You may have seen the ‘I’m In’ adverts for pension auto enrolment featuring the likes of Theo Paphitis. Many businesses need to be very clear about what exaclty they must do.

Under the auto enrolment scheme which was introduced in 2012 employers have legal duties to automatically enrol certain members of staff into a pension scheme and make contributions towards it.

The changes were introduced to support an ‘ageing population’ (the proportion of the total population which is over retirement age is increasing whilst the proportion of working age remains static). This affects most developed economies and one of the remedies is to ensure that individuals have some independent means of financial support in older age.

Yes, but an eligible jobholder must be automatically enrolled before they can choose to opt out of the pension scheme.

Automatic enrolment is achieved when the employer has given information about the eligible jobholder to the pension scheme, and the eligible jobholder has received the enrolment information from their employer and has become an active member of the pension scheme.

The employer cannot provide the form to opt out - it must come from your pension company or adviser. Employees will have one month to opt out after receiving notification they have been auto-enrolled and may receive a full refund of their contributions. They must however, be auto-enrolled once again in 3 years-time (from the staging date) where they may or may not choose to repeat the opting out process.

This affects any employer with one or more employees. It is essential to understand who is caught by this legislation as the categories of ‘worker’ are very wide.

In order to discern the impact on your business, you need to identify which employees will have to be auto-enrolled (eligible jobholders) and those who don’t need to be (entitled workers). There is a third category (non-eligible jobholders) who may opt-in. By assessing your workforce it is possible to appreciate the likely cost and to build this into budgets.

The following is a guide to staging dates, but to find your exact date enter your HMRC payroll reference number into the following page on the Pensions Regulator website.

You can’t delay your staging date but you can elect to bring it forward.

We recommend appointing a project team in your organisation and give a senior individual the responsibility of getting the tasks completed on time. Without this you will not reach your staging date in a state of readiness to comply. The areas affected by the changes are finance, payroll and HR. A useful reference guide to follow would be the following steps:

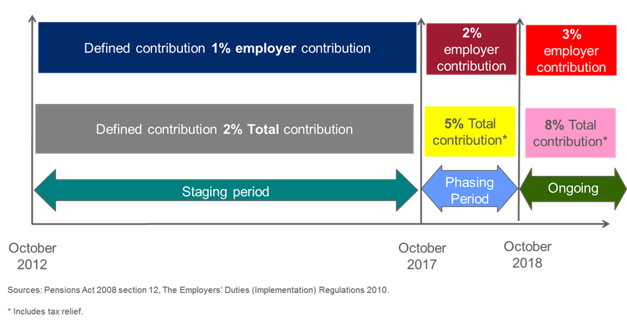

No, in order that the impact is moderated for both employers and employees, the minimum statutory requirement will reduce during the initial period and increase up to the 3% by 2018.

Strict regulations prevent employers from using prohibited recruitment policies (favouring candidates who may not join the pension scheme) or using incentives (cash) as an alternative to pension membership are in place. These practices are specifically banned and carry heavy fines.

Below is a summary of your duties:

The potential penalties for those employers who do not comply with the legislation are:

David is the Employee Benefit Consultant at PQR Financial Planning, an independent financial planning firm with Chartered status.

The content of this post is up to date and relevant as at 19/12/2013.

While every care has been made in preparing these articles to ensure their accuracy, they cannot be considered to be exhaustive and are no substitute for detailed examination of the relevant statutes, cases and other material when advising clients on particular matters. The opinions expressed herein represent the view of the authors at the time of preparation and should not be interpreted as advice. No responsibility can be accepted either by PQR Financial Planning or any of the authors and their representatives for any loss occasioned to any person acting or refraining to act in reliance on anything contained in these articles. No part of any of the above articles may be reproduced in any form without the prior written permission of the Author.

Click below for office location details

leave a comment -