective rates of 0%, 25% and 30.56%. So, these represent the true rates for comparison purposes.

This has also proved confusing for those with individual savings accounts (ISAs) and self-invested personal pension (SIPPs), many investors thought erroneously that they were being taxed at 10% from their statements. They thought they couldn’t reclaim the tax credit. What they were failing to realise was that their dividend income represented only 90% of the tax charge.

Most investors won’t be impacted by the new dividend tax rates. In fact the good news is dividends paid into an ISAs or SIPPs remain tax free for all tax payers. Besides, you need a substantial investment portfolio to earn over £5,000 per year in dividend income. Therefore those with sizeable holdings would be well advised to consider transferring their portfolios into ISAs or SIPPs where possible.

The most affected by these tax rate changes will be the owners and directors who withdraw profits as dividends in addition to their tax free allowance. Whilst doing this still remains advantageous compared to drawing on the reserves as salary and paying income tax, the advantages of the lower tax rates on dividends won’t be as good as they currently stand.

For those considering forming a corporate entity, these changes will add to the options available. When considering the tax and legal implications of such a move, it’s wise to discuss these matters with a professional who can tailor their advice according to your personal and business circumstances.

As a main takeaway, business owners and directors who are shareholders would do well, where possible, to maximise their dividend drawings prior to the application of the new, higher tax rates in April 2016.

The content of this post is up to date and relevant as at 11/08/2015.

Please be aware that information provided by this blog is subject to regular legal and regulatory change. We recommend that you do not take any information held within our website or guides (eBooks) as a definitive guide to the law on the relevant matter being discussed. We suggest your course of action should be to seek legal or professional advice where necessary rather than relying on the content supplied by the author(s) of this blog.

Click below for office location details

leave a comment -